Sławomir Mentzen, a libertarian presidential candidate in Poland is making headlines with his ambitious plan to create a Strategic Bitcoin Reserve if he wins the May 2025 elections.

He promising to transform Poland into a crypto-friendly haven with supportive regulations, low taxes, and a cooperative attitude from banks and regulators.

A vision for crypto in Poland

“Poland should create a Strategic Bitcoin Reserve. If I become President, our country will be a cryptocurrency haven with friendly regulations and low taxes.”

This idea seems to be inspired by the Satoshi Action Fund’s model, which advocates for Bitcoin adoption.

Lech Wilczynski, CEO of Swap.ly, emphasized the urgency of adopting progressive strategies, warning that waiting too long could put Poland at a disadvantage in the crypto innovation race.

Mentzen plans to use the Satoshi Action Fund’s open-source policy framework to guide his initiative.

His enthusiasm for Bitcoin isn’t just talk, because he’s also invested in it. Earlier this month, he celebrated Bitcoin hitting an all-time high and vowed not to sell his holdings despite the price spikes.

Riding the global Bitcoin wave

Mentzen’s proposal aligns with a growing trend worldwide where countries are considering integrating Bitcoin into their financial strategies.

In the U.S., discussions about adopting Bitcoin as a strategic reserve have gained traction following Donald Trump’s reelection.

Advocates see this as an opportunity to position Bitcoin as digital gold to boost the value of the U.S. dollar.

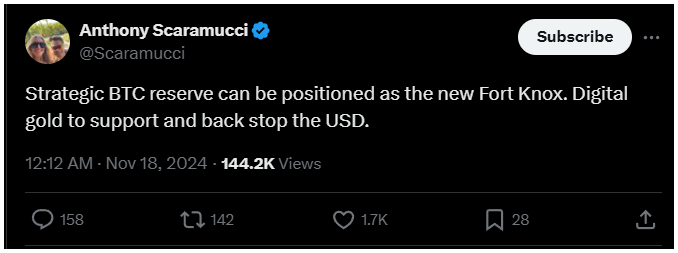

Former White House official Anthony Scaramucci even suggested that a strategic BTC reserve could become the new Fort Knox, essentially a digital backup for the dollar.

El Salvador is already leading the way by embracing Bitcoin as legal tender under President Nayib Bukele.

The country holds over 5,700 BTC, valued at around $522 million, showcasing its commitment to integrating cryptocurrency into its economy.

Countries, companies

It’s not just nations getting in on the action, several publicly traded companies are also looking to add Bitcoin to their treasury reserves, or already have.

They believe that holding BTC can help shield them from inflation and diversify their assets.

With Mentzen’s forward-thinking approach and the global momentum behind Bitcoin, Poland could be on the brink of becoming a significant player in the crypto industry in Europe.

If he follows through on his promises, it might just pave the way for a new era of crypto adoption in the continent.