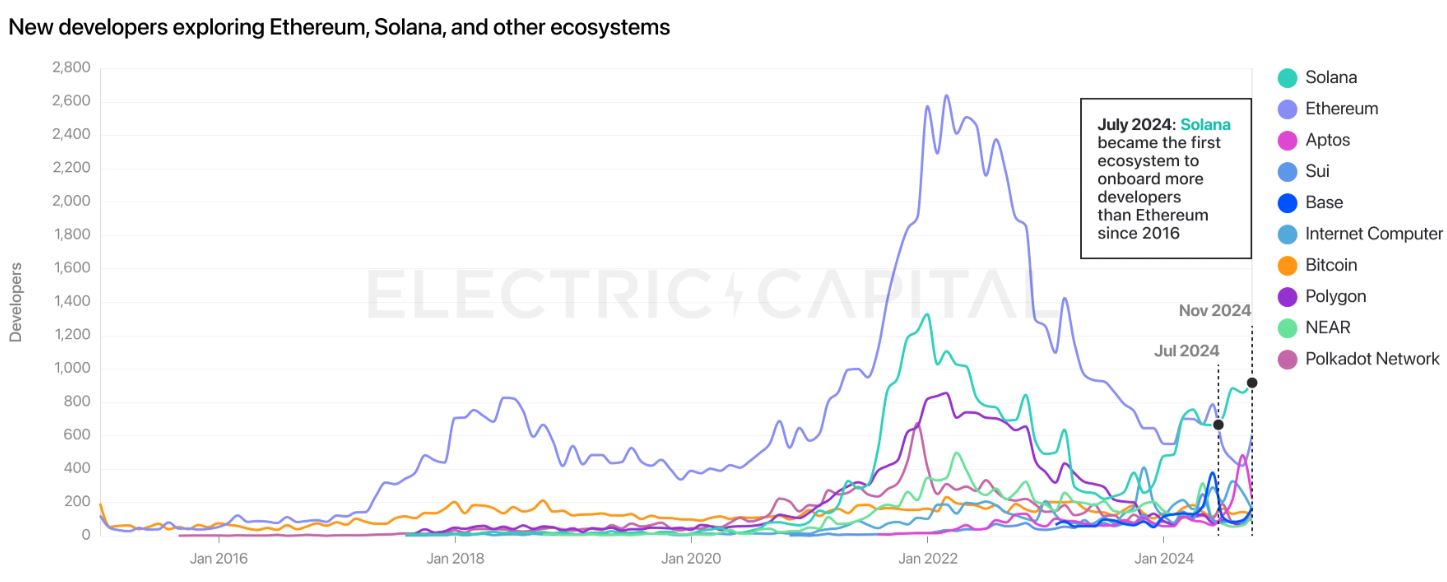

Solana just dethroned Ethereum as the top choice for new developers this year, ending Ethereum’s eight-year reign. Ethereum still leads globally in total developer activity.

Popularity is growing

Electric Capital released a new report, and it reveals that Solana welcomed 7,625 new developers in 2024, outpacing Ethereum’s 6,456.

This is the first time since 2016 that Solana has pulled ahead in this category. The surge in new developers is largely driven by growth in Asia.

The report highlights that Solana’s ecosystem has seen an 83% increase in activity compared to last year, and at various points this year, Solana even outperformed Ethereum in key metrics.

For example, on March 18, Solana’s network activity surged past Ethereum’s during a frenzy of Solana-based memecoins.

Then on October 28, it generated more daily network fees than Ethereum for a full 24 hours.

It’s worth noting that the total number of developers coming into crypto has dropped by 7% this year, with only 39,148 new developers entering the space, about half of the record high of over 77,000 in 2022.

Ethereum still holds the crown

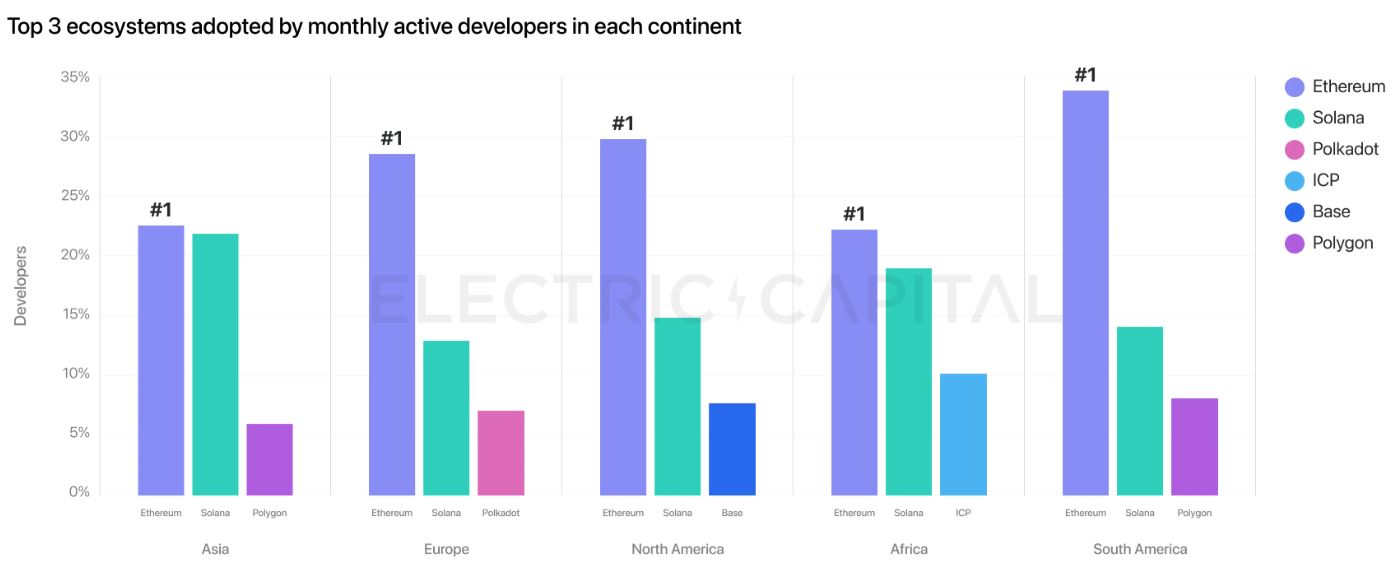

Despite the undeniable influx of new talent to Solana, Ethereum remains the heavyweight champion when it comes to total developer activity.

Even though the number of monthly developers on Ethereum has decreased by 17% over the past year, it still boasts the most active developers across all regions, Asia, Europe, North America, Africa, and South America.

Ethereum’s layer-2 networks have also seen a significant uptick of 64% since 2021. 26% of all monthly crypto developers are now working on these layer-2 solutions and the mainnet.

Global crypto growth

Electric Capital’s report also reveals that general crypto development is expanding globally. Developer numbers are rising in Africa, South America, and Asia, with Asia leading the charge, one in three developers worldwide is based there.

Interestingly, crypto activity is now happening around the clock across different time zones. Stablecoin transactions are consistently active during daylight hours in Asia, Europe, and Africa.

Meanwhile, NFT trading peaks during American work hours while minting spikes during Asian business hours. The industry is marching, no matter what.