Balaji Srinivasan, the former CTO of Coinbase, has recently criticized the Federal Reserve’s monetary policy, igniting hotheaded discussion within the financial and cryptocurrency communities.

Not the biggest fan of the Fed

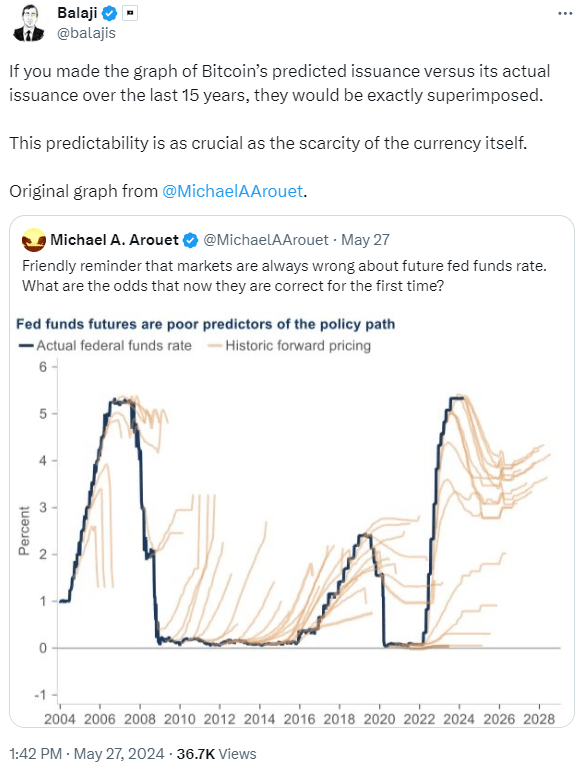

Srinivasan argues that the Federal Reserve’s policies are unpredictable, especially when compared to Bitcoin’s consistent issuance schedule.

According to Srinivasan, the Fed’s approach to managing the economy, primarily through adjusting interest rates, is insufficient for dealing with the complexities of a modern economic system.

The Fed’s recent decision to maintain interest rates at a 23-year high to combat inflation is a good example of this strategy.

Srinivasan thinks that this single-parameter adjustment method is fundamentally flawed for managing a complex, multifaceted economy, and instead of this, he suggest that Bitcoin’s predictable issuance schedule provides a more stable and reliable alternative.

This perspective resonates with many Bitcoin supporters who value the cryptocurrency’s transparency and predictability.

Man vs machine

The debate between the predictability of Bitcoin and the unpredictable nature of the Federal Reserve’s policies raises many questions about the effectiveness of central bank strategies, and the central bank itself.

Bitcoin’s fixed issuance rate contrasts with the Fed’s ability to change policies based on economic conditions, which can sometimes looks arbitrary.

This contrast is strong in the context of managing inflation and economic growth.

While the Federal Reserve adjusts interest rates to influence economic activity and control inflation, critics like Srinivasan argue that these adjustments are reactive rather than proactive, potentially leading to market instability.

Maybe this is not the inflation control what are we looking for.

Srinivasan’s comments match to the growing sentiment among cryptocurrency supporters who are skeptical of traditional central bank policies.

They argue that Bitcoin’s inherent predictability offers a more reliable foundation for financial stability, taking the fallible human element out from the equation.

This perspective might lead to increased support for Bitcoin and other cryptocurrencies as viable alternatives to traditional financial systems.

Power games

Some expert thinks Srinivasan’s critique could pressure the Federal Reserve to adopt more transparent communication regarding future policy changes, but others are sceptical.

Bigger transparency might help mitigate some of the unpredictability associated with the Fed’s decisions, but this didn’t happen before.

Bitcoin’s decentralized nature and predetermined supply contrast with the centralized control and the power of traditional central banks like the Federal Reserve, and Srinivasan’s criticism aligns with a broader movement advocating for decentralized financial systems.

Proponents argue that decentralized systems can offer greater financial inclusivity, reduce the risk of policy-induced market effects, and provide a hedge against inflation and currency debasement.