Bitcoin’s been playing this game again, flashing a signal that’s got traders buzzing.

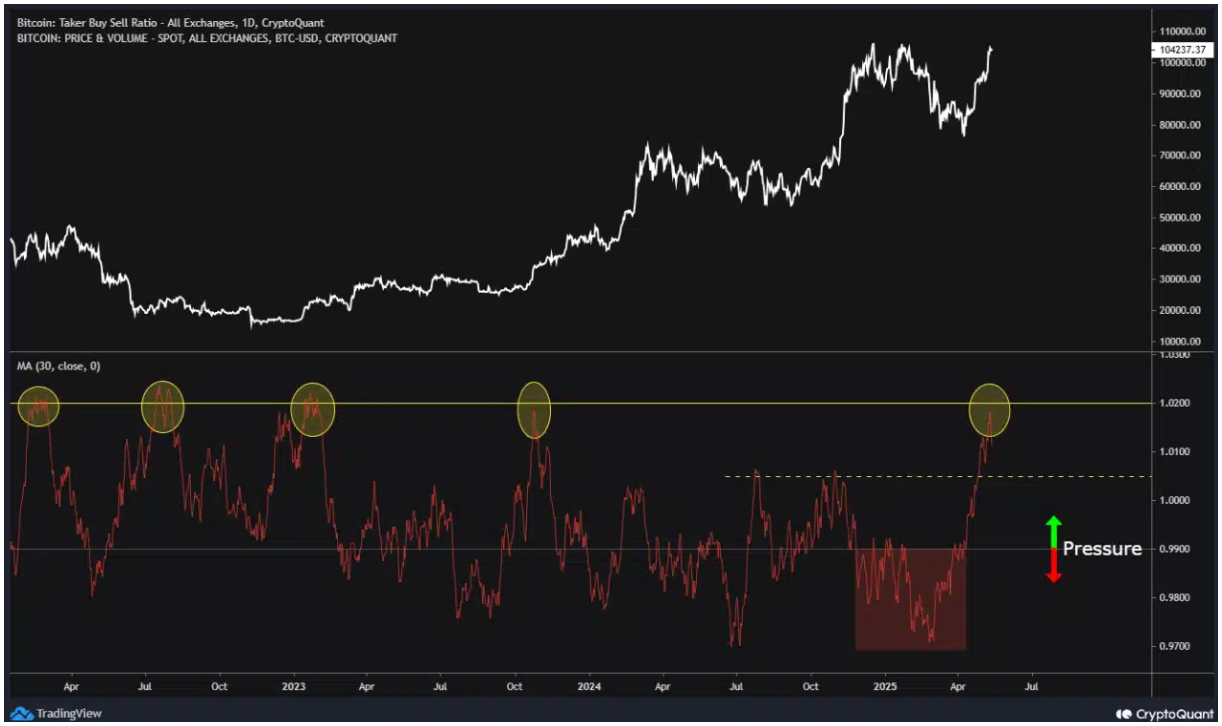

The Taker Buy/Sell Ratio, the fancy measure of how many buyers are aggressively snapping up Bitcoin versus sellers offloading it, just shot up to 1.02.

Now, that might sound like a boring number to some, but to those who know, it’s the kind of level you only see right before Bitcoin pulls a big move, like a breakout to new highs.

Priorities

Remember those moments back in late 2022 when Bitcoin was cozying up between $15K and $20K? Or that October 2023 jump past $30K?

Yeah, the ratio hit similar highs then, signaling that the big players were gearing up.

Now, with Bitcoin hovering just shy of its ATH, this growth in aggressive buying has everyone wondering, is this the calm before the storm, or just another tease?

But on the other hand, the mega whales, those fat cats holding over 10,000 BTC, have hit the brakes.

Glassnode, revealed their buying has cooled off, settling into a neutral zone.

Meanwhile, the mid-sized whales, those holding between 1,000 and 10,000 BTC, are still throwing their chips in, pushing the market forward.

Smaller institutional wallets are also flexing their muscles, but retail investors? They’re offloading, cashing out like it’s payday.

It’s over?

So, what’s driving this rally? It’s not the biggest fish anymore, it’s the mid-tier players trying to make a splash.

But unfortunately, Bitcoin’s price is showing signs of getting tired. It’s been flirting with $105,000 but just can’t seem to break through.

The RSI is sitting at 70.68. That’s like a flashing neon sign saying, hey, maybe take a breather.

The MACD, another momentum gauge, is still positive but flattening out, hinting that the buying frenzy might be losing steam.

Resistance

If Bitcoin can’t punch through that $105K ceiling soon, don’t be surprised if it takes a little dip back to $100K or even lower before making another run. It’s like a boxer circling, catching their breath before the next big punch.

The market’s got its eyes wide open, buyers are stepping up, but the big whales are playing it cool.

Bitcoin’s at a crossroads, either it breaks out in a blaze of glory or stumbles into a short-term cooldown. For anyone holding or watching, buckle up.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.