Solv Protocol launched its BTC+ yield vault to use over $1 trillion in idle Bitcoin held by institutions.

The vault is designed for institutional investors to generate returns from inactive Bitcoin (BTC) holdings through structured yield strategies.

The BTC+ vault uses decentralized finance (DeFi), centralized finance (CeFi), and traditional finance methods.

Solv said it will include protocol staking, basis arbitrage, and yields from tokenized real-world assets, such as BlackRock’s BUIDL fund.

To improve transparency, the vault integrates Chainlink’s Proof-of-Reserves for on-chain verification. It also uses drawdown safeguards based on net asset value (NAV), a method often applied in private equity risk management.

Dual-Layer Custody in BTC+ Vault by Solv Protocol

The BTC+ vault uses a dual-layer architecture that separates custody from yield strategies. Solv Protocol explained that this structure enhances fund safety by isolating custody from investment activity.

“Bitcoin is one of the world’s most powerful forms of collateral, but its yield potential has remained underutilized,”

said Ryan Chow, co-founder of Solv Protocol.

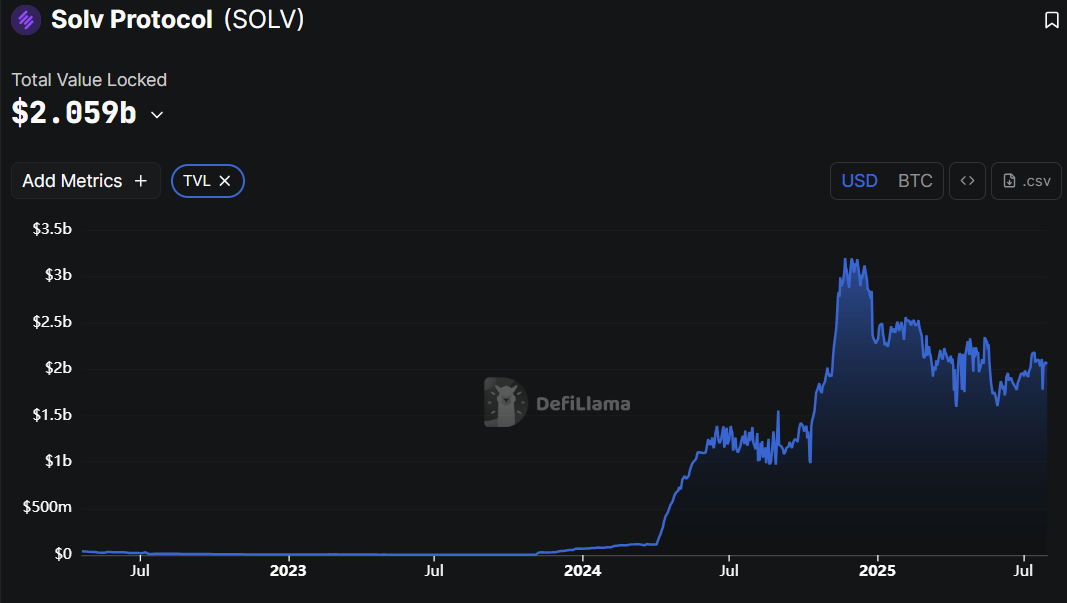

Data from DefiLlama shows that Solv Protocol currently holds more than $2 billion in total value locked (TVL). This amount highlights institutional participation in on-chain yield products.

Institutional Bitcoin Yield Options Expand

In April, Coinbase launched a Bitcoin yield fund for institutional clients outside the United States, offering up to 8% returns through a cash-and-carry strategy.

Crypto firm XBTO partnered with Arab Bank Switzerland on a Bitcoin yield product. It uses BTC options sales to generate annualized returns of about 5%.

These offerings show how institutions are targeting idle Bitcoin with structured yield programs across regulated channels and crypto-linked products.

Bitcoin ETF Approval Spurs Institutional Growth

The U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs in January 2024, driving institutional adoption.

Since then, Bitcoin’s price increased by 156%, pushing its market capitalization to about $2.5 trillion.

Traditional banks have also adjusted. JPMorgan began reviewing Bitcoin ETF-backed loans to integrate Bitcoin into lending models.

The Federal Housing Finance Agency (FHFA) directed Fannie Mae and Freddie Mac to examine Bitcoin and crypto assets in risk evaluations for housing loans, expanding regulatory assessment of digital assets.

Corporate Bitcoin Yield Strategies Develop Further

Corporate entities have adopted structured yield strategies for Bitcoin. MicroStrategy, identified in the report as Strategy, introduced a BTC Yield metric to assess Bitcoin’s contribution to shareholder value.

Mining firm MARA Holdings increased its allocation of Bitcoin to Two Prime, an adviser focused on crypto yield. These developments align with institutional and corporate growth in the Bitcoin yield market.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.