The Bitcoin bull-bear market cycle indicator, which monitors shifts in investor sentiment, finally flipped back to bullish territory.

Following Bitcoin’s drop below $50,000 last weekend, this sounds pretty good!

Bitcoin bounces back

CryptoQuant founder and CEO Ki Young Ju shared that most of Bitcoin’s on-chain cyclical indicators that showed uncertainty, now returned to signaling a clear a bull market.

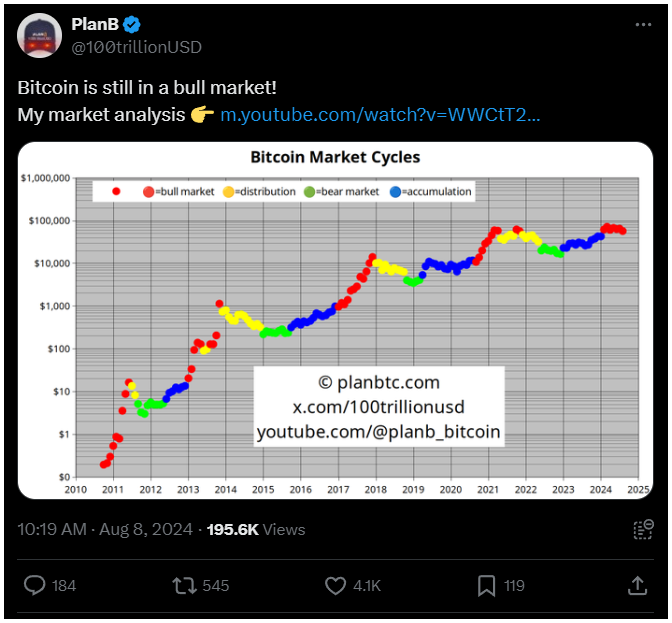

In a post on X, Ju told that Bitcoin is still in a bull market, reinforcing the sentiment shared by the crypto trader known as PlanB.

Ju noted that Bitcoin was only discounted for three days, referring to the short period when Bitcoin’s price dipped to $49,751 on August 5, an event some have dubbed Crypto Black Monday.

This was Bitcoin’s first drop below $50,000 since February. But then in few days, by August 8, Bitcoin had recovered, trading above the $60,000 level.

Right now, in time of writing, Bitcoin’s price is around $61.000

Market sentiment quickly turn optimist

The bull-bear market cycle indicator hadn’t shown a bearish signal since January last year, shortly after the collapse of FTX. During the current dip, other indicators also reflected market anxiety.

The Crypto Fear & Greed Index, for example, even plunged to a score of 17, indicating “Extreme Fear,” its lowest reading since the FTX fallout.

The index, just like the market, has since rebounded to a more neutral reading of 48.

Some traders speculate that the fast price recovery could mean that the downturn was a bear trap, a textbook strategy where experienced traders temporarily drive down the price of Bitcoin to trick short-sellers before pushing the price back up.

Bitcoin’s future price

While some analysts believe Bitcoin’s dip aligns with patterns seen before previous bull runs, others are approaching the situation with way bigger caution.

Markus Thielen, head of research at 10x Research, suggested that the ideal entry point for the next bull market could occur if Bitcoin’s price falls to the low $40,000s. But it’s a big if.

A report from Cathie Wood’s investment firm, Ark Invest, identified key support levels for Bitcoin at $52,000 and $46,000.

Veteran trader Peter Brandt also weighed in, noting that Bitcoin’s current decline mirrors the pattern seen during the 2015-2017 halving bull market cycle, implying that another bull run could be on the horizon.