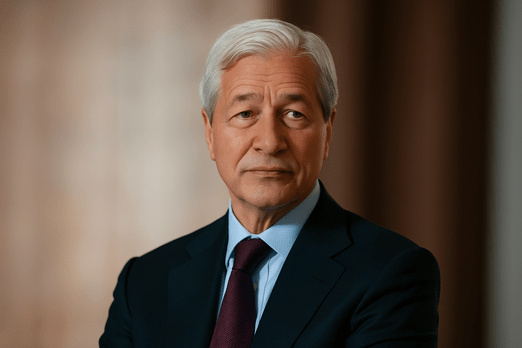

JPMorgan CEO Jamie Dimon said on May 19 that the bank will allow clients to buy Bitcoin. However, JPMorgan will not offer Bitcoin custody services.

Dimon spoke during the bank’s annual investor day and clarified the limits of the new access.

“We are going to allow you to buy it. We’re not going to custody it. We’re going to put it in statements for clients,”

Dimon said.

The decision shows that JPMorgan will support Bitcoin investment but will not manage or store the asset.

Instead, clients will see their Bitcoin positions reflected on account statements, while custody remains external. This marks a change in JPMorgan’s approach to crypto access, as the bank previously avoided direct involvement.

JPMorgan Expands Into Bitcoin ETFs and Spot Bitcoin Exposure

According to CNBC, JPMorgan will now offer access to spot Bitcoin ETFs. The report cites unnamed sources familiar with the decision.

This will provide a regulated method for JPMorgan clients to gain Bitcoin investment exposure without owning the asset directly.

So far, JPMorgan’s crypto offerings included only futures-based products. By expanding into spot Bitcoin ETFs, JPMorgan will give clients more direct exposure to Bitcoin prices. The bank still plans to avoid Bitcoin custody.

The move follows the United States Securities and Exchange Commission’s approval of multiple spot Bitcoin ETFs in January 2024.

Since then, total inflows into these ETFs have reached nearly $42 billion. JPMorgan joins other major banks, such as Morgan Stanley, in offering these investment options.

Morgan Stanley now allows its advisers to recommend spot Bitcoin ETFs to qualified clients. This broader access to Bitcoin investment vehicles marks a shift among large banks toward regulated crypto-related services.

Jamie Dimon Stays Critical Despite Opening Access to Bitcoin

Jamie Dimon repeated his crypto criticism while announcing the decision. He compared buying Bitcoin to smoking and said,

“I don’t think you should smoke, but I defend your right to smoke. I defend your right to buy Bitcoin.”

Dimon has previously expressed strong concerns about cryptocurrency. He said crypto is linked to illegal activity such as money laundering, terrorism, and sex trafficking.

His position has remained unchanged even as JPMorgan opens Bitcoin investment options.

In 2023, Dimon told the Senate Banking Committee,

“I’ve always been deeply opposed to crypto, Bitcoin, etc. The only true use case for it is criminals, drug traffickers, money laundering, tax avoidance.”

He also said,

“If I were the government, I’d close it down.”

Dimon criticized Bitcoin again at the 2024 World Economic Forum in Davos. He said,

“Bitcoin does nothing. I call it the pet rock.”

That comment followed Bitcoin’s rise above $100,000 for the first time.

Back in 2021, during a previous bull run, Dimon called Bitcoin “worthless.” In 2018, he said he had no interest in buying it. Still, JPMorgan has now decided to allow clients to buy Bitcoin under strict conditions.

Bitcoin Price Remains Strong at Over $105,000

On May 19, Bitcoin traded at $105,906. The price has held steady around this level in recent days.

The announcement from JPMorgan about Bitcoin investment access has not caused sharp price moves so far.

JPMorgan’s decision to allow clients to buy Bitcoin coincides with growing institutional interest in spot Bitcoin ETFs.

Despite Dimon’s crypto criticism, JPMorgan has responded to demand for regulated exposure.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.