David Bailey, a Bitcoin entrepreneur and adviser to Donald Trump, announced plans to raise $200 million for a political action committee (PAC) focused on Bitcoin policies in the US.

Bailey, founder of Bitcoin Magazine and BTC Inc., shared the plan on X, citing his experience in Trump’s campaign.

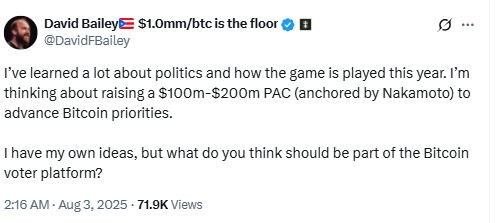

“I’ve learned a lot about politics and how the game is played this year. I’m thinking about raising a $100m-$200m PAC, anchored by Nakamoto, to advance Bitcoin priorities,”

Bailey posted, referencing Nakamoto Holdings, his Bitcoin treasury company.

PACs gather donations and fund candidates or causes. Fairshake, a crypto-focused PAC backed by Coinbase and Ripple Labs, spent $130 million during the 2024 elections to support pro-crypto candidates and oppose anti-crypto ones.

Bitcoin Price Goal and Policy Priorities

Bailey stated that one of the PAC’s main priorities would be to push Bitcoin’s price toward $10 million while building long-term policy support. He requested ideas from the Bitcoin community on X for additional priorities.

Bitcoin podcaster Stephan Livera proposed abolishing capital gains tax on Bitcoin sales and securing self-custody rights.

Alex Gladstein of the Human Rights Foundation suggested legal protections for open-source developers, adding Bitcoin education to high school curricula, and enabling foreign nations to repay debts to the US in Bitcoin.

Bitcoin investor Tuur Demeester highlighted banking reform, saying,

“The most important thing for American peace and prosperity as it relates to Bitcoin would be a return to full reserve banking,”

referring to banks holding 100% of deposits in reserve.

Other proposals included funding for Bitcoin ATMs, promoting Bitcoin advocacy on a non-partisan basis, and creating federal funding programs for Bitcoin education.

Bailey Faces Corporate Scrutiny Over Political Role

Bailey’s Nakamoto Holdings raised $300 million in May. His hedge fund, 210k Capital, was reported by Bloomberg to invest heavily in companies with Bitcoin treasuries.

Charles Allen, CEO of BTCS, warned Bailey against mixing corporate and political funding.

“If you anchor political efforts with public company funds, you may find yourself staring down the barrel of a class-action lawsuit for breach of fiduciary duty,”

Allen said.

Bailey responded that this approach was similar to Coinbase’s backing of Fairshake. However, Allen questioned if such spending remains justified in the current pro-crypto climate.

Political Impact and Registration Process

Creating a PAC involves appointing a treasurer, registering with the US Federal Election Commission (FEC), and filing financial reports.

Crypto companies spent $134 million during the 2024 elections, resulting in a wave of pro-crypto candidates.

James Walkinshaw, a Democrat, won his primary after a crypto-backed PAC spent over $1 million supporting his campaign.

Fairshake has reported holding $141 million in assets for upcoming elections, underscoring the continued influence of crypto-backed PACs in US politics.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 5, 2025 • 🕓 Last updated: August 5, 2025