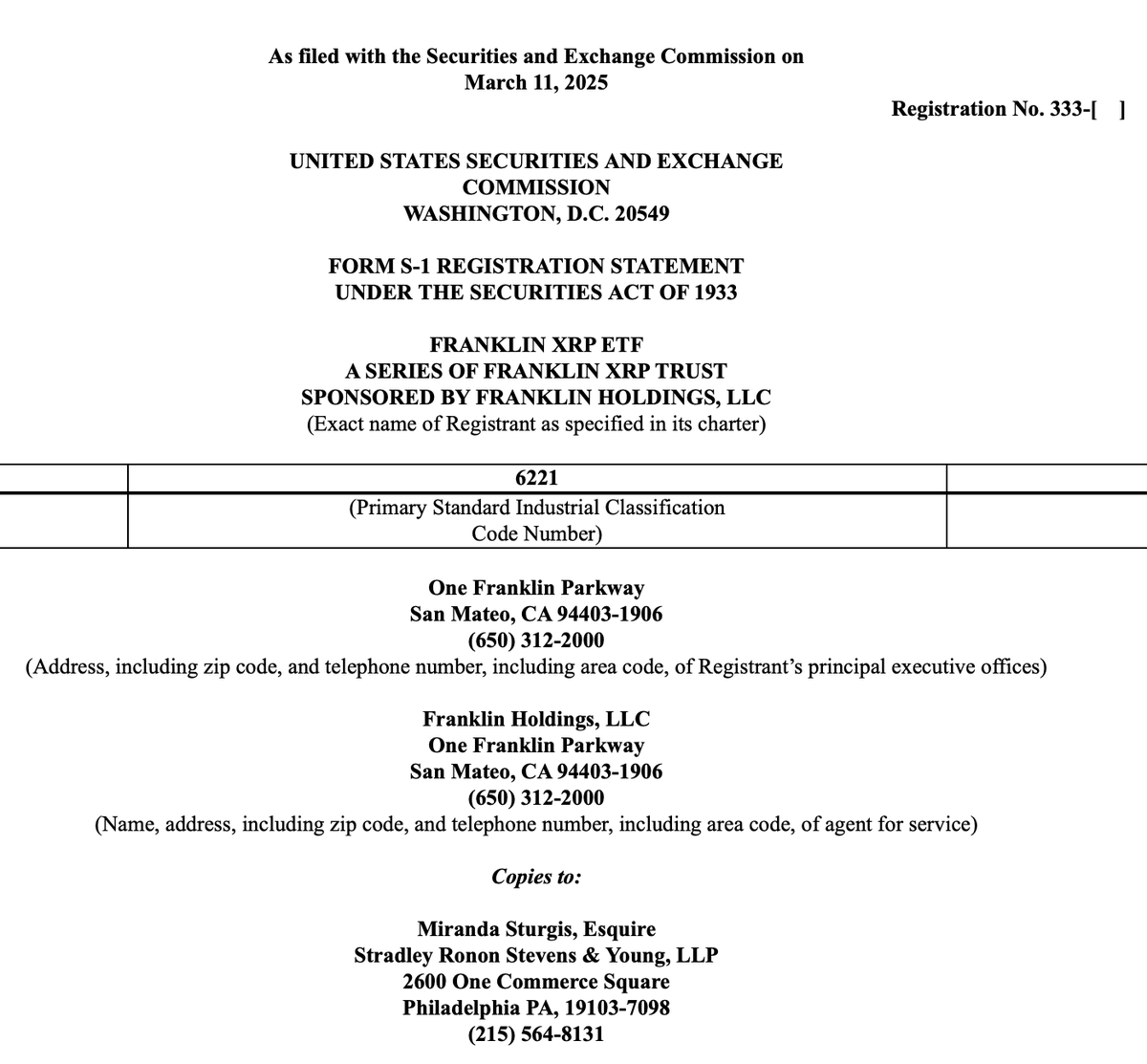

Franklin Templeton’s spot XRP ETF is set to begin trading tomorrow under the ticker EZRP, marking a major addition to this month’s lineup of newly approved U.S. crypto ETFs.

The launch comes as XRP hovers above a critical support zone, drawing fresh attention to whether buyers can defend the $2.15 level ahead of the fund’s debut.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Franklin Templeton’s Spot XRP ETF Set to Launch Tomorrow

Franklin Templeton will launch its spot XRP exchange-traded fund (ETF), trading under the ticker EZRP, tomorrow, November 18, on Cboe.

The new fund will give traditional investors regulated exposure to XRP as part of a broader wave of U.S. spot XRP ETF listings this month.

The account STEPH IS CRYPTO (@Steph_iscrypto) flagged the launch as “breaking” in a November 17 post on X, noting that Franklin Templeton’s EZRP goes live tomorrow and suggesting that “XRP to $5 seems fair.”

The comment highlights how some market participants view the ETF rollout as a potential catalyst for higher XRP prices, even as those targets remain speculative and depend on actual demand once trading begins.

XRP Tests $2.15 Support as Traders Watch for Move Toward $2.70

Analyst Ali Martinez says $2.15 remains the key “line in the sand” for XRP, marking the support level that needs to hold to keep the current structure intact.

On his latest chart, XRP repeatedly bounces near this zone after a series of sharp intraday swings.

The level now acts as the main boundary between a deeper breakdown and another attempt higher.

If buyers defend $2.15, Ali notes that XRP could revisit the $2.40 to $2.70 range that capped previous rallies.

In that case, the market would likely shift its focus back to how much volume follows any move into this resistance band.

The upper range has already rejected price several times, so a new test there would measure the strength of fresh demand.

However, a clear daily close below $2.15 would weaken this bullish setup and open the door to lower supports on the chart.

For now, XRP trades between the $2.15 floor and the mid-range zone, while traders track whether the latest bounce can build into a sustained push toward $2.40–$2.70.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