Ladies and gentlemen, hold onto your crypto wallets because Terraform Labs is back in the spotlight.

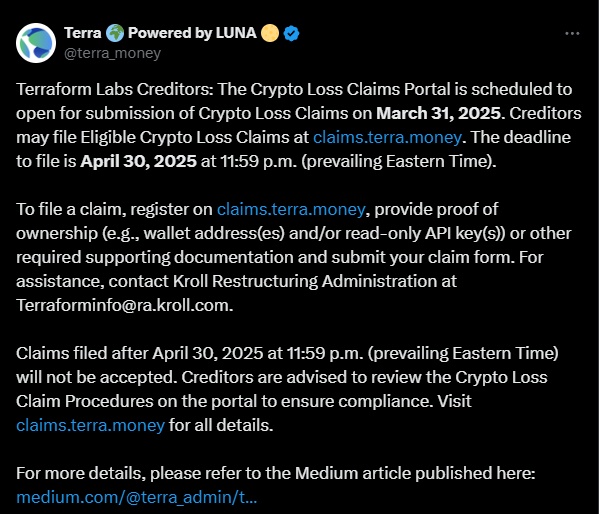

Starting March 31, creditors who lost money in the infamous TerraUSD collapse of 2022 can finally file their claims through a shiny new portal. But there’s a deadline, so pay attention!

Papers please

You’ve got until April 30 to submit your paperwork, or kiss any chance of recovery goodbye.

Tick-tock, guys, no time for procrastinating. Now, let’s rewind for a second. Terraform Labs, the company behind TerraUSD, watched its stablecoin implode spectacularly in May 2022 when its algorithmic peg to the US dollar went poof.

Billions vanished into thin air, leaving investors scrambling and dragging Terraform into bankruptcy.

Now, after years of lawsuits and regulatory headaches, they’re throwing creditors a lifeline, or maybe just a rope to climb out of this mess.

The Crypto Loss Claims Portal, managed by Kroll Restructuring Administration, is where creditors can submit their claims electronically.

No snail mail here, it’s all online. You’ll need proof of ownership, like read-only API keys or signed blockchain transactions. Got manual evidence like screenshots or transaction logs? Sure, you can use that too, but don’t expect a speedy review.

Eligibility

Now here’s the bad news, not all crypto assets are eligible for claims. If your holdings lack on-chain liquidity or include Luna 2.0, tough luck. The official list of eligible cryptocurrencies will drop on March 31.

Once claims are submitted, Terraform’s Wind Down Trust will take over. Within 90 days of the deadline, creditors will get an initial determination or notice of extended review.

For those approved, payouts will be distributed pro rata, meaning everyone gets their fair share based on what’s left in the pot.

Mark the calendar

But let’s not sugarcoat it, this portal is no miracle cure for the chaos Terraform left behind. The collapse didn’t just burn wallets, it torched trust in algorithmic stablecoins and triggered regulatory crackdowns across the globe.

It was a financial disaster of epic proportions, like watching a house of cards crumble while holding your life savings.

If you’re one of the thousands still reeling from TerraUSD’s downfall, mark your calendar and get your claim in before April 30. Because once that clock strikes midnight, there are no second chances.

Have you read it yet? New Fidelity stablecoin is coming?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.