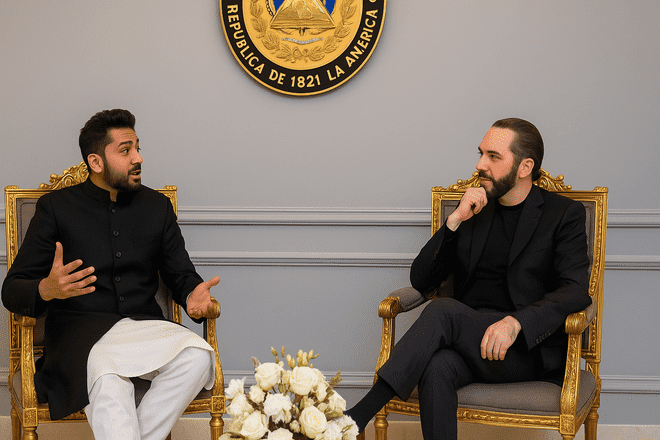

Bilal Bin Saqib, special assistant to Pakistan’s prime minister on crypto and blockchain, met President Nayib Bukele in San Salvador to finalize a Bitcoin agreement.

The meeting led to the signing of a Letter of Intent between El Salvador’s Bitcoin Office and the Pakistan Crypto Council.

This agreement sets up a formal structure for Bitcoin collaboration. It focuses on public sector Bitcoin adoption, blockchain financial inclusion, and crypto policy development for emerging economies.

Saqib also heads the Pakistan Crypto Council, the country’s leading body for digital asset initiatives.

On July 11, Saqib posted about the meeting on X, emphasizing President Bukele’s early support for Bitcoin.

He wrote,

“When it wasn’t cool to back Bitcoin, he stood with conviction.”

Bukele’s administration made Bitcoin legal tender in 2021 and continues to manage international partnerships through its Bitcoin Office.

Pakistan Bitcoin Mining Plan Faces IMF Objections

In May, Pakistan allocated 2,000 megawatts of surplus electricity for Bitcoin mining and AI centers.

This initiative is led by the Pakistan Crypto Council with support from the Ministry of Finance. However, the International Monetary Fund (IMF) rejected the proposal, citing concerns over subsidized energy pricing.

The IMF, which oversees Pakistan’s $7 billion loan program set to continue until 2027, warned that allocating cheap power to a specific industry like crypto mining could unbalance energy pricing.

Although the mining plan targets off-peak seasons such as winter, the IMF blocked the move as inconsistent with free market energy policies.

Despite this, the Bitcoin mining in Pakistan proposal remains part of a larger digital transformation plan. The country sees blockchain infrastructure and Bitcoin use cases as part of its tech-driven modernization strategy.

Michael Saylor Meets With Pakistan’s Finance Ministry

A day before the El Salvador meeting, Michael Saylor, founder of MicroStrategy, joined a virtual discussion with Pakistan’s Finance Minister Muhammad Aurangzeb and Bilal Bin Saqib. The conversation focused on Pakistan’s Bitcoin strategy and potential use of digital assets.

MicroStrategy currently holds more than $62 billion in Bitcoin reserves, making it one of the largest corporate holders. Saylor’s meeting with Pakistani officials signals growing engagement between global Bitcoin investors and Pakistan’s government bodies.

The Pakistan Crypto Council later shared the meeting on X, stating,

“This strategic engagement reflects Pakistan’s growing commitment to establishing itself as a leading force in the global digital asset economy.”

Pakistan Looks to El Salvador’s Bitcoin Experience

The Bitcoin Letter of Intent signed in San Salvador aims to help Pakistan build a framework based on El Salvador’s experience.

According to Business Recorder, the collaboration will focus on creating custom crypto policies suitable for Pakistan’s economic conditions.

El Salvador has been accumulating Bitcoin despite external criticism. As of July 2025, the country holds over 6,240 BTC, worth roughly $740 million, according to data from BitcoinTreasuries.NET.

These reserves are managed through the government’s Bitcoin Office, which was launched following the legal tender decision in 2021.

By studying El Salvador’s Bitcoin adoption model, Pakistan aims to structure its own public sector integration for blockchain and digital assets.

The plan includes creating guidelines for secure transactions, digital wallets, and regulatory controls for Bitcoin use.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.