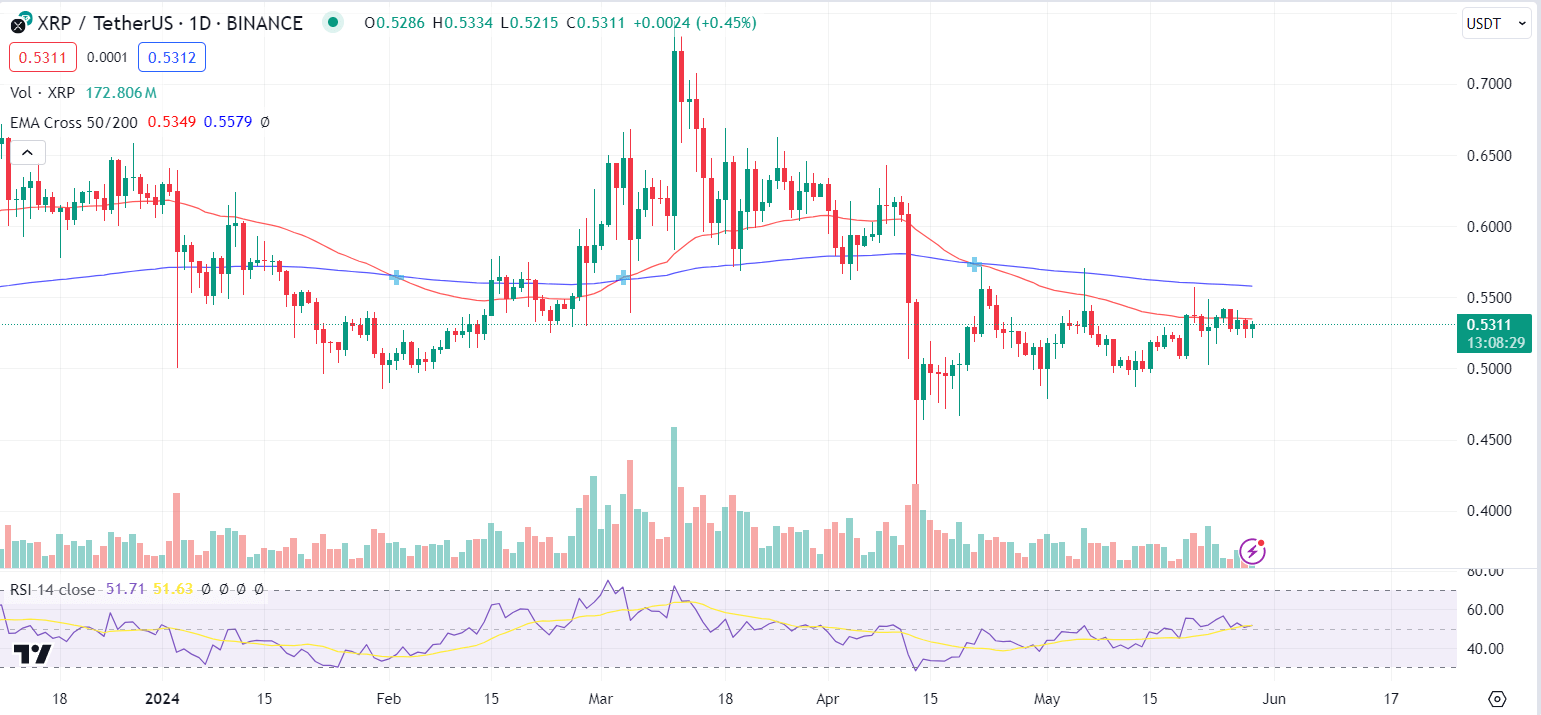

The price of XRP is hovering around $0.52, presenting a challenging scenario for investors as it struggles to maintain support above its short-term moving average.

The long-term moving average is acting as resistance at $0.58, making it difficult for the price to break through and sustain higher levels.

