BitMEX co-founder Arthur Hayes has issued a stark macro warning, signaling that the U.S. tariff bill and sluggish global credit expansion could trigger significant volatility in crypto markets.

In a post shared on X, Hayes forecasted a test of $100,000 for Bitcoin and a pullback to $3,000 for Ethereum, citing a lack of credit creation to support nominal GDP growth worldwide.

U.S. Tariff Bill Sparks Economic Concerns

Hayes pointed to the upcoming expiration of the U.S. tariff bill in Q3 as a trigger for further market weakness.

Following disappointing U.S. non-farm payroll (NFP) data, investors are increasingly skeptical about whether any major economy is stimulating enough credit to maintain GDP momentum.

“No major economy is creating enough credit fast enough to boost nominal GDP,” Hayes noted, warning that in such conditions, Bitcoin and Ethereum could retest key support zones as they revert to macro-safe havens.

Hayes Sells $13M in Crypto Amid Market Uncertainty

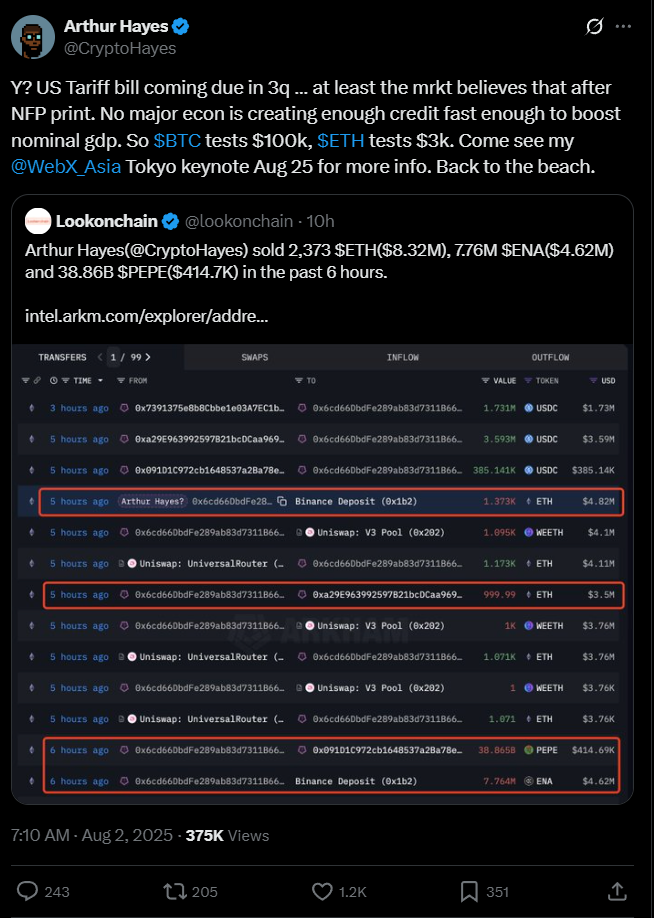

In parallel with his warning, Hayes sold over $13.3 million worth of crypto assets.

His portfolio movements include:

-

2,373 ETH (