The White House narrowed talks on stablecoin rewards after a third meeting in 16 days between crypto firms and bank lobby groups, according to reports. The discussion focused on whether third parties can offer stablecoin rewards tied to transactions and activity, while excluding rewards tied to balances.

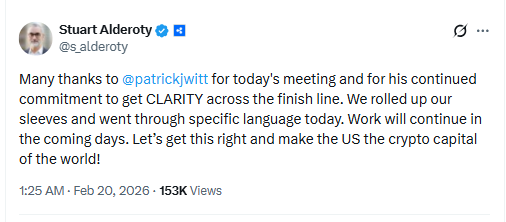

White House crypto adviser Patrick Witt pushed language that would allow exchanges and other third parties to offer stablecoin rewards only when users complete transactions or show activity, not when they hold idle balances. Ripple Chief Legal Officer Stuart Alderoty said on X,

“We rolled up our sleeves and went through specific language today.”

Coinbase Chief Legal Officer Paul Grewal said the meeting was “constructive and the tone cooperative.”

The meeting took place Thursday and involved representatives from the crypto industry and the banking industry. No final agreement came out of the session. Still, participants described progress on drafting specific text.

White House stablecoin rewards proposal limits rewards to transaction activity

The latest proposal would restrict stablecoin rewards to payments linked to transaction activity. That detail aims to address bank concerns about rewards on balances, which banks view as similar to paying interest on deposits.

Terrett reported that “Earning yield on idle balances, a key crypto industry goal, is effectively off the table,” citing people who attended. She added that the debate now centers on whether firms can offer rewards linked to certain activities.

Mueller reported that banks plan to meet tomorrow to decide whether to accept the trade off. Discussions are expected to continue in the coming days.

Stablecoin rewards talks follow Feb. 2 and Feb. 10 White House meetings

The Thursday session was the third meeting between crypto and bank representatives at the White House. The first meeting took place on Feb. 2 and the second on Feb. 10. The groups met again Thursday as the Senate looks to pass a crypto market structure bill that would define how US market regulators oversee crypto.

The House passed a similar bill, the CLARITY Act, in July. However, the Senate effort has stalled because the Senate Banking Committee has not secured enough bipartisan support to move it forward.

Blockchain Association CEO Summer Mersinger called the latest meeting a “step forward” on resolving issues tied to stablecoin rewards and on keeping the market structure legislation moving.

Banks and crypto groups weigh $6.6 trillion Treasury deposit outflow estimate

Banking groups in the talks included the Bank Policy Institute, the American Bankers Association, and the Independent Community Bankers of America. None publicly commented on the meeting.

Banking groups have argued that stablecoin rewards could undermine banks by encouraging people to move deposits into stablecoins. They have also said rewards could increase competition against traditional bank products.

The US Treasury estimated in April that mass stablecoin adoption could trigger $6.6 trillion in deposit outflows from the banking system. However, according to Terrett, one banking participant said the concern focuses more on competitive pressure than on deposit flight risk.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 20, 2026 • 🕓 Last updated: February 20, 2026