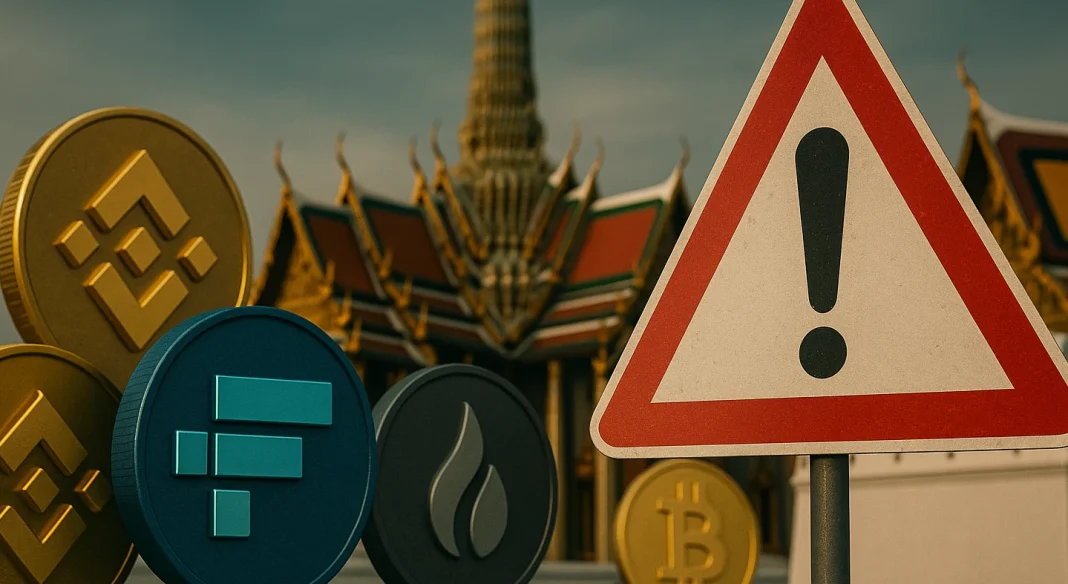

Listen, here’s the deal from the land of smiles. Thailand’s Securities and Exchange Commission is stirring the pot, and they want you to have a say.

They just kicked off a public consultation to rethink the rules on how crypto assets get listed on local exchanges.

Transparency first

One big change on the table? Exchanges might soon be allowed to list their own utility tokens, or tokens from their buddies, the affiliated entities.

Imagine your local coffee shop suddenly selling its own brand of coffee beans. Sounds like a power move, right?

But with great power comes great responsibility. The SEC wants exchanges to spill the beans, literally, by disclosing who’s behind these tokens. No more hiding in the shadows.

And get this, exchanges will have to slap warning alerts in their systems to help the SEC sniff out any insider trading.

It’s like putting a security camera in the break room to catch who’s sneaking extra donuts. Existing tokens?

They’ve got 90 days to name names if this new rule passes. The SEC’s open for comments until July 21, so if you’re in Thainland, and you’ve got thoughts, now’s the time to shout.

New plans

As they say, Thailand’s not just talking the talk, they’re walking the walk. Earlier this week, they rolled out a five-year tax break on crypto income.

That’s right, no tax on your crypto gains for five years. It’s like the government saying, go ahead, take a chance, we got your back.

Deputy Finance Minister Julapun Amornvivat put it plainly, and said Thailand’s gunning to be a global digital asset hub, and they’re not messing around.

Keeping up

This summer, Thailand plans to drop about $150 million worth of digital investment tokens.

These aren’t your grandma’s savings accounts tho, they’re promising higher returns than your typical bank deposits. It’s like upgrading from a tricycle to a motorcycle in the investment world.

And remember back in January? The SEC was already flirting with the idea of letting bitcoin ETFs hit Thai exchanges.

With global competition heating up, Thailand’s making sure it stays in the crypto fast lane.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.