Bitwise has just made a splash by officially filing for a spot Dogecoin exchange-traded fund with the U.S. Securities and Exchange Commission.

This isn’t just any filing as memecoin ETF, but it’s the first of its kind under the ’33 Act, setting it apart from previous attempts by Rex Shares and Osprey Funds.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Imagine saying „Dogecoin ETF” five years ago, and here we are

So, what does this mean for the holders? If the SEC gives it the thumbs up, just like in case of any other spot ETF, this fund will give investors a chance to ride the waves of Dogecoin’s price, currently sitting at about $0.32.

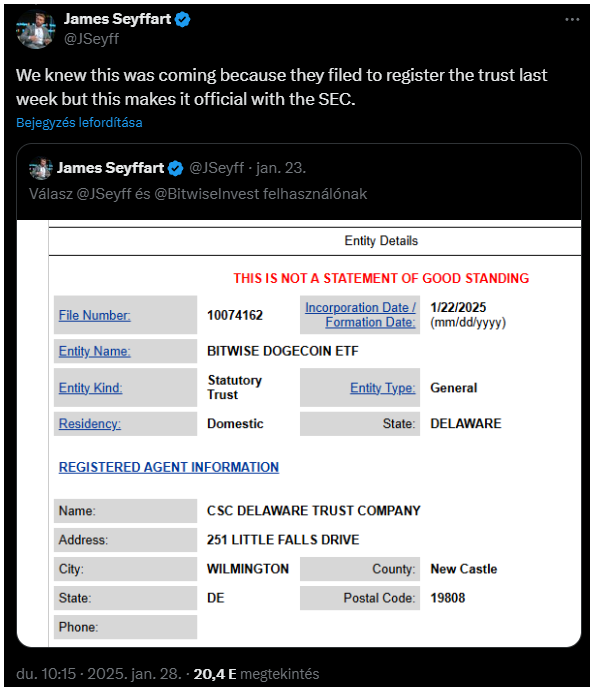

Bitwise submitted its S-1 registration application on Tuesday, just a week after filing some preliminary paperwork in Delaware on January 22.

Bloomberg ETF analyst James Seyffart wasn’t surprised by this move, and noted on X that everyone saw it coming after Bitwise registered the trust last week.

Memecoins to the mainstream?

Bitwise is no stranger to the ETF game, as they already manage $4.5 billion Bitcoin ETF and are eager to join the growing trend of memecoin ETFs now that there’s a clear pro-crypto vibe in Washington.

Matt Hougan, Bitwise’s chief investment officer, told the Financial Times that there’s a huge appetite for Dogecoin investments. After all, it’s the sixth-largest crypto asset out there, trading over $1 billion daily.

While Rex Shares and Osprey Funds have also filed for Dogecoin ETFs earlier, Eric Balchunas from Bloomberg points out that Bitwise’s application is unique.

It’s the first “33 Act Doge filing,” which means it’s set up as a commodity-based ETF. In contrast, those other filings were made under the ’40 Act, which has stricter SEC rules and offers more robust investor protection.

The bullish case for Bitwise

Bitwise isn’t stopping here at all, they have several pending applications for other crypto ETFs, including one for XRP. Ripple President Monica Long believes that with the new regulatory environment in the U.S., we might soon see approvals for XRP-related ETFs.