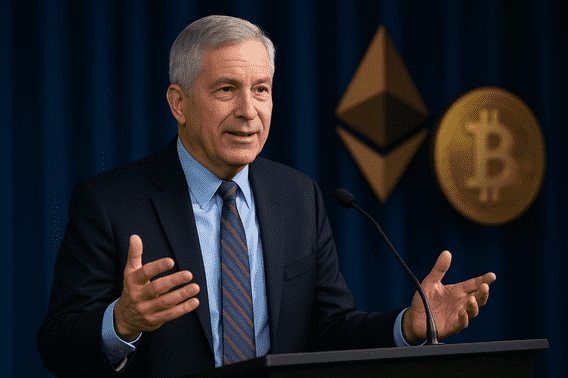

Federal Reserve Governor Christopher Waller told bankers and policymakers there is “nothing to be afraid of” about DeFi and stablecoins.

He made the remarks at the Wyoming Blockchain Symposium 2025.

“There is nothing scary about this just because it occurs in the decentralized finance or DeFi world — this is simply new technology to transfer objects and record transactions,”

Waller said.

He urged regulators and banks to recognize that smart contracts, tokenization, and distributed ledgers can support everyday transactions.

“There is nothing to be afraid of when thinking about using smart contracts, tokenization, or distributed ledgers in everyday transactions,”

he added.

Fed Policy Toward DeFi and Stablecoins Changes in 2025

The Federal Reserve has taken steps in 2025 to ease its stance on DeFi and stablecoins. In April, the Fed withdrew its 2022 guidance that discouraged banks from handling crypto and stablecoin activities.

Last week, the Fed ended its “novel activities supervision program”, which oversaw banks’ crypto-related operations.

On Tuesday, Fed Vice Chair for Supervision Michelle Bowman suggested Fed staff should be allowed to hold small amounts of crypto to gain technical knowledge.

Waller’s role may grow further as he is a front-runner to succeed Jerome Powell as Fed chair.

Powell’s term ends in May 2026, and reports suggest President Donald Trump has pressured Powell to resign before the end of his mandate.

DeFi Payments Compared to Debit Card Transactions

Waller compared DeFi transactions with stablecoins to traditional debit card payments. He said the process of buying a memecoin with stablecoins mirrors buying groceries.

“I can go to the grocery store and buy an apple and use a digital dollar in my checking account to pay for it. I tap my debit card on a card reader to conduct the transaction. Finally, the machine prints out a receipt, which is the record of the transaction. The same process applies to the crypto world,”

he said.

“I buy a meme coin and use a stablecoin as the means of payment. The transaction takes place using a smart contract. Finally, the transaction is recorded on a distributed ledger.”

GENIUS Stablecoin Bill Called Important for Adoption

Waller described the GENIUS stablecoin bill — Guiding and Establishing National Innovation for US Stablecoins Act — as an “important step” for stablecoin adoption.

The legislation was signed recently to regulate stablecoin use in the United States.

He said stablecoins could strengthen the international use of the US dollar in high-inflation economies and regions with limited access to physical cash.

Stablecoins, according to him, can also help improve retail and cross-border payments.

Stablecoin Market Growth Projected to $2 Trillion

The US Treasury estimated that the stablecoin market, currently valued at $280 billion, could grow 615% to reach $2 trillion by 2028.

Officials said a regulatory framework could drive demand for US Treasury bills as stablecoin backing assets.

According to CoinGecko, Tether (USDT) holds a market capitalization of $167 billion, while Circle’s USDC stands at $67.5 billion. These two stablecoins dominate the global market and remain central to the sector’s expansion.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 21, 2025 • 🕓 Last updated: August 21, 2025