Strategy plans to convert about $6 billion of convertible debt into equity over three to six years, according to Michael Saylor on X. The company said it can still cover that debt even if Bitcoin drops to $8,000, based on its stated reserves and liabilities.

Strategy convertible debt plan targets a 3 to 6 year equity conversion

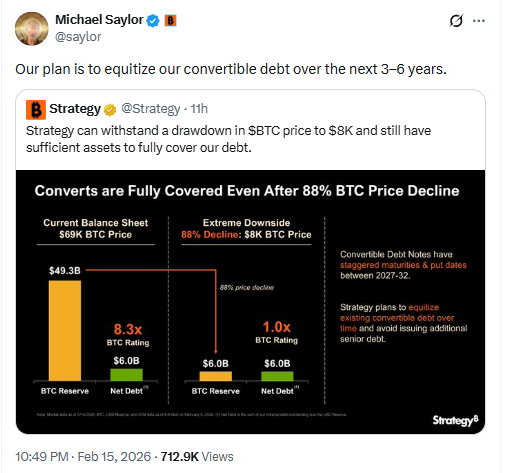

Michael Saylor responded after Strategy posted that it can manage its capital structure even during major Bitcoin drawdowns. The company’s approach relies on convertible notes, which are bonds that can convert into stock shares under set terms.

In practice, equitizing convertible debt means the company issues shares instead of paying cash at maturity. As a result, bondholders can become shareholders through conversion.

This structure can reduce cash repayment pressure. However, it can also dilute existing shareholders because the company creates new shares during conversion.

Strategy says Bitcoin at $8,000 still covers $6 billion convertible debt

Strategy said it holds about $49 billion in Bitcoin reserves. The company also said its stash totals 714,644 BTC, and it described itself as a Bitcoin treasury company.

Strategy put its convertible debt near $6 billion. It said BTC would need to fall about 88% for the Bitcoin holdings and the debt to match on value.

Even in that scenario, Strategy said it would still hold enough assets to cover the notes. “Strategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt,” the company stated on X.

Strategy average Bitcoin buy price near $76,000 as BTC trades near $68,400

Strategy said its average Bitcoin purchase price is about $76,000. With Bitcoin trading near $68,400, the firm sits about 10% below its average cost.

Michael Saylor also signaled another Bitcoin buy. He posted Strategy’s accumulation chart on X on Sunday, a pattern linked to past purchase updates.

The next purchase would extend Strategy’s streak to 12 consecutive weeks of buying, based on prior disclosures tied to similar posts.

MSTR stock at $133.88 as Strategy shares remain 70% below $456

Strategy stock (MSTR) rose 8.8% on Friday and ended the week at $133.88, based on market pricing data.

The move followed Bitcoin moving back above $70,000 late Friday. However, BTC later slipped to about $68,400 in early Monday trading.

Strategy shares remain about 70% below a mid July high of $456. Over the same period, Bitcoin prices remain about 50% below an early October peak.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 16, 2026 • 🕓 Last updated: February 16, 2026