Hyperliquid’s token, HYPE, has burst onto the scene with 290% price increase this month alone, rocketing to a new ATH of $35.

While Bitcoin and alts are taking a breather, investors are flocking to HYPE as the mid-cap star to watch.

What’s fueling the HYPE?

As the market shifts away from Bitcoin and its altcoin pals, HYPE has captured the spotlight with its strategic focus on key aspects of the crypto ecosystem.

Industry insiders are buzzing about Hyperliquid’s potential to dominate crypto fee generation by 2025.

Ryan Watkins, co-founder of Syncracy Capital, is among those who believe that HYPE could soon lead the pack.

At the core of Hyperliquid is its decentralized exchange, where trading fees are generated every time users swap currencies, just like in any other DEXs.

More traders mean higher fees, which translates to more revenue for the platform. But DEX volumes are plummeting.

Resilience

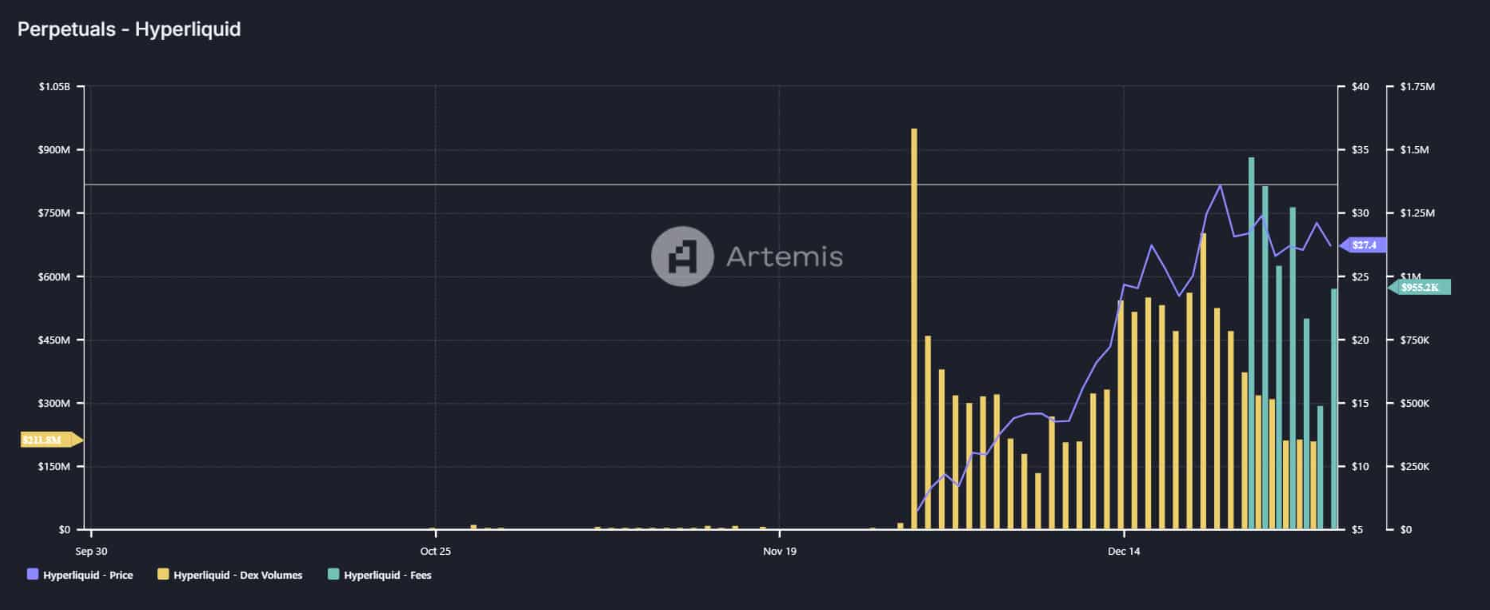

Once boasting an impressive trading volume of $952 million, it has decreased to just $211.8 million recently, and this drop has also impacted revenue, which fell from $1.5 million to $955K.

On the other hand, Hyperliquid is showing some serious resilience. In a market that feels like a rollercoaster ride, it’s managing to hold its ground better than many competitors. Talk about a silver lining!

As the yeear arrived to its end, HYPE is ending on a high note with a quite nice 780% growth year-to-date, after it’s firmly established itself in the top20 crypto and even made waves in the crypto derivatives market with half a billion in open interest just one month after launch.

The road ahead

So what’s next for HYPE? With its technology combining spot and derivatives exchanges through HyperEVM, Hyperliquid is setting itself up for long-term success, because this unique blend offers users seamless trading experiences, something that could really set it apart from rivals.

Experts predict that as Hyperliquid continues to refine its business model and adapt to market demands, it could very well surpass its competitors in revenues generation by 2025.

With its focus on core crypto functions and declining DEX volumes elsewhere, HYPE looks poised for even greater rally.