Experts say an interesting shift becomes visible among institutional investors, who are increasingly moving their funds from Bitcoin to Ethereum.

While Bitcoin has traditionally been the focal point due to its status as the leading cryptocurrency and the base for many trading pairs, Ethereum is seemingly coming for the king.

Is this the flippening?

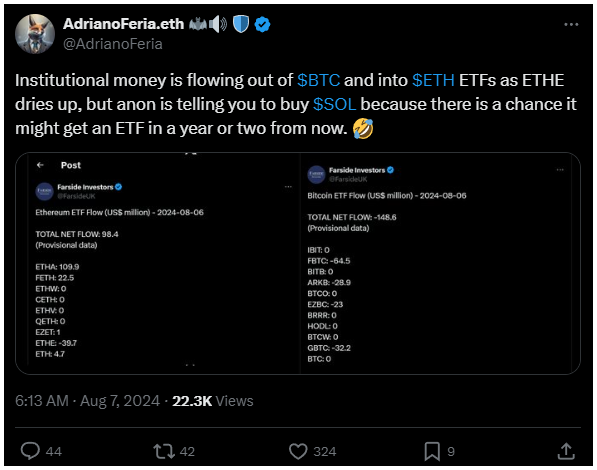

An analyst shared this trend by examining spot ETF flows over the past few days. Based on the data, institutions are favoring Ethereum over Bitcoin, as evidenced by big inflows into spot Ethereum ETFs, while inflows into Bitcoin ETFs have been drying up.

The optimism around Ethereum is growing, with many confident that ETH can withstand selling pressures and eventually break through resistance levels at $2,800 and $3,300. Of course, there is a long way to go.

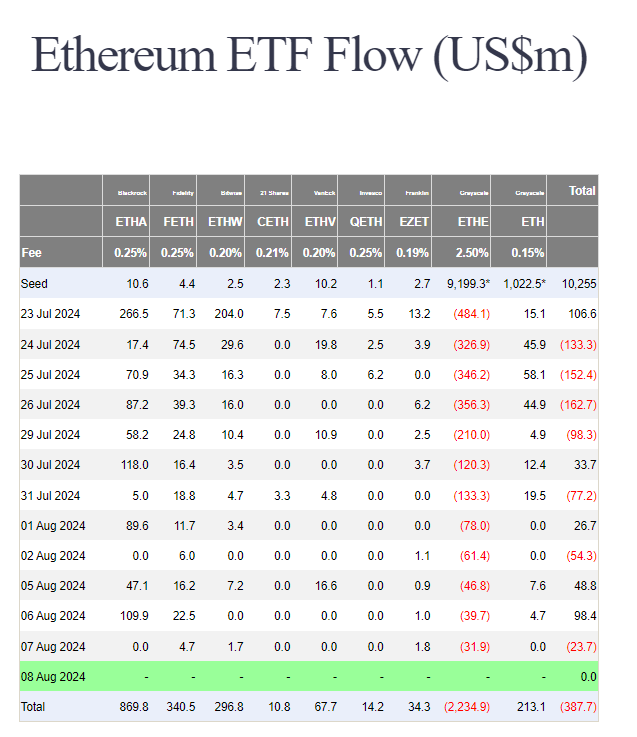

But the market is also confident, as BlackRock’s iShares Ethereum Trust has become the largest spot Ethereum ETF by assets under management, attracting nearly $870 million since its launch.

Ethereum won’t replace Bitcoin soon

Earlier this week, when prices took a dip, investors purchased $50 million worth of ETH through ETHA, followed by another $109 million.

Overall, all spot Ethereum ETFs saw inflows exceeding $98 million on August 6, with ETHA leading the way.

Fidelity’s FETH also saw $22.5 million in net inflows, while Grayscale’s ETHE experienced outflows of $39.7 million.

On the other hand, spot Bitcoin ETFs recorded outflows totaling $148 million on August 6, but Bitcoin continues to hold its ground.

BlackRock’s spot Bitcoin ETF, IBIT, did not see any inflows during this period, while Fidelity’s spot Bitcoin ETF, FBTC, faced outflows of $64 million.

A BlackRock azonnali Bitcoin ETF-je, az IBIT nem látott beáramlást ebben az időszakban, míg a Fidelity azonnali Bitcoin ETF-je, az FBTC 64 millió dolláros kiáramlással szembesült.

Grayscale’s GBTC also saw outflows amounting to $32 million.

Profit possibilities

Some analysts think this shift in demand towards Ethereum ETFs over Bitcoin ETFs may bring a reversal of ETH’s losses against BTC in the near future.

The BTC/ETH chart tells another story, because Bitcoin is in a bullish breakout formation compared to Ethereum.

But the changing investment patterns among institutions signals that Ethereum could gain some ground. Unlikely, but there are chances.

This trend of institutions reallocating funds from Bitcoin to Ethereum only measn the crypto market is basically the same as any markets.

If Ethereum continues to attract institutional interest, it could lead to a stronger performance relative to Bitcoin. But replacing it? We aren’t sure about that.