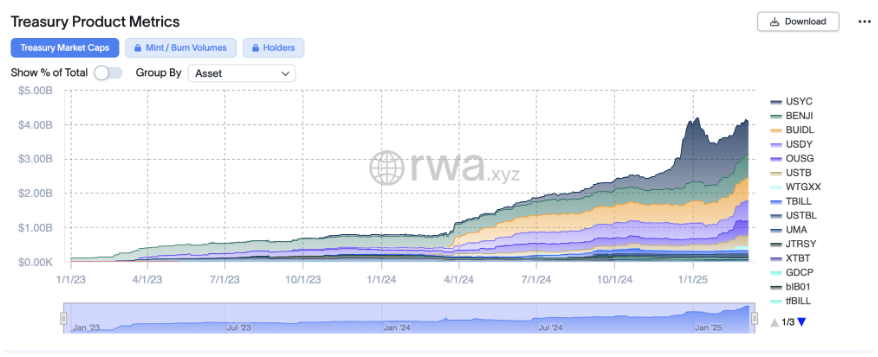

Listen up, guys, the tokenized U.S. Treasuries game just hit a major milestone. In just 103 days, this sector grew by a cool $1.57 billion, crossing the $4 billion mark.

Institutional investors are here, and it’s not just a flash in the pan. This is the real deal.

Hashnote’s USYC is the king of the castle

Hashnote’s Short Duration Yield Coin, or USYC is the big cheese here. It combines short-term U.S. Treasury holdings with Reverse Repo agreements, giving investors a double whammy of yield generation.

And boy, is it paying off. USYC’s market cap nearly doubled from $495.07 million to $956.27 million. That’s a $461.2 million boost, if you’re counting.

Global investors can get in on this action via the Hashnote International Feeder Fund or the Short Duration Yield Fund, provided they’ve got the cash and meet the eligibility criteria, a cool $100,000 minimum stake.

Franklin Templeton and Blackrock are inching closer

Franklin Templeton’s onchain fund, BENJI, is hot on USYC’s heels. It’s available to institutional investors in several European countries and has grown by $270.35 million since November.

Blackrock’s BUIDL, distributed via Securitize, rounds out the top three. It’s exclusive to heavyweight clients with a $5 million entry threshold.

Together, these three funds control over 56% of the tokenized Treasury sector’s $4.07 billion valuation.

The rest of the pack

Other notable players include Ondo’s USDY and OUSG, Superstate’s USTB, Wisdomtree’s WTGXX, and Openeden’s TBILL.

These funds offer an average APY of 4.2%, attracting 15,463 holders across 37 tokenized Treasury funds, a near doubling in just over three months.

This isn’t just a niche experiment anymore, but pretty much it’s a mainstream contender.

If you’re an institutional investor looking for a solid yield, tokenized Treasuries are worth a serious look.

And if you’re just a regular Joe, it’s a sign that the big boys are taking digital assets seriously. Either way, this market is on fire, and it’s not slowing down anytime soon.

Have you read it yet? Altcoins in free fall

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.