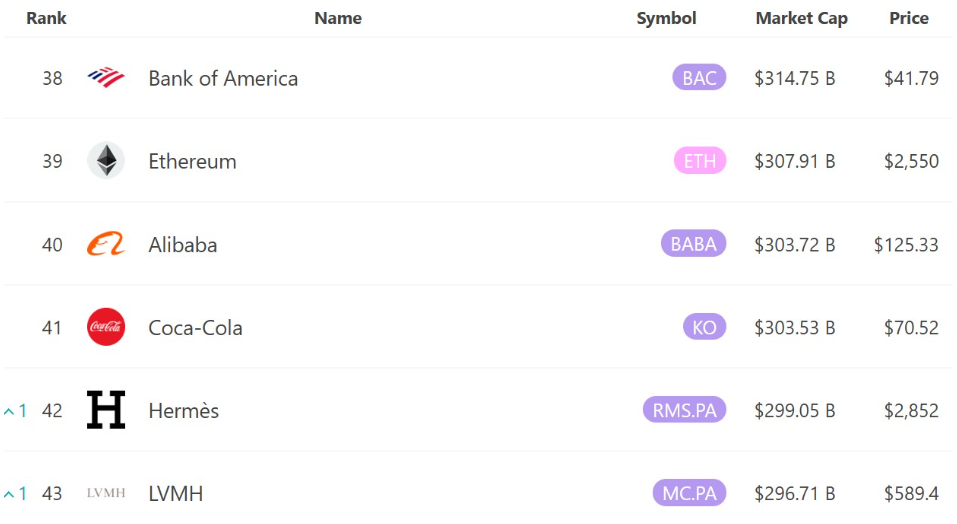

Ethereum just pulled a fast one on some serious corporate giants. In five days, Ether’s market cap jumped 42%, pushing it past Coca-Cola and Alibaba in the global asset rankings.

Ethereum’s now the 39th-largest asset on the planet, clocking in with a market cap north of $308 billion while trading around $2,550. Coca-Cola and Alibaba are stuck just under $304 billion each.

Stronger, faster, better

What’s behind this sudden growth? The Pectra upgrade. Originally slated for March 2025, this upgrade faced its fair share of hiccups, like failed testnet launches, empty blocks mined by attackers, you name it.

Ethereum’s devs had to roll up their sleeves, create a new testnet called Hoodi, and iron out the kinks before finally pushing Pectra live on the mainnet on May 7. And boy, did it pay off.

Pectra brings some slick improvements, it lets externally owned accounts, the regular wallets you and I use, act like smart contracts.

That means paying gas fees with tokens other than ETH, no more scrambling for Ether every time you want to move coins.

Plus, staking got a serious upgrade, with validator limits jumping from 32 ETH to 2,048 ETH.

Big players can now stake easier and bigger. And let’s not forget the layer-2 scaling boost, more data per block mean faster, cheaper transactions for everyone.

The dark side

The market noticed. Ether was trading around $1,780 on May 7, and by May 12, it jumped to $2,550-a 42% leap in less than a week.

That’s like watching a classic underdog story. But hold your horses, there are some bad news too. Security pros are waving red flags.

The new upgrade introduced a fresh transaction type that could let hackers hijack wallets without users signing onchain transactions.

Arda Usman, a Solidity smart contract auditor, warned that offchain signed messages might be exploited to drain funds. So yeah, the upgrade’s powerful, but it’s got its shadows.

Same, but different

Still, Ethereum’s showing it’s not just a crypto asset anymore, but it’s progessive, developing tech, pushing boundaries, and climbing ranks. Surpassing Coca-Cola and Alibaba? That’s a big deal. Well done!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.