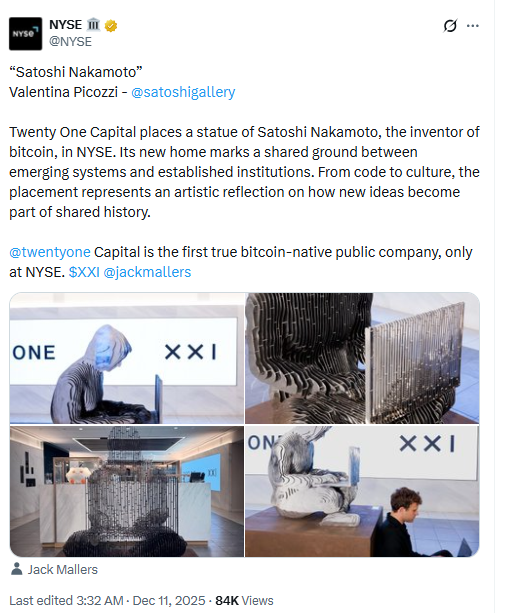

A new Satoshi Nakamoto statue now stands inside the New York Stock Exchange (NYSE), showing Bitcoin’s direct presence on a major Wall Street venue.

The piece is part of Valentina Picozzi’s series of “disappearing” Satoshi statues and is the sixth in a planned set of 21.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The statue arrived as Twenty One Capital, a Bitcoin company, launched for trading on the same exchange.

The New York Stock Exchange described the Satoshi Nakamoto statue in an X post as “shared ground between emerging systems and established institutions.”

The wording placed the Bitcoin ecosystem beside traditional finance without using marketing language.

Just a few years ago, many banks and brokers treated Bitcoin as a risky asset that did not belong near the NYSE floor.

Artist Valentina Picozzi, who uses the Satoshigallery handle on X, commented on the arrival of the Satoshi statue at the New York Stock Exchange.

She wrote, “This is such an achievement, even in our wildest dream we wouldn’t think about placing the statue of Satoshi Nakamoto in this location! The 6th/21 statues of Satoshi Nakamoto found its home in the NYSE.”

Her reaction focused on the location and the 6-of-21 count that links the project to the 21 million Bitcoin supply cap.

The timing of the installation also aligns with an early step in Bitcoin history.

The Satoshi Nakamoto statue reached the New York Stock Exchange around the anniversary of the Bitcoin mailing list, which Satoshi Nakamoto launched on Dec. 10, 2008.

That mailing list carried some of the first public notes about Bitcoin code and the plan for a decentralized payment system.

Bitcoin History From Genesis Block To Wall Street Statue

The Bitcoin history behind the Satoshi Nakamoto statue starts with the genesis block.

On Jan. 3, 2009, Satoshi Nakamoto mined the first block on the network, creating the first 50 Bitcoin.

That moment moved Bitcoin from a discussion on the Bitcoin mailing list into live software and real transactions recorded on-chain.

Use in everyday life came later. On May 22, 2010, programmer Laszlo Hanyecz made what is widely accepted as the first recorded purchase of goods using Bitcoin.

He paid 10,000 BTC for two Papa John’s pizzas, a transaction that later became a reference point in Bitcoin history as the price of those 10,000 Bitcoin increased over time.

In the years that followed, the Bitcoin ecosystem faced strong pushback from many institutions and banks.

Several firms refused to serve crypto businesses, while some policymakers and regulators looked for ways to restrict activity.

Reports around “Operation Chokepoint 2.0” described efforts that allegedly targeted crypto-related companies through banking pressure rather than direct bans.

However, attitudes toward Bitcoin institutional adoption gradually changed. Large asset managers, including BlackRock and its CEO Larry Fink, shifted from a skeptical view to direct involvement in Bitcoin-related products.

Exchange-traded funds (ETFs) that hold or track Bitcoin, along with corporate treasuries that now include Bitcoin on their balance sheets, turned the asset into a regular part of many portfolios.

According to data from Bitbo, public and private companies, countries and ETFs collectively hold more than 3.7 million Bitcoin, worth over $336 billion.

These figures show how much of the Bitcoin supply now sits in vehicles tied to regulated markets and state entities.

The Satoshi Nakamoto statue at the New York Stock Exchange now sits in the same world where those holdings are managed.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 11, 2025 • 🕓 Last updated: December 11, 2025