Imagine Morgan Stanley, the $8 trillion mega-bank, throwing open its digital vault and saying, hey, everyone in wealth management, welcome to the crypto party.

That’s exactly what happened. Starting mid-October, all wealth management clients, regardless of their risk appetite or asset size, can now dip their toes into the cryptocurrency waters, even if their money’s parked in retirement accounts.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Crypto investments

Now, experts say this is a pretty massive upgrade from the old rules that only let the big investors with at least $1.5 million and a devil-may-care attitude touch crypto investments.

Now, Morgan Stanley is extending those shiny Bitcoin and Ethereum invitations to the whole gang, including 401(k) holders.

This move syncs perfectly with the new regulatory vibes, especially the executive order from President Donald Trump that gave a green light to 401(k) crypto investments.

Morgan Stanley’s financial advisors will start offering crypto investments on October 15, riding the wave of growing institutional enthusiasm for crypto assets.

But the bank also plans to roll out crypto trading features next year for E-trade clients, focusing on the heavy hitters like Bitcoin, Ethereum, and Solana. Institutional investors craving seamless crypto access are about to get a major upgrade.

Portfolio allocation

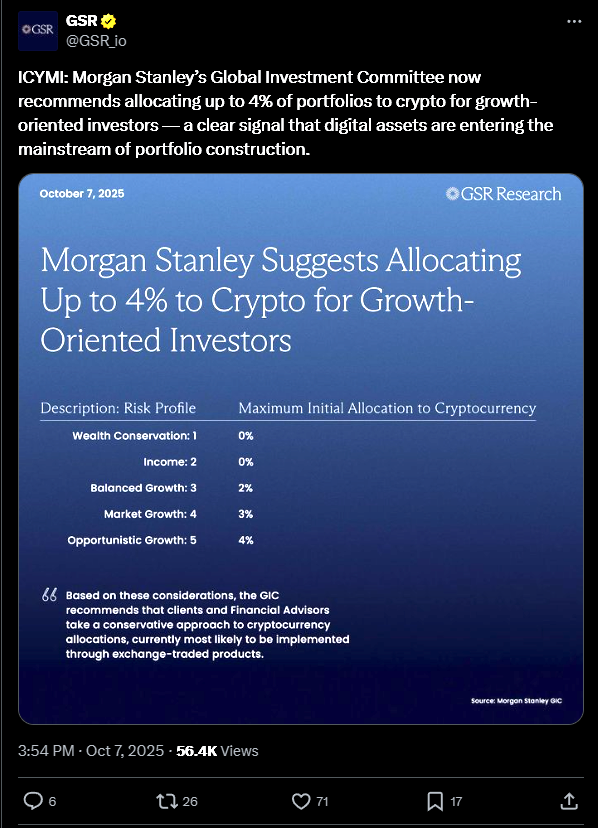

When it comes to how much crypto you should add to your portfolio, Morgan Stanley has some handy guidelines.

Growth-focused investors might consider allocating up to 4% to cryptocurrencies. For those hunting steady market growth, 3% is the suggested sweet spot.

Balanced growth enthusiasts would do well with a 2% crypto slice. Of course, Morgan Stanley reminds everyone these aren’t lottery tickets, crypto’s a speculative asset, but with enticing upside potential if played smartly.

Trend

Behind this big crypto announcement is a clear signal, crypto assets aren’t a fringe fad anymore but a growing cornerstone of mainstream finance.

Morgan Stanley is positioning itself as a heavyweight contender in the shifting sector of investing, while the broader financial world watches closely, likely poised to follow suit. Very likely.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 12, 2025 • 🕓 Last updated: October 12, 2025

✉️ Contact: [email protected]