Price dynamics, or more like price stability

As of now, XRP is facing strong resistance at $0.58, which aligns with its long-term moving average, this level has proven to be a barrier that XRP has yet to overcome.

The Relative Strength Index (RSI), a popular technical indicator, also remains neutral. Many thinks a drop in the price below $0.52 could indicate a weakening bullish trend, signaling further downward movement.

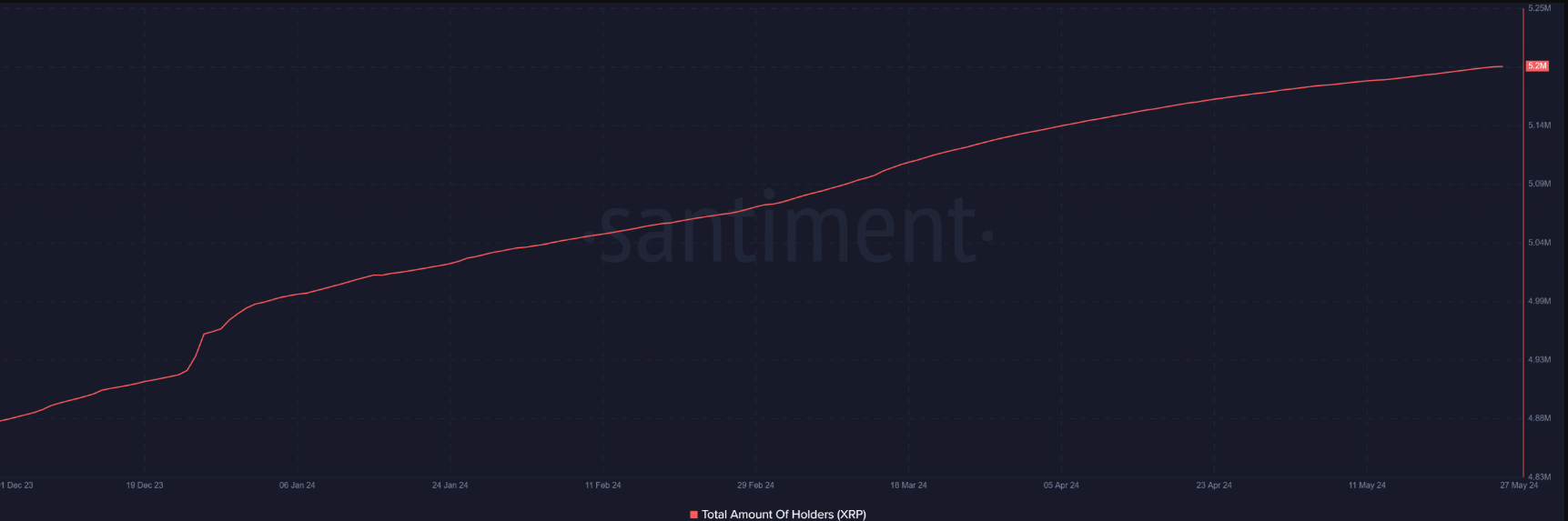

Interestingly, the number of XRP holders remains stable at around 5.2 million, and the trading volume is also consistent at approximately $793 million.

