It’s Christmas Eve, and who shows up under the tree but Jim Cramer, wrapping Bitcoin in a big red bow of doom.

The CNBC madman, that eternal fountain of market hot takes, has flipped 100% bearish on BTC.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Traders everywhere are cracking open the eggnog, because when Cramer goes full grizzly, history screams “inverse play”. Oh boy. Full send.

The Cramer curse

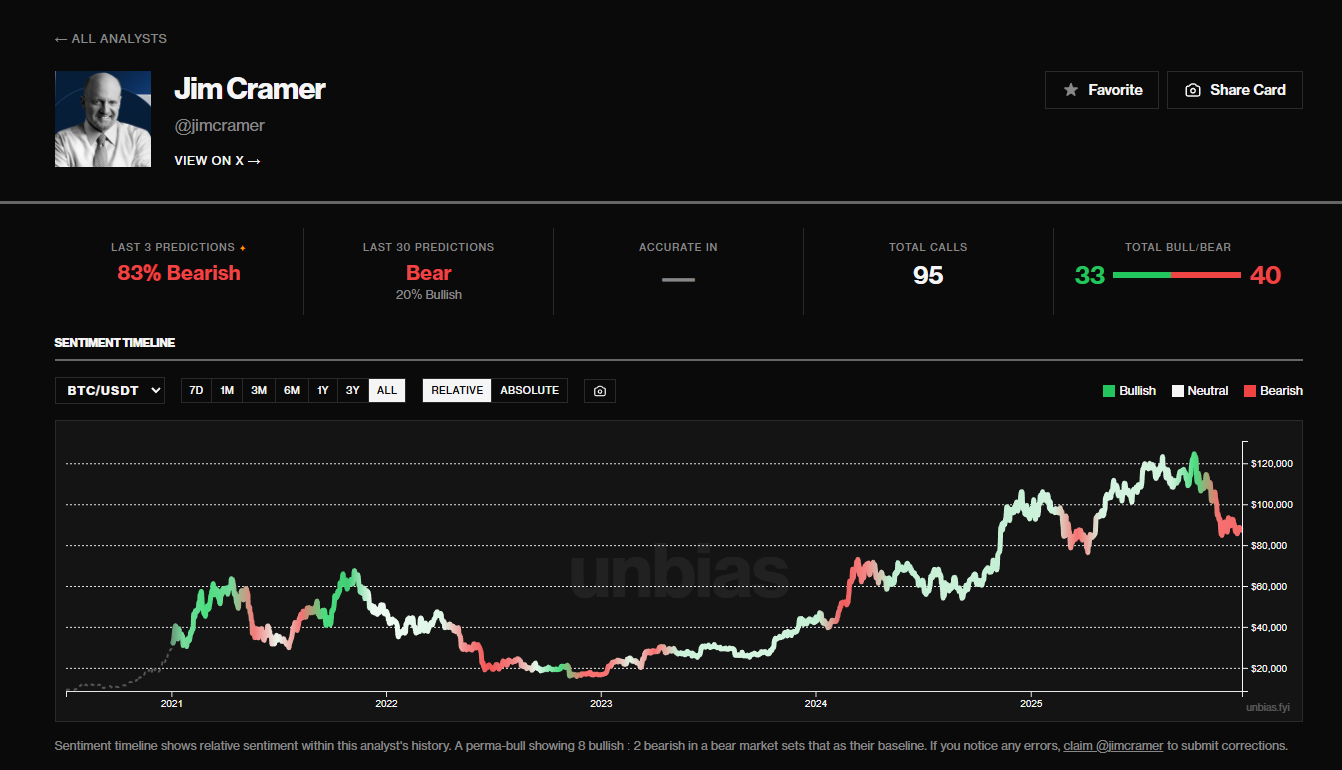

Unbias, the no-nonsense tracker of Cramer’s crypto rants, paints the picture crystal clear.

Their dashboard lights up with his latest Bitcoin blasts, categorized as straight-up bearish or “bearish (nuanced),” like he’s hedging a bet he already lost.

No more fairy tales about long-term adoption.

Nah, Cramer’s zeroed in on the dark underbelly, dodgy derivatives, sky-high leverage, and those sham “Bitcoin pseudo-companies” drowning in debt. It’s like he’s spotted the Death Star’s exhaust port in BTC’s market structure.

But here’s the cosmic joke that keeps crypto cowboys chuckling.

They call it the Cramer curse, that delicious superstition where whatever Cramer pumps or dumps rockets the other way.

His loudest cheers have turned into market U-turns so often, people treat his calls like a contrarian signal straight from the oracle of Delphi, only drunk and yelling on TV.

Inverse Cramer Tracker ETF

This ain’t just Bitcoin folklore. The man’s “reverse indicator” rep got so legendary, they actually launched an Inverse Cramer Tracker ETF to bet against his stock picks. For real.

Sure, it fizzled out like a bad sequel, but the legend lives. CryptoQuant’s Ki Young Ju nailed it on X:

“BREAKING: Jim Cramer is 100% bearish on Bitcoin. Merry Christmas.” Ho ho ho, indeed.

BREAKING: Jim Cramer is 100% bearish on Bitcoin.

Merry Christmas 🎄 pic.twitter.com/qDr2Yx2U8X

— Ki Young Ju (@ki_young_ju) December 24, 2025

Betting against the loudest voice often pays the biggest dividends?

Why the glee amid the gloom? Analysts say Bitcoin’s teetering on a knife-edge right now, squeezed in a fragile range between $93k rejection overhead and $81k support below.

Glassnode’s Dec. 17 “Week On-chain” report spells disaster, saying that heavy supply raining down, demand fizzling.

Choppy late-cycle action, they say, perfect setup for Cramer’s bear howl to echo as the ultimate buy signal.

Traders whisper that if BTC bucks the bears and blasts higher, sentiment was “too negative” to ignore. But if it cracks support?

Well, the party’s over, and Cramer’s laughing last. Still, in this game of crypto chicken, betting against the loudest voice often pays the biggest dividends.

Who’s got the stones to fade the Cramer curse this time?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: December 27, 2025 • 🕓 Last updated: December 27, 2025

✉️ Contact: [email protected]