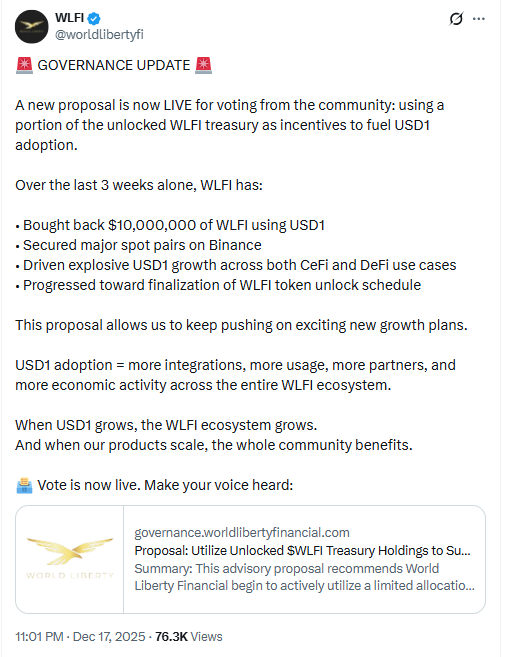

World Liberty Financial posted a proposal that targets the USD1 stablecoin supply. The post appeared on the project’s governance forum on Wednesday.

The proposal focuses on a 5 percent treasury unlock from the WLFI treasury. The project linked that move to expanding USD1 stablecoin adoption.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The team described the stablecoin market as “an increasingly competitive stablecoin landscape.” It tied the treasury plan to raising USD1 circulation.

WLFI token Treasury Proposal Points to 19.96 billion Tokens and $2.4 billion Value

World Liberty Financial previously said 19.96 billion of total WLFI token supply would go to the WLFI treasury. The proposal uses that allocation as the base for the unlock.

At current prices cited in the report, that treasury allocation equals almost $2.4 billion. The same math puts the 5 percent treasury unlock near $120 million.

The proposal does not describe a single spending event. Instead, it frames the WLFI token treasury unlock as a way to increase the USD1 stablecoin supply.

Governance Forum Vote Opens With “For”, “Against”, and “Abstain” Options

The governance forum vote lists three choices: for, against, and abstain. The post says the vote is live.

However, the proposal does not clearly explain the voting process. It does not state how the system counts votes or finalizes outcomes.

Forum responses showed mixed positioning. The visible tally in the report showed “against” slightly ahead of support.

USD1 market cap Stands at $2.74 billion as PYUSD Remains Larger

The USD1 stablecoin launched in March, according to the report. The proposal now links treasury use to pushing the stablecoin’s supply higher.

The report cited CoinGecko data that put the USD1 market cap at $2.74 billion. That figure placed USD1 as the seventh largest USD pegged stablecoin at the time.

The same comparison pointed to the next stablecoin above it. PayPal PYUSD had a market cap $1.1 billion larger than USD1, based on the figures cited in the report.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 18, 2025 • 🕓 Last updated: December 18, 2025