The crypto market plunged over 5% in 24 hours, with Bitcoin slipping to a multi-week low of $113,164 and the total market cap falling to $3.7 trillion.

As prices decline, Eric Trump returns with another bullish tweet — and history suggests it might mean more volatility ahead.

Market Dips Hard — Altcoins Hit the Floor

Bitcoin is holding just above $113,000, down 1.5% on the day, while altcoins like Ethereum, XRP, Cardano, and Solana have each dropped between 2% and 4%.

The slide follows a combination of weak U.S. job data, increased macro uncertainty, and $115 million in net outflows from Bitcoin ETFs on Thursday — breaking a five-day inflow streak.

On August 1 alone, ETFs saw $812 million in outflows, underlining a sharp shift in investor sentiment.

Eric Trump Tweets — and the Market Reacts (Again)

Right as the market tumbled, Eric Trump tweeted: “₿uy the dips!!! $BTC $ETH.”

This isn’t the first time his tweet has stirred conversation — many in the crypto community believe his “dip calls” often precede further sell-offs before a recovery kicks in.

Analysts Expect Rebound After Short-Term Pain

Investor Ted Pillows believes the current correction could bottom out by Monday, with a recovery rally likely after that.

Analyst Michaël van de Poppe shares a similar outlook, saying August is likely to be a consolidation phase ahead of a bullish breakout in Q4.

There we go, we start correcting with the markets, which means that it's time to accumulate your next positions for the next run.

Perhaps August is a month of stabilization and we'll go back up later in the month for #Altcoins and #Bitcoin. pic.twitter.com/DMuPhkYeSS

— Michaël van de Poppe (@CryptoMichNL) August 1, 2025

Van de Poppe argues Bitcoin is entering a prime accumulation zone and is unlikely to drop below $108,000.

He identifies $114,700 and $116,800 as key resistance levels — once breached, they could fuel a strong rally into September.

📉 Bitcoin – Key Support & Resistance Levels

- 🟢 Support: $113,000 • $111,200 • $108,000

- 🔴 Resistance: $114,700 • $116,800 • $120,000

Bitcoin is currently trading near $113,750. A drop below $113K could test deeper support at $111K or even $108K. Breaking above $116,800 could signal renewed bullish momentum into Q3–Q4.

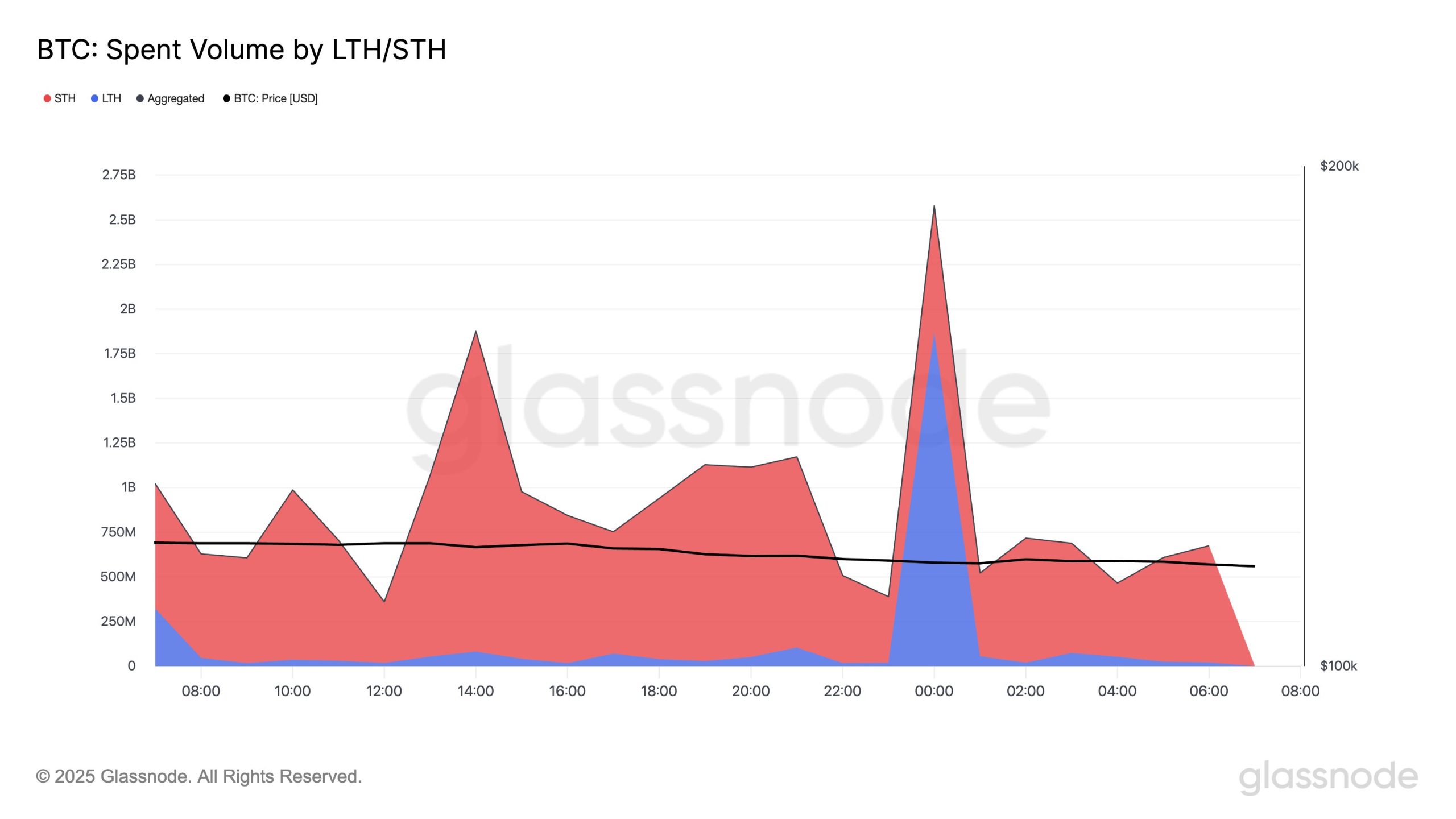

Short-Term Holders Are Selling

According to on-chain data from Glassnode, over 90% of Bitcoin supply has remained in profit for over a month — a sign of a strong cycle. But it also means more traders are likely to take profits.

In the past 24 hours, 85.5% of Bitcoin spent volume came from short-term holders.

That suggests the current sell-off is driven by newer investors, not long-term holders — a typical pattern in mid-cycle corrections.

Is This the End of the Bull Run?

Not necessarily. Historically, August has been a weak month for crypto markets, and analysts don’t see this drop as a trend reversal.

If market structure holds, most expect the next leg up to begin between late August and October.

Eric Trump’s timing may look off — but his message might still prove right.

Frequently Asked Questions (FAQ)

Why did Bitcoin drop to $113K?

The drop followed weak U.S. jobs data, rising geopolitical tensions, and $115 million in net ETF outflows. Short-term holders also contributed to selling pressure.

What does Eric Trump’s “Buy the dip” tweet mean?

Eric Trump’s tweet is seen as a bullish signal, though some traders joke it coincides with short-term dips. His message implies confidence in long-term crypto gains.

Will Bitcoin rebound soon?

Analysts expect Bitcoin to consolidate in August and possibly rebound by late August or September, especially if resistance at $116K is broken.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 2, 2025 • 🕓 Last updated: August 2, 2025

✉️ Contact: [email protected]