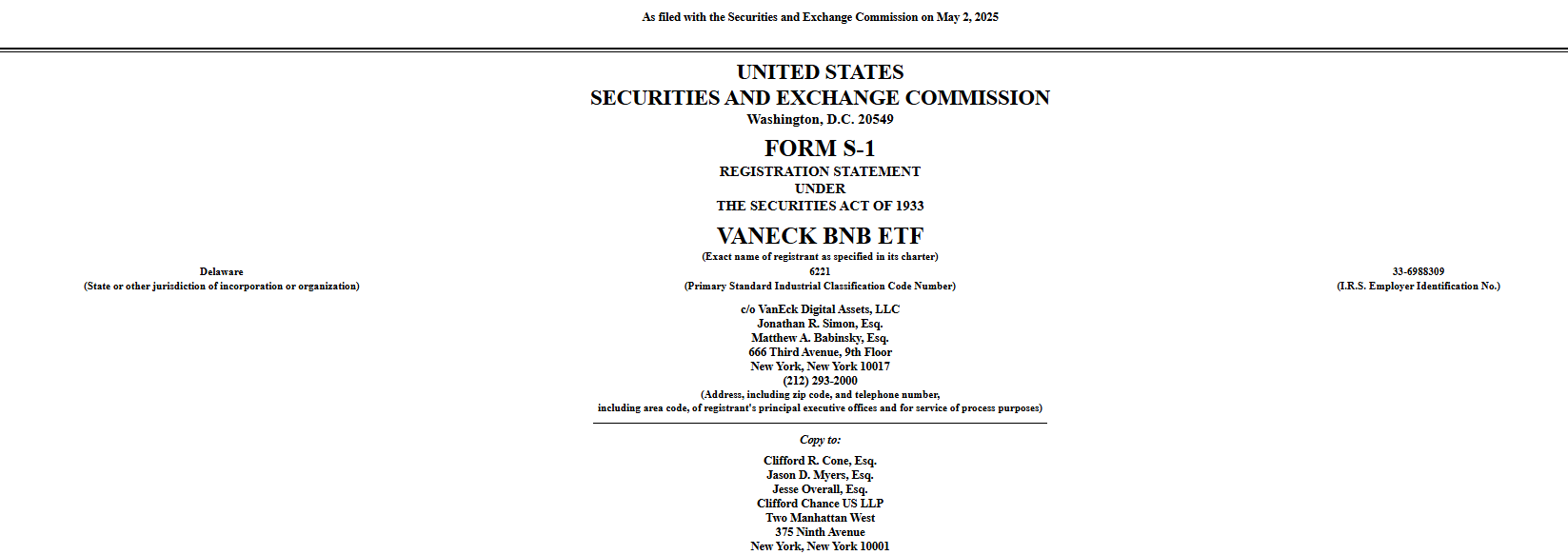

Asset manager VanEck submitted an application to the U.S. Securities and Exchange Commission (SEC) to list a spot BNB ETF.

The proposal marks the first attempt to register a U.S.-based ETF holding the Binance BNB token.

The VanEck BNB ETF will directly hold BNB and may also stake a portion of its assets. According to the S-1 filing, staking will occur through trusted providers. This structure is similar to VanEck’s earlier filings for other altcoin ETF products.

As of May 6, 2025, the BNB token price stood at $599. Its total market capitalization reached about $84 billion, based on CoinMarketCap data.

Staking rewards for BNB are approximately 2.5%, according to StakingRewards.com.

The SEC ETF filing includes a standard Delaware statutory trust format. VanEck previously used the same setup for an Avalanche ETF filing in March 2025.

