If you thought OpenSea was just the NFT hangout spot, think again. The marketplace giant is gearing up for a comeback with a bang, launching its own SEA token in early 2026, and guys, it’s not messing around.

Half of these tokens are headed straight to the community, with early users and rewards programs taking a nice slice of the pie.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Token value in OpenSea’s ecosystem

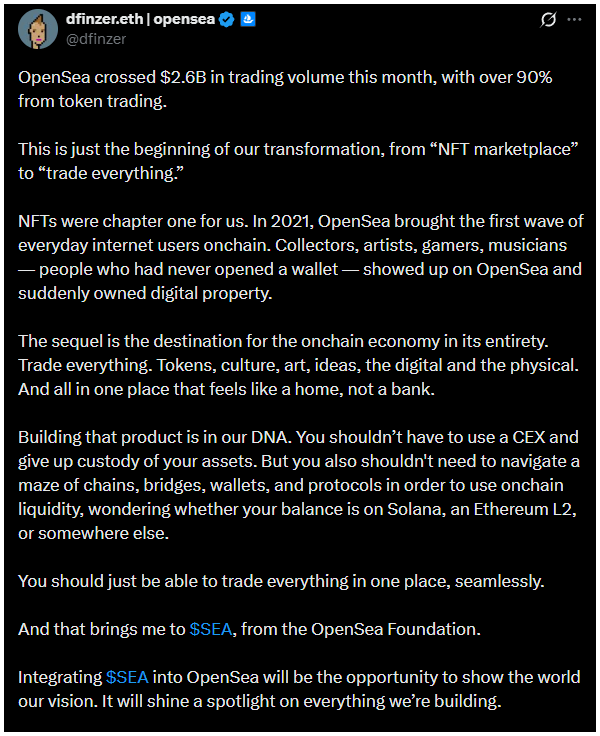

OpenSea CEO Devin Finzer spilled the beans on X, revealing a tokenomics plan that’s all about giving back.

Half the total SEA supply is community-bound, and the company is putting its money where its mouth is, promising to burn through 50% of platform revenue buying back SEA tokens.

On top of that, users get to stake their SEA behind favorite collections or projects, blending engagement with real utility. This is a strategic pivot focused on baking token value deep into the OpenSea ecosystem.

Why the sudden token hype? Well, OpenSea is reinventing itself beyond just an NFT hotspot.

Once the kingpin of digital art sales, it now dances across 22 blockchains, clocking a nice $2.6 billion in trading volume this October alone.

The twist, over 90% of that haul is from token trading rather than NFTs, clearly pointing to a market shift.

OpenSea mobile app

Industry experts say this pivot was necessary after the NFT boom fizzled. Trading volumes dropped more than 90% from their 2021 heyday, with market cap sliding from a show-stopping $20 billion to a humbler $4.87 billion.

The company’s transformation is less a choice, more a survival tactic, with Finzer famously saying, “You can’t fight the macro trend. People want to trade everything, not just digital art.”

OpenSea’s moves are the real deal. New tools, including a freshly minted mobile app and perpetual futures trading, are making the platform a “trade-any-crypto” playground.

Its multi-chain aggregator now taps buy and sell orders from decentralized exchanges like Uniswap, raking in about $16 million in revenue this month thanks to a 0.9% fee.

Competition

Remember when OpenSea was cashing in $125 million monthly at the height of the NFT craze?

Fast forward to late 2023, and that figure shrank to $3 million, forcing layoffs and a major company shakeup.

Competition heated up with platforms like Blur offering zero fees and creators freaking out over royalty cuts. OpenSea’s own relaxation on royalties didn’t win hearts either.

But the company’s Miami HQ move and renewed focus are paying off. This October saw $1.6 billion in crypto trades and $230 million in NFTs, a three-year high signaling that OpenSea’s phoenix is rising, SEA token in tow.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 20, 2025 • 🕓 Last updated: October 20, 2025

✉️ Contact: [email protected]