The blockchain prediction market platform is gearing up for a massive $200 million funding round.

And guess who’s leading the charge? None other than Peter Thiel’s Founders Fund.

This deal would peg Polymarket’s value at a nice $1 billion. That’s right, unicorn territory, baby.

Money never sleeps

Now, it’s worth to mention that Polymarket’s been dancing on thin ice, especially in the US. The platform’s actually banned for American users.

Back in November, the FBI swooped in, searching founder Shayne Coplan’s devices, worried that Polymarket might be letting Americans slip through the cracks. Talk about drama.

Despite all that, Polymarket’s been stacking cash. They’ve already raised over $100 million before this round, including a secret $50 million earlier this year.

And now, with this fresh $200 million injection, the company’s ready to roll even bigger.

Ghost in the shell

And if this is not enough, here’s where it gets pretty spicy! Polymarket just teamed up with Elon Musk’s social media playground, X.

Together, they’re blending Polymarket’s prediction markets with Grok, the AI chatbot that dishes out analysis.

Imagine betting on future events with AI whispering in your ear. It’s like your office buddy who always has a hot take, but way smarter.

Speaking of bets, Polymarket lets users wager on everything under the sun. From geopolitical tensions like Israel striking Iran again, to whether the US will slide into a recession in 2025, or even the chances of a Russia-Ukraine ceasefire this July.

They’ve even got odds on the New York City mayoral primary. And get this, the platform’s showing an 87% chance that the GENIUS Act, a stablecoin bill, will become law this year. That’s some serious crystal ball action.

Behind enemy lines

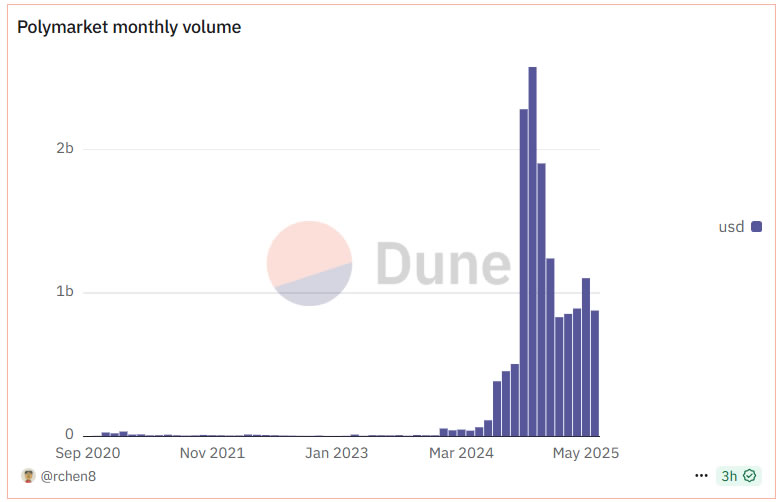

Numbers don’t lie. Polymarket’s got around 1.2 million traders, 21,000 open markets, and 20 million open positions.

May’s trading volume hit about $1.1 billion, which is down 56% from the November peak of $2.5 billion. Still, that’s huge.

But it’s not all sunshine and rainbows, as they say. Polymarket’s facing bans beyond the US, in France, Singapore, Thailand, Taiwan, Poland, Belgium you name it. Plus, there’s been whispers about market manipulation, which ain’t great for a platform built on trust.

Competition’s fierce too. Kalshi, backed by heavy hitters like Y Combinator and Sequoia Capital, is breathing down Polymarket’s neck.

So, Polymarket’s playing a high-stakes game, navigating regulatory roadblocks and skepticism, yet still pulling in billion-dollar valuations and partnerships. Epic!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.