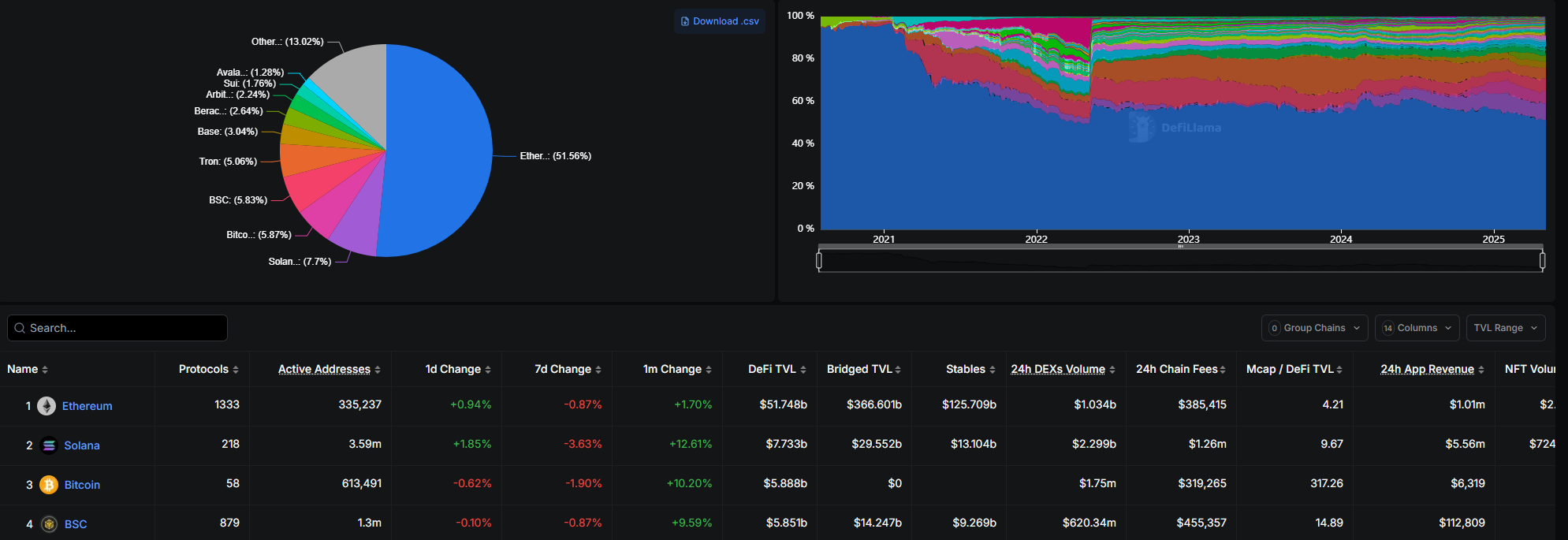

BNB Chain Holds Nearly $6 Billion in Locked Value

The Binance BNB Chain supports the proposed ETF’s asset base. As of early May, the total value locked (TVL) on BNB Chain was close to $6 billion, based on data from DeFiLlama.

BNB Chain remains one of the leading smart contract networks. It hosts numerous decentralized applications, supporting the utility of the Binance BNB token.

The spot BNB ETF would allow indirect access to BNB through traditional markets. It tracks the native token’s value on the BNB Chain while offering institutional exposure to a staked asset with yield.

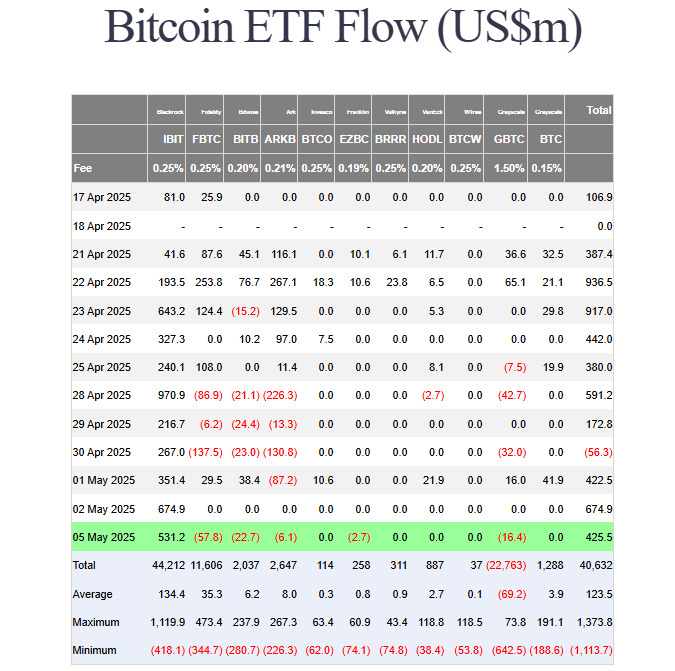

Altcoin ETF Filings Rise as Bitcoin ETF Flows Increase

The VanEck BNB ETF filing adds to a growing list of altcoin ETF filings. Since January 2024, spot Bitcoin ETFs have attracted more than $40 billion in net inflows, according to Farside Investors.

Changpeng Zhao, known as CZ and the co-founder of Binance, recently commented on ETF trends at the Token2049 conference in Dubai. He said,

“This cycle so far has been the ETFs. And it’s almost all Bitcoin. Ether hasn’t had as much success but Bitcoin success will spill over to the others eventually.”

VanEck has filed multiple applications to list ETFs based on tokens such as Solana (SOL) and Avalanche (AVAX). The SEC has acknowledged receipt of those applications.

U.S. SEC Reviews Multiple Crypto ETF Applications

The VanEck BNB ETF proposal arrives as the SEC continues to review many crypto ETF applications.

Since President Donald Trump began his term on January 20, the agency has acknowledged filings for both major and minor digital assets.

This includes ETF filings for native Layer-1 tokens and meme coins. Dogecoin (DOGE), trading at $0.1701 as of the last update, is one such token included in proposals.

VanEck’s SEC ETF filing is the first to include the Binance BNB token. The BNB ETF would expand investor access to one of the largest tokens by market capitalization and a key player in the decentralized finance space.

The SEC has not issued a timeline for reviewing or responding to the VanEck BNB ETF application.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.