A new survey reveals that more than a half of Japan’s institutional investors are considering cryptocurrency investments as a viable way to diversify their portfolios.

Nomura Securities found that 54% of these investors plan to enter the cryptocurrency market within the next three years.

Rising sun and rising interest

Nomura Holdings, along with its subsidiary Laser Digital Holdings, conducted a survey to know the interest of institutional investors in cryptocurrencies.

The survey originally took place from April 15 to April 26, involved 547 investment managers from domestic institutional investors, family offices, and public interest corporations.

The findings show a clearly growing acceptance and interest in cryptocurrencies within Japan’s financial sector.

Gains, not transactions

According to the survey, 25% of respondents have a positive outlook on cryptocurrencies for the coming years, while 23% view them negatively, and 52% remain neutral.

Bitcoin and Ethereum were particularly favored, likely reflecting their leading positions in the market.

A significant 62% of respondents see cryptocurrencies as a good opportunity to diversify their investments, driven mainly by the potential for high returns that digital assets offer.

Only 16% consider cryptocurrencies as an alternative to traditional currencies, suggesting that most are interested in the investment potential rather than using them for everyday transactions.

New ways

The survey also revealed that 66% of respondents would allocate 2-5% of their assets to cryptocurrencies. 76% of those surveyed plan to hold their cryptocurrency investments for at least one year, showing a long-term investment approach.

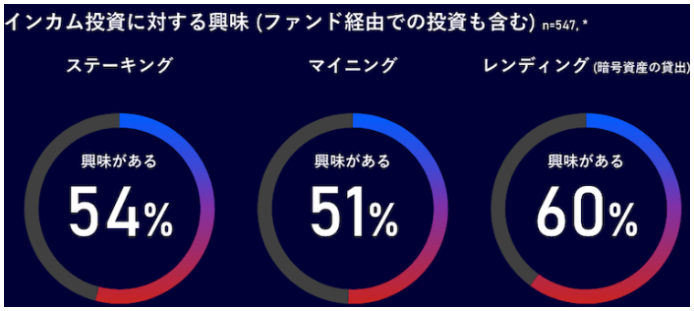

The interest in cryptocurrencies extends beyond traditional investments, with more than half of the respondents keen on exploring staking, mining, and lending opportunities, not just simply buying and holding.

Many thinks the introduction of a cryptocurrency ETF in Japan could further stimulate market activity and attract more institutional investors.

One can speculate that such developments can boost confidence in digital assets in the financial sector, leading to bigger adoption.