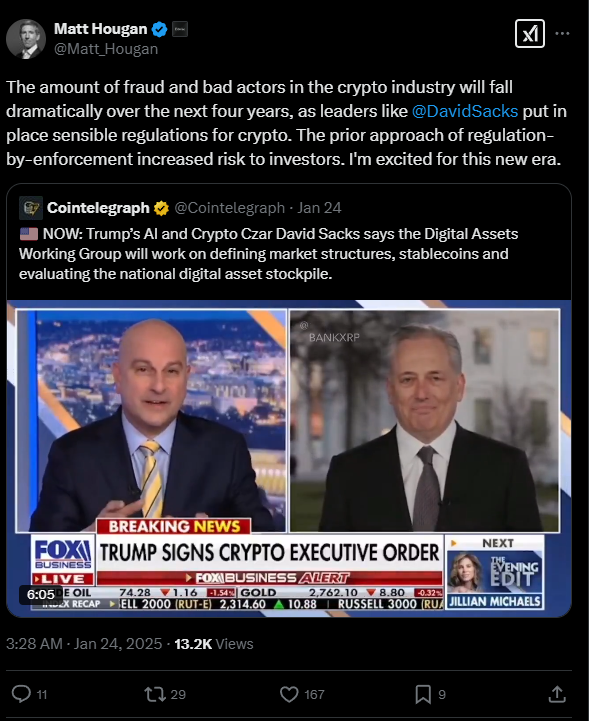

The crypto community is buzzing with news about an executive order from none other than President Donald Trump.

Matt Hougan from Bitwise shared that this could shake up Bitcoin’s notorious four-year cycle of ups and downs.

A new timeline

Trump dropped a bombshell with his crypto order, which, combined with some shifts at the Securities and Exchange Commission, signals a new era where banks and Wall Street are ready to literally dive headfirst into the crypto pool.

Hougan believes this move is ushering in the full mainstreaming of crypto, making it easier for big financial players to get involved.

Hougan thinks that while we might not completely escape the four-year cycle, as there are the Bitcoin halvings, any market pullbacks we face could be shorter and shallower than in previous years. So, maybe less dramatic drops.

The supply and the demand

Historically, Bitcoin has danced through these cycles, losing dollar value in 2014, 2018, and 2022 but bouncing back to new heights in between.

If the pattern holds, we could see another dip around 2026, but Hougan’s feeling optimistic about the future.

He notes that the crypto crowd has matured big time, with more savvy investors and institutions, funds, companies who are focused on value rather than just chasing quick gains.

In 2022 major bankruptcies from players like FTX and Three Arrows Capital sent shockwaves through the market.

Add in the SEC’s crackdown on initial coin offerings few years back, or the infamous Mt. Gox collapse from the early years of Bitcoin, and you’ve got a recipe for disaster.

The bureaucracy is still slow

As for Trump’s order, we shouldn’t expect immediate fireworks. White House crypto czar David Sacks will need some time to whip up a regulatory framework, and Wall Street giants will take even longer to fully grasp crypto’s potential. But there’s good news.

Wall Street banks can now handle crypto more easily since the SEC lifted a rule that previously forced them to treat crypto as liabilities.

Hougan is feeling bold with his predictions too, and he’s sticking with Bitwise’s ambitious forecast that Bitcoin could hit $200,000 by the end of 2025. And guess what?

That could happen whether or not a strategic Bitcoin reserve comes into play.