The crypto world is still reeling from the massive Bybit hack, but this week could be just as eventful.

The U.S. economic calendar is packed with key data releases that could either boost or bust crypto markets. Let’s see what’s coming up.

Macroeconomic factors

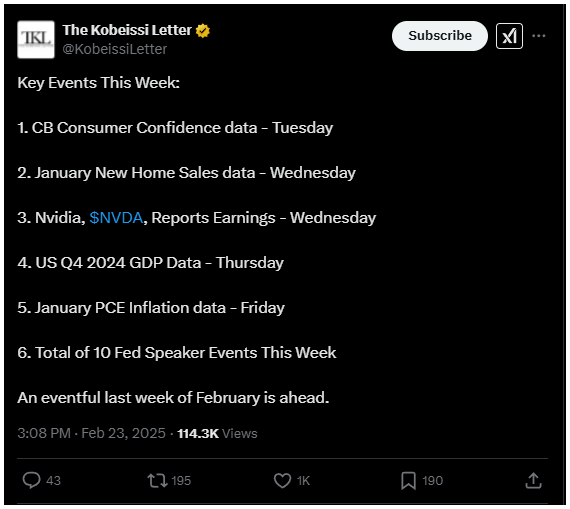

First off, the U.S. economy is showing some cracks, as last week’s service-sector PMI reading was the lowest in over two years, and this week we’re expecting GDP and PCE inflation data.

The PCE inflation report is particularly important, as it’s the Fed’s go-to gauge for inflation.

If it shows inflation is rebounding, forget about those rate cuts you’ve been hoping for.

On the other hand, if it’s lower than expected, the Fed might just give you a rate cut Christmas present. Or Easter present.

Rate cuts are good for Bitcoin?

Economic events this week include consumer confidence and new home sales data, but the big showstopper is Thursday’s GDP data.

If it’s higher than expected, it could mean no rate cuts anytime soon, but if it’s lower, the Fed might have a reason to cut rates.

Friday brings the Core PCE report, which will give us a clearer picture of consumer spending.

In the crypto industry, a Senate Banking Committee hearing on Wednesday could bring some positive vibes for digital assets.

Nvidia’s earnings report could impact AI-related crypto assets, and several major crypto miners are set to release their revenue reports.

Have you read it yet? Raydium’s token takes a hit, because of Pump.fun

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.