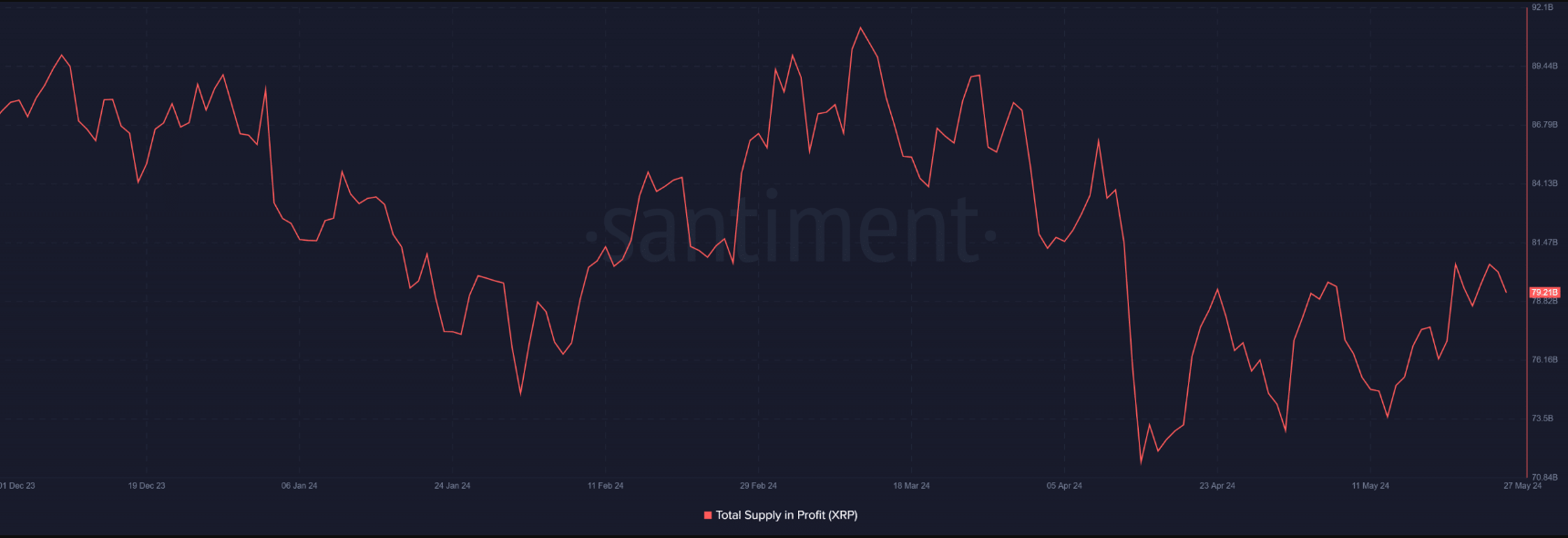

Despite these stable metrics, the portion of XRP supply in profit has seen a slight decrease from over 80% to 79% recently, and this drop suggests that more investors are holding XRP at a loss, reflecting the ongoing price struggles.

Who cares XRP?

One of the primary reasons for XRP’s current weakness could be flat demand coupled with low trading volume.

When demand for a cryptocurrency is low, it becomes challenging for the price to gain upward momentum.

Low trading volume can causing price volatility and make it harder for the market to find a clear direction.

The overall market sentiment also plays an important role in the price, as cryptocurrencies are highly influenced by investor sentiment, news, and market trends.

In XRP’s case, the lack of positive news and the broader market’s cautious stance might be contributing to its less impressing performance.

Investors holding XRP are pretty much interested in its price movement and future gains.

The current price discovery mode highlight the importance of closely monitoring support and resistance levels.

If the price falls below the $0.52 support level, it could trigger a bearish trend, leading to further declines, and no doubt this would be a bad news for investors.

To hold, or not to hold?

A bigger price drop could result in more XRP holders finding their investments in the red, shaking investor confidence, which is already looks weaker than before.

While the current situation looks challenging, it could be worse. If demand and trading volume remain low, XRP might experience a decline below its current support level of $0.52.

This move could push more XRP out of the profit zone, increasing selling pressure and further impacting the price negatively.

Any positive developments in the cryptocurrency market or specific positive news related to XRP could help maintain demand and drive the price upward, but for now, there aren’t much.

Investors should keep an eye on market trends and news to catch potential movements.

In conclusion, XRP’s current price struggles are a result of multiple factors, including low demand, stable but insufficient trading volume, and technical resistance levels.

Investors must stay informed and vigilant, as the market remains unpredictable and subject to rapid changes.