Ethereum is looking pretty beat up lately, but could a massive short squeeze be on the horizon?

Hedge funds are betting big against ETH, and some analysts think they might be playing a dangerous game.

Hedge funds pile on the ETH shorts

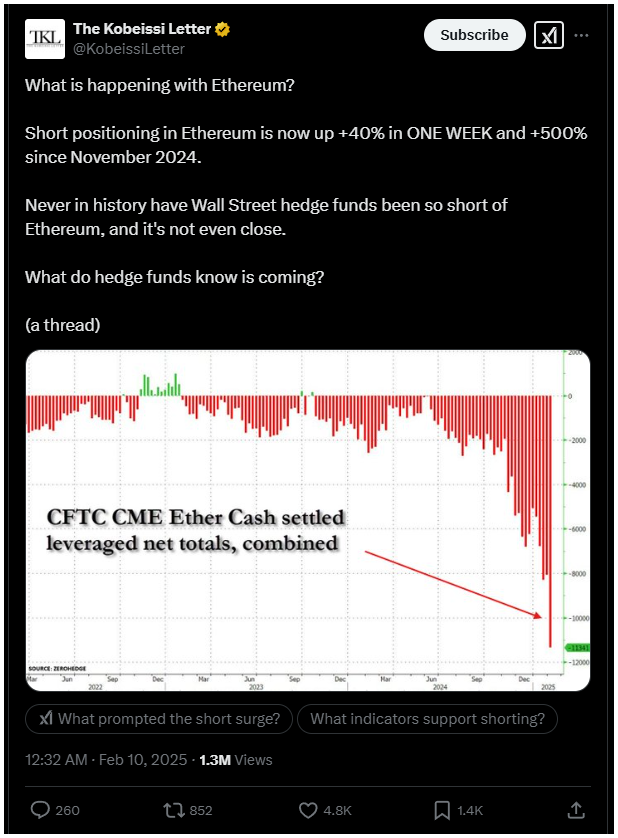

Short positions on ETH have skyrocketed. We’re talking about a 40% jump in a single week and a 500% increase since November.

According to the Kobeissi Letter, Wall Street hedge funds have never been so short on Ethereum.

This extreme positioning had consequences earlier this month when crypto markets tanked. Ethereum got hammered, dropping 37% in just 60 hours.

Some analysts compared it to a flash crash, and actually, it was exactly like that.

Ethereum ETFs buck the trend

On the other hand, no matter the bad news, Ethereum ETFs added $2 billion in new funds in December and even had a record week with $854 million in inflows.

Plus, trading volume has been strong. Concerns about the SEC labeling ETH as a security also seem to be fading.

Even with all this, Ethereum is still trading 46% below its all-time high from November 2021.

This begs the question, why are hedge funds so determined to short Ethereum? Do they know something?

Short squeeze incoming?

A short squeeze is a real possibility. Why? Because of the crazy number of short positions, the huge performance gap between Bitcoin and Ethereum, and some rumors that the Trump Administration might be ETH-friendly. Bitcoin has outperformed ETH by a mile in the past year.

If ETH starts to climb, those short sellers will need to cover their positions to avoid massive losses.

This means buying back ETH, which drives the price up even further, forcing more short sellers to cover. The result?

A rapid, upward price spiral. Given the massive increase in ETH short positions, a short squeeze could be pretty epic in the current levels.