Vitalik Buterin, the co-founder of Ethereum, said that the rise of Ethereum treasury firms helps expand access to ETH.

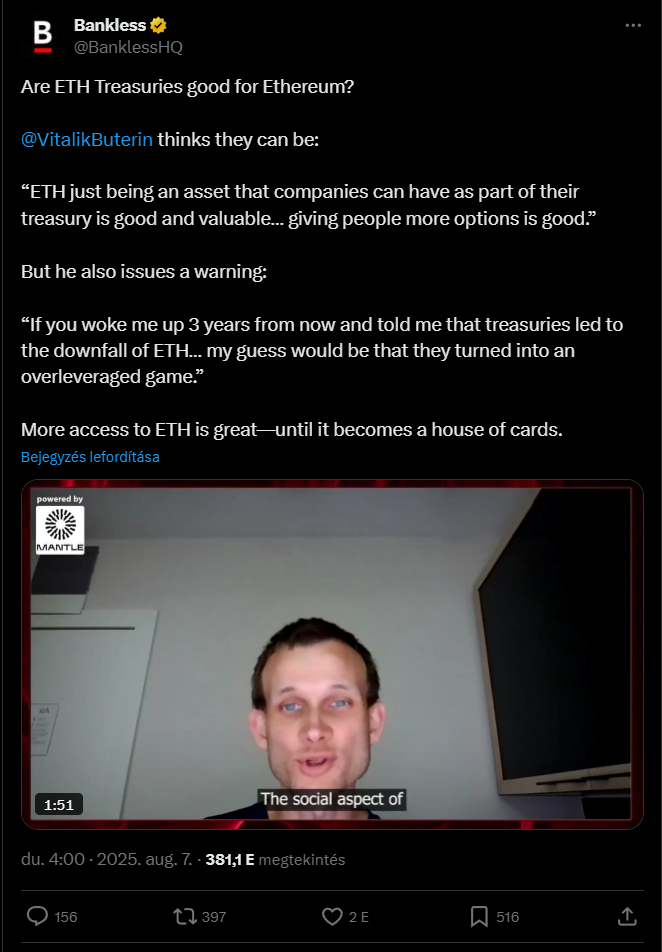

In an interview with the Bankless podcast published Thursday, he said public companies holding ETH could expose the asset to more types of investors.

“There’s definitely valuable services that are being provided there,”

He explained that these ETH treasury companies let people engage with Ethereum even if they can’t or don’t want to hold the tokens directly.

Buterin added that this structure creates more entry points for individuals with different financial profiles. However, he also stressed that this growth must not rely on excess borrowing or overleverage.

Buterin Warns ETH Could Face Liquidation Chain Reactions

Buterin said that while Ethereum treasury firms serve a role, heavy leverage could hurt Ethereum’s future. “If you woke me up three years from now and told me that treasuries led to the downfall of ETH, then, of course, my guess for why would basically be that somehow they turned it into an overleveraged game,” he said.

He described how forced liquidations could start if ETH price falls sharply. That could cause treasury firms to sell off large amounts, creating more price drops and damaging ETH’s credibility.

Buterin pointed to the 2022 collapse of Terra as a case where overleverage caused a breakdown.

“These are not Do Kwon followers that we’re talking about,” he added, referring to the Terra co-founder.

ETH Treasury Firms Now Hold $11.77 Billion

The value of ETH held by public treasury firms has reached $11.77 billion, according to StrategicETHReserve.xyz.

The largest holder is BitMine Immersion Technologies, which owns 833,100 ETH worth around $3.2 billion.

SharpLink Gaming holds $2 billion in ETH, followed by The Ether Machine with $1.34 billion. The Ethereum Foundation and PulseChain are also among the top five ETH treasury holders.

The growth in ETH treasury firms adds a new layer to Ethereum’s investment structure. These firms hold Ethereum on their balance sheets and operate in public markets.

Ethereum Price Recovers 163% After April Drop

ETH has recovered from its yearly low. In January 2025, Ethereum traded around $3,685. On April 9, it fell to $1,470. Since then, ETH has climbed to $3,870, marking a 163% rebound.

This recovery comes during increased activity by Ethereum treasury companies, which added large ETH positions throughout 2025.

The rising interest among public firms has affected Ethereum’s supply and trading patterns.

Ethereum’s performance is now closer to Bitcoin and Solana (SOL $175.36) in 2025. Price action shows Ethereum making gains after the dip in April, alongside institutional participation through treasury holdings.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 8, 2025 • 🕓 Last updated: August 8, 2025