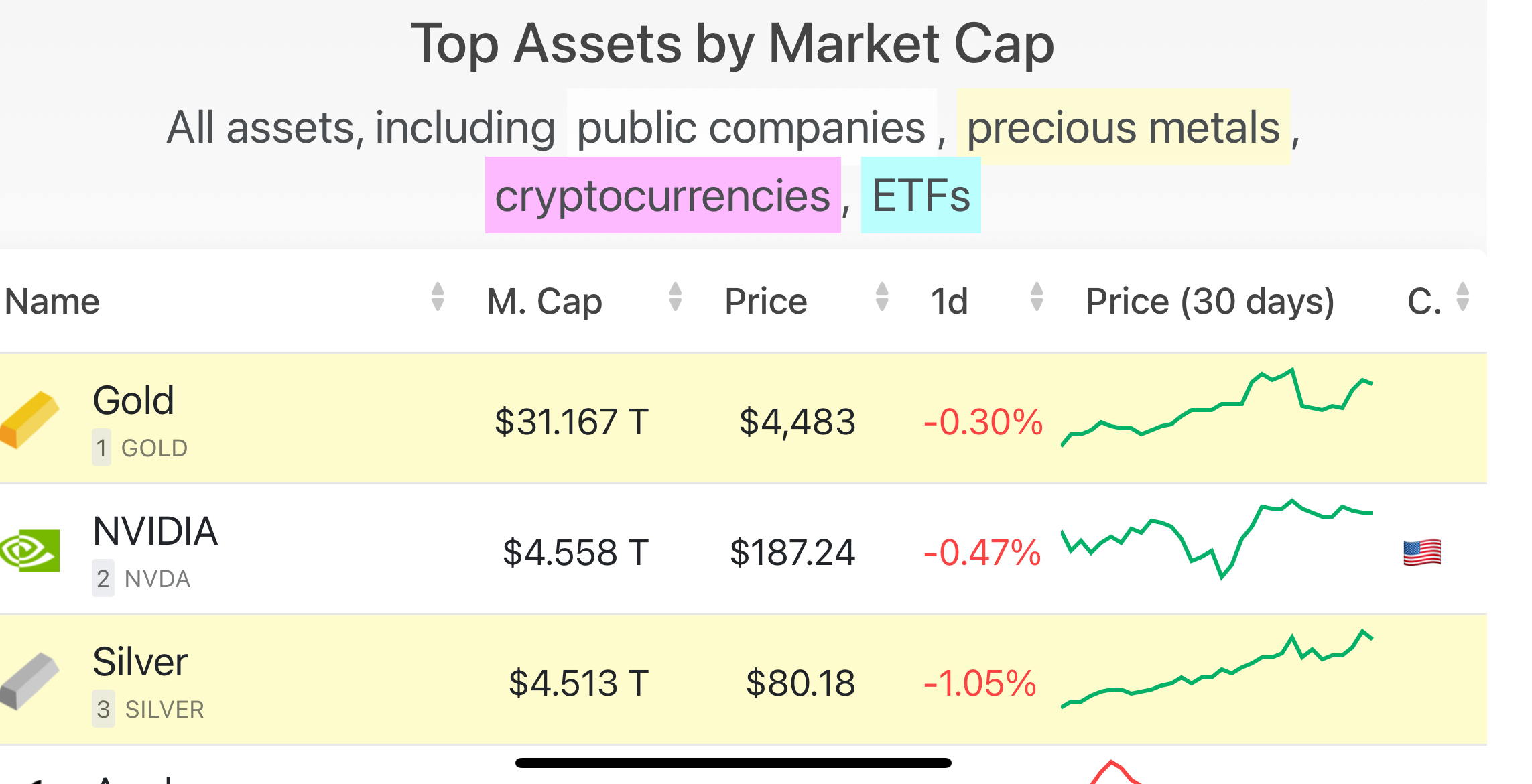

Gold and silver briefly returned to the top two places by market capitalization as 2026 began, based on CompaniesMarketCap data. The same market capitalization ranking placed Bitcoin market cap in the eighth spot.

Gold market cap stood at $31.1 trillion in the dataset at the time of the update.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The ranking treated gold and silver as traditional stores of value during a period of uncertainty.

The same CompaniesMarketCap data also showed a close fight for second place. Silver market cap and Nvidia market cap traded positions again after a months long back and forth.

CompaniesMarketCap data shows gold market cap at $31.1 trillion

The CompaniesMarketCap data listed gold market cap at $31.1 trillion, keeping it at the top of the market capitalization ranking. The dataset placed gold ahead of the largest public companies and major crypto assets.

The report linked the move to demand for stores of value. It said investors shifted toward precious metals over the past year during global conflicts and trade disputes.

In the same market capitalization ranking, Bitcoin market cap stayed in eighth position. The dataset did not show Bitcoin moving into the top two during this period.

Silver market cap flips Nvidia market cap, then falls back again

Silver market cap briefly moved ahead of Nvidia market cap, according to CompaniesMarketCap data. However, Nvidia regained second place by the time of publication.

The report said silver and Nvidia have traded places since December. It described the gap as small, with the two assets “almost neck and neck” on the CompaniesMarketCap chart.

The report also noted Nvidia’s strength came from demand for AI related computing resources.

It tied the Nvidia market cap position to continued spending on hardware and infrastructure for artificial intelligence workloads.

Federal Reserve rate cuts and 2026 monetary policy enter the picture

The report said investors expect Federal Reserve rate cuts under a new chair. It linked those expectations to demand for commodities, including gold and silver, in early 2026.

It also cited recent price levels for metals. The report said gold and silver recently tagged new all time highs of around $4,500 for gold and $80 for silver.

In a separate interview cited in the report, Owen Lau, managing director at Clear Street, said the Fed’s 2026 monetary policy decisions will be “one of the key catalysts for the crypto space.”

Lau also said lower rates would increase interest in risk assets, and he referenced “digital gold” when discussing crypto.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 7, 2026 • 🕓 Last updated: January 7, 2026