Cardano is having a bit of a rough patch, struggling to get back above that all-important $1 level as market sentiment remains cautious and profit-taking heats up.

The textbook rollercoaster ride

In the past weeks, ADA has experienced some quite serious price swings, making it tough to maintain a solid footing above the 1 dollar level.

The overall market mood is leaning towards neutral to bearish, which isn’t helping the situation at all.

But don’t count Cardano out just yet, long-term holders are sticking around, providing essential support and hopefully preventing any major price drops.

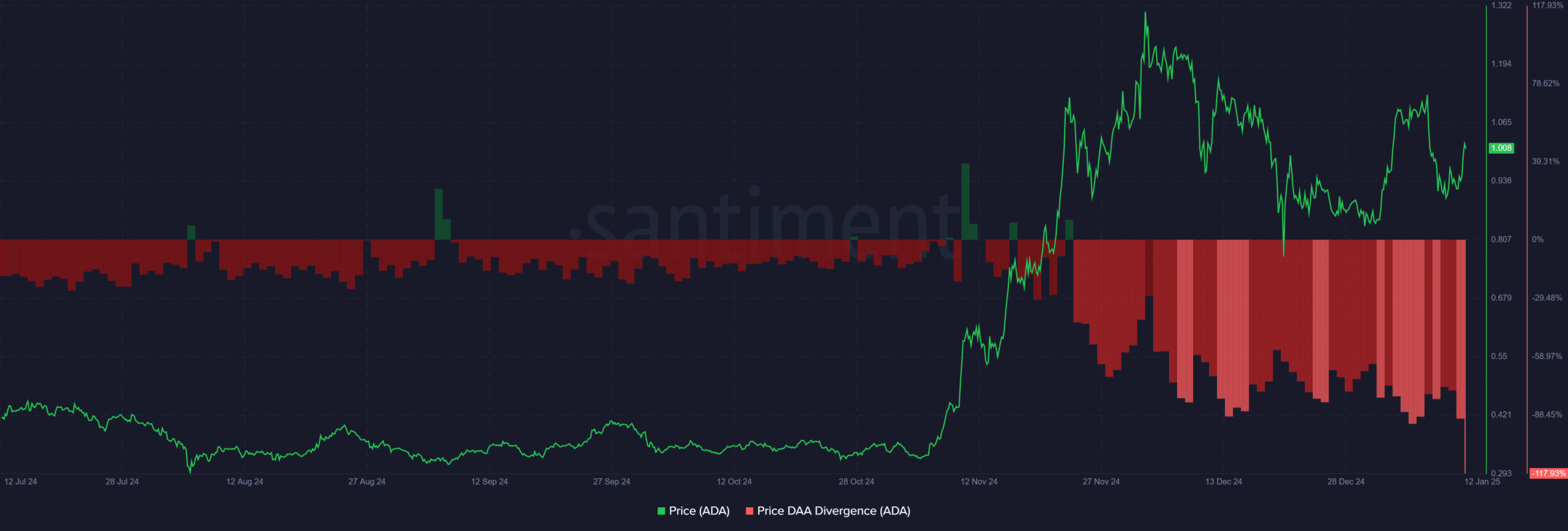

One key indicator to watch is Cardano’s Price DAA, the Daily Active Addresses Divergence, which has been sending out persistent sell signals.

This means there’s a disconnect between ADA’s price struggles and the activity on the network.

Profit-taking?

