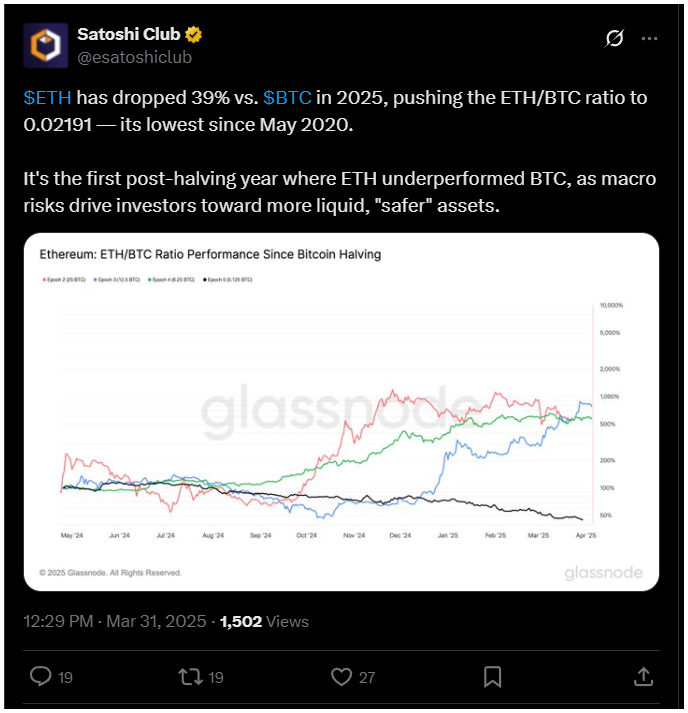

Ethereum’s performance against Bitcoin has hit rock bottom. We’re talking a five-year low here, guyss.

The ETH/BTC ratio has sunk to 0.02191, with Ethereum dropping 39% against Bitcoin. If you’re an ETH holder, this news might sting a little, or a lot.

No flippening

Let’s put this into perspective. Historically, Ethereum tends to thrive in the first quarter of the year. It’s like its lucky season, an average Q1 gain of 77%. But not this time.

In Q1 2025, Ether is down a brutal 45.98%, marking its worst start since 2018 when it fell by 46.61%. What happened to the good times? They’re nowhere to be found.

Now, before you start thinking Bitcoin is out here flexing its dominance, let’s take a closer look. BTC isn’t having a great year either.

After briefly climbing to $88,000 earlier in Q1, it’s now hovering in the lower $80,000 range, a 12.18% quarterly decline.

Sure, it’s not as bad as Ethereum’s tumble, but it’s still BTC’s worst Q1 performance since that infamous crash of 2018.

Where’s the big money?

And let’s not forget the institutional interest, or lack thereof. Spot Bitcoin ETFs have seen only modest inflows this year, with the longest streak lasting just ten days and total inflows barely scraping $1 billion. It seems like big players are sitting this one out.

Blame it on trade wars, inflation fears, or even President Trump’s latest tariff drama—it all adds up to uncertainty in the market.

The optimism that fueled Bitcoin’s rise to $108,000 earlier this year feels like ancient history now. And Ethereum? Well, it’s caught in the same storm.

ETH ETFs haven’t fared much better either, with 17 consecutive days of outflows ending just last week. It’s clear that confidence in Ethereum is wavering, and that’s putting it mildly.

When Moon?

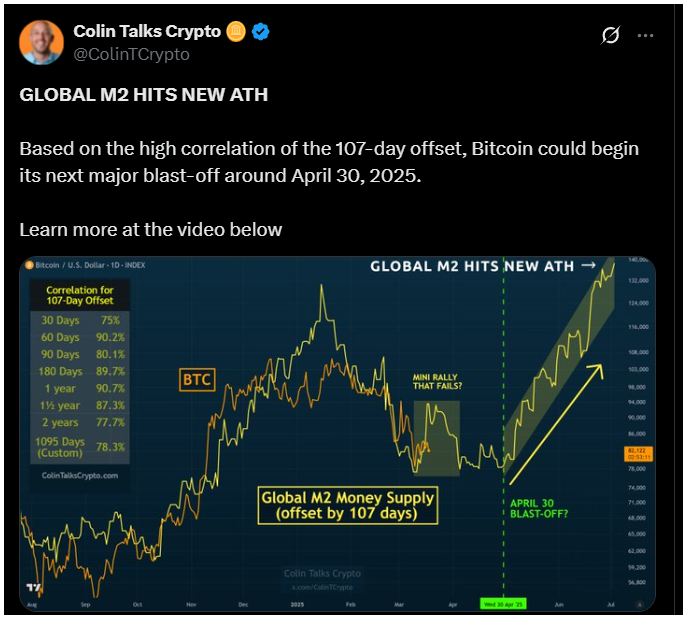

But there might be light at the end of this gloomy crypto tunnel. Market experts like Sina G from 21st Capital believe we’re in undervalued-neutral territory and predict a rebound once trade wars cool off and government spending cuts are resolved.

He even suggests tax cuts and deregulation could spark a market revival within the next quarter.

Others are equally optimistic. CryptoQuant analysts note that experienced traders are accumulating BTC rather than selling, a sign of potential growth ahead.

Plus, historical trends show that Q2 often brings better days for both Bitcoin and Ethereum. Hopium reloaded.

Have you read it yet? Solana’s whale problem is a big issue?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.