India’s Madras High Court recognized XRP as “property,” granting it legal protection under Indian law and halting a proposed redistribution of a user’s XRP tied to a WazirX incident.

The court said cryptocurrency qualifies as a virtual digital asset capable of being owned, enjoyed, and held in trust, shifting the frame from “speculative” to property rights.

The injunction prevents Zanmai Labs (WazirX’s operator) from reallocating 3,532.30 XRP while the case proceeds.

With this ruling, exchanges face clearer custodial obligations. The court asserted jurisdiction because the buyer funded the purchase from Chennai and accessed the platform in India.

As a result, user claims over digital assets gain firmer footing in local courts, narrowing room for “socialized loss” plans following hacks or restructurings.

The decision also sets a reference point for future policy and litigation. By anchoring crypto to property law and trust principles, it strengthens recovery, injunction, and tracing remedies available to holders.

Legal analysts say the move could influence taxation treatment and compliance standards as India refines its crypto framework.

XRP rejects wedge retest; focus shifts to blue support

XRP’s daily chart shows price reclaiming the wedge briefly, then rejecting at the descending trendline.

The move comes after a multi-month squeeze between falling resistance and a rising base. As sellers reassert control, the chart circles a failed re-entry, signaling that the breakdown risk remains in play.

Consequently, attention turns to the blue support near the $1.57 macro Fibonacci level highlighted on the chart. That zone aligns with prior wick extremes from the broad market shock and now acts as a logical downside magnet if momentum stays weak. Volume has not confirmed a decisive reversal, and structure still leans lower.

However, conditions can shift quickly. A sustained reclaim and close back above the wedge resistance would invalidate the immediate bearish read and reopen higher targets.

Until that occurs, the path of least resistance points toward testing supports, with $1.57 as the key line in focus.

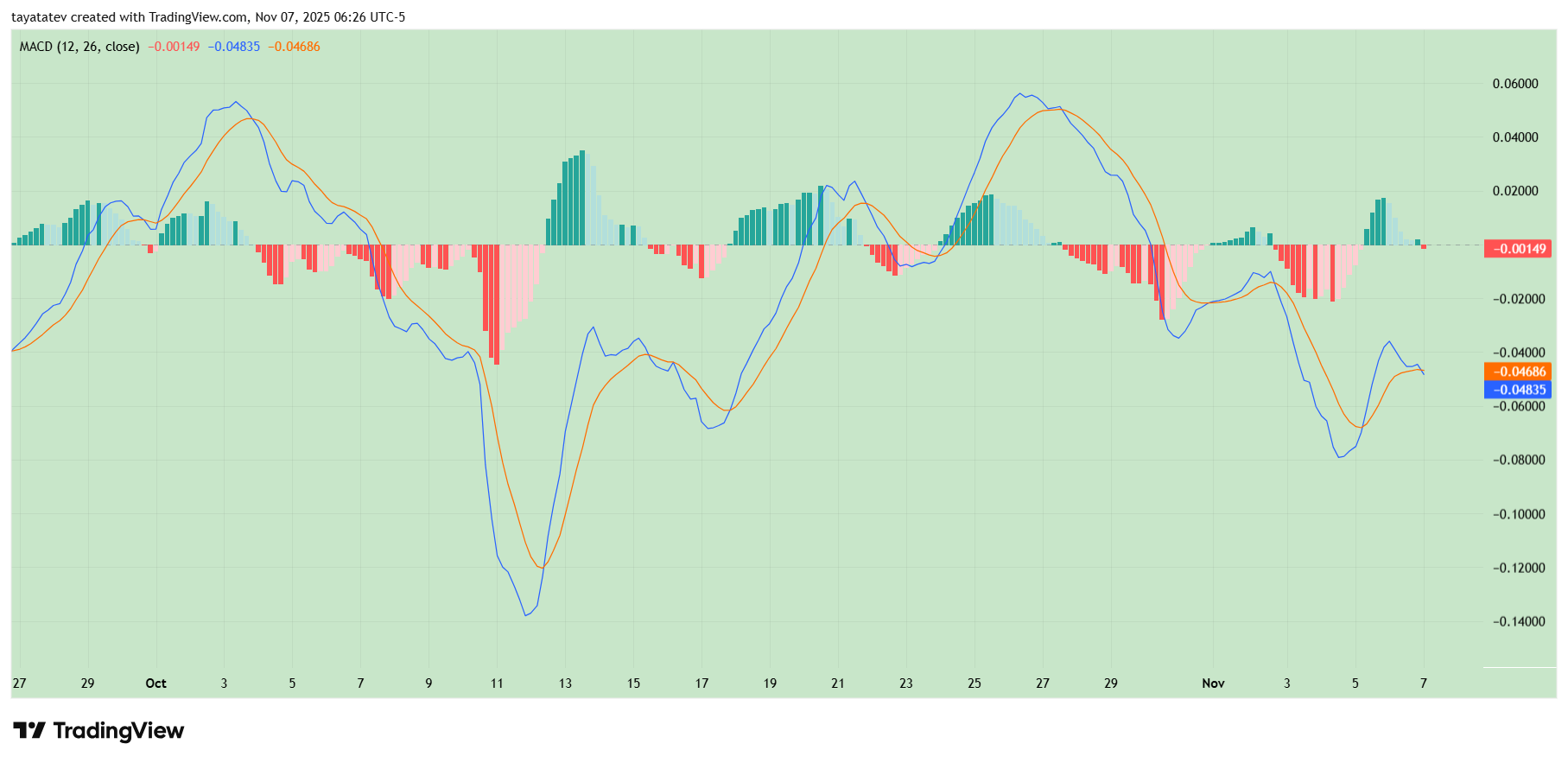

XRP MACD nears inflection; momentum improves but stays negative

Meanwhile, XRP’s MACD on the 4-hour view shows steady recovery from deep negative territory.

The histogram has climbed toward the zero line and now prints only a small negative read, which signals waning bearish momentum. As a result, selling pressure looks less aggressive than earlier in the week.

However, the signal lines still sit below zero, keeping the broader momentum bias bearish.

The MACD line remains slightly under the signal line, so a bullish crossover has not confirmed yet. Until that flip occurs, rallies face a momentum headwind.

Looking ahead, watch for a clean histogram flip to positive and a MACD-over-signal crossover while holding above the zero line.

If those triggers align with rising volume, momentum would confirm a shift. Otherwise, failure to cross could see the indicator roll back down and re-energize sellers.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 7, 2025 • 🕓 Last updated: November 7, 2025