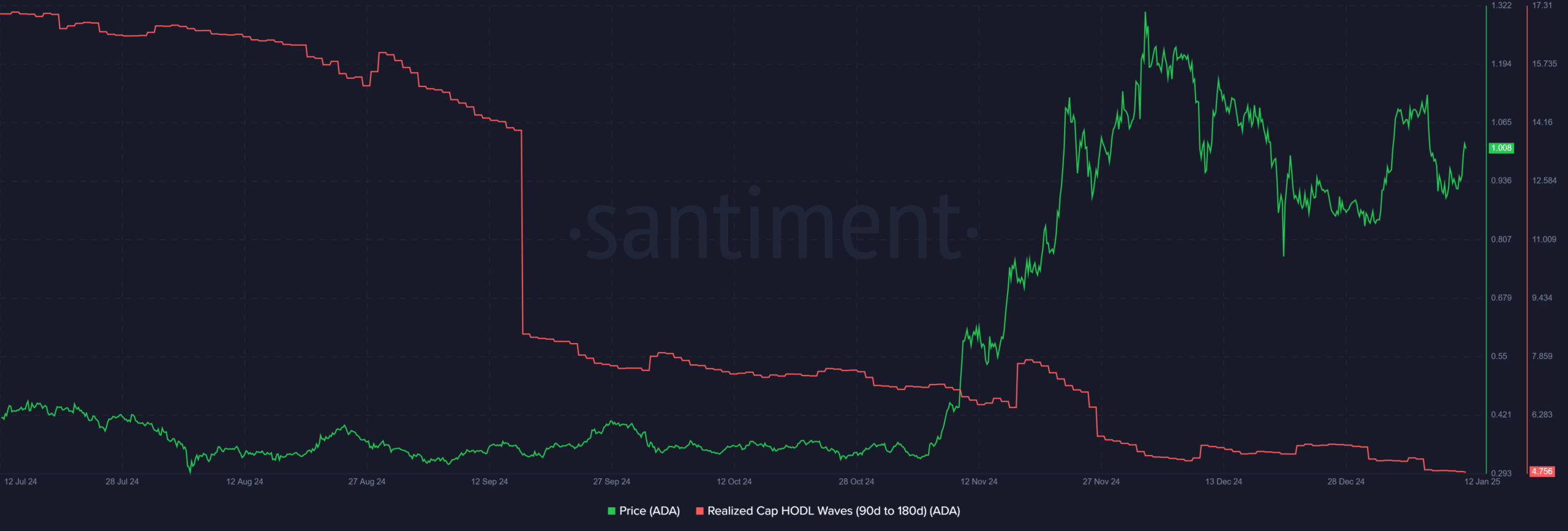

Looking at the Realized Capital HODL Waves for Cardano, there’s been a noticeable decline, especially among mid-term holders who seem to be cashing out during the price surges.

This behavior suggests that as ADA approaches its critical resistance levels near $1, profit-taking is becoming more common.

On the other hand, long-term holders are holding steady, showing their commitment despite the short-term ups and downs. This split between mid-term sellers and long-term believers highlights ongoing uncertainty in the market.

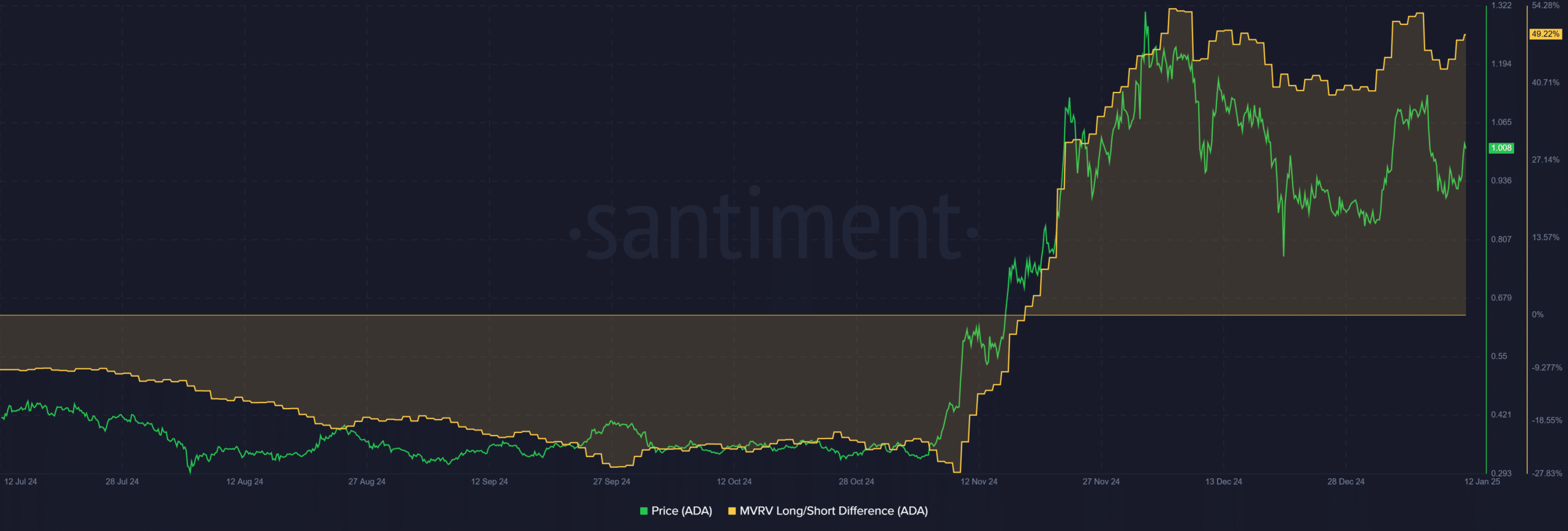

Another interesting metric to consider is the MVRV Long/Short Difference, which shows a shift in profitability dynamics.

As ADA’s price briefly climbed above $1, short-term holders who bought in at lower levels started taking profits en masse, adding pressure to the selling side.

The big question: what’s next for ADA?

Cardano’s price seems caught between short-term selling pressure and the resilience of long-term holders.

Establishing support at $1 is pretty important as skepticism grows. If ADA can reclaim the $1.10 resistance level, it might spark some investor confidence and drive momentum toward $1.30.

On the downside, if it loses support at $0.95, we could see further declines with potential retests of $0.85 and even $0.75. With ongoing profit-taking and muted network engagement, bearish risks are on the rise.