For once, the crypto debate in Washington isn’t about conflict of interest, token listings, or whether something “counts as a security.”

It’s about something far more basic: who gets to pay interest on your money.

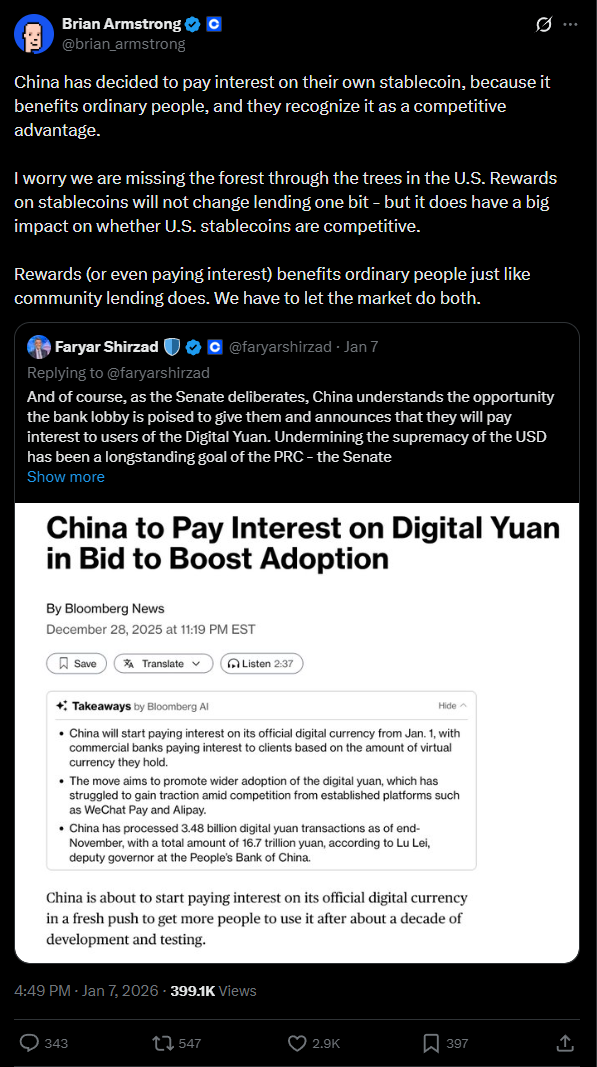

This week, a quiet but intense fight spilled into public view. Banks warned lawmakers that stablecoins offering yield could drain hundreds of billions from traditional deposits.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Crypto executives fired back, accusing the old system of protecting its turf. Regulators, stuck in the middle, are now being asked to decide whether digital dollars should behave like bank money, or something entirely new.

And here’s the part that matters most.

If stablecoin yield survives regulation, everyday users could earn 4–5% on dollar-like assets from a phone app.

If it doesn’t, banks keep paying near-zero on deposits while charging double-digit interest on credit cards.

That’s the real stake. Everything else is framing.

Banks: “this could break the deposit model”

The warning shot came from traditional finance.

Analysts at Standard Chartered estimated that as stablecoins scale, as much as $500 billion could flow out of U.S. bank deposits by 2028, and possibly much more over time.

Banks aren’t panicking over crypto technology itself. They’re worried about something simpler, the competition for deposits.

If stablecoins, or the platforms holding them, can offer yield, even indirectly, why would users park cash in an account paying 0.01%?

From the banking perspective, this isn’t innovation, but erosion.

That’s why bank lobbyists have pushed lawmakers to draw a hard line, no yield on stablecoins, full stop.

In private conversations and public statements, the argument is framed as financial stability.

The subtext is less subtle. Deposits fund lending. Lose deposits, and the model starts wobbling.

Crypto’s response: “you’re afraid of losing the customer”

Crypto executives didn’t take long to respond.

From their side, the idea that stablecoin yield threatens the system feels backwards. Industry voices argue that banks aren’t losing deposits because of crypto. They’re losing them because they stopped competing for savers years ago.

Several crypto leaders have pointed out that the proposed rules don’t actually ban yield at the issuer level.

Instead, they restrict how stablecoins themselves operate, while leaving room for platforms, exchanges, or on-chain protocols to offer returns.

Translation: even if regulators try to wall off yield, the market will route around it.

There’s also a bruised-ego element at play. For years, banks dismissed crypto as irrelevant.

Now that dollar-denominated tokens can move instantly, globally, and potentially pay interest, the tone has changed.

Regulators caught refereeing a power struggle

Lawmakers were hoping stablecoin legislation would be one of crypto’s easier wins, a way to bring order without drama. Instead, yield has become the fault line.

On one side, banks warning of deposit flight and systemic risk. On the other, crypto firms arguing that banning yield locks consumers into an uncompetitive status quo.

The White House has reportedly stepped in, hosting meetings with both camps as the bill stalls. Everyone agrees regulation is coming.

Nobody agrees on what it should protect: financial stability, consumer choice, or incumbent balance sheets.

Zoom out: this isn’t new, just newly visible

Here’s the weird part.

We’ve seen this movie before.

Money-market funds once triggered similar fears by offering higher yields than banks. Online brokerages did it again by unbundling services.

Each time, regulators had to decide whether protecting the system meant protecting institutions, or letting consumers move their money freely.

Stablecoins are just the latest front. The difference is speed. And scale.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

What this actually comes down to

Strip away the policy language, and the debate becomes uncomfortably simple.

Banks pay 0.01% on deposits, if that. The same institutions routinely charge double-digit interest on credit cards.

So when people hear that a dollar-denominated token might pay 4–5% from a phone app, we may ditch the ideology, because it becomes a cold-reality practical question.

If stablecoin yield is allowed, money becomes more mobile and banks have to compete.

If it’s restricted, the legacy system keeps its grip on deposits, and crypto stays on the outside, tolerated but not integrated.

Crypto’s elite wants in. Banks want control. Regulators are trying not to break anything.

Meanwhile, users are watching all of this and doing the math in their heads.

Where this heads next

No final decision has been made. But one thing is already clear, stablecoins are no longer a niche payment tool. They’re a direct challenge to how money is stored, moved, and rewarded.

And the fight over yield isn’t about crypto versus banks.

It’s about who gets to decide what your money is allowed to do, and much you’re allowed to earn.

The referee hasn’t blown the whistle yet. But the crowd knows what’s at stake.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: January 31, 2026 • 🕓 Last updated: January 31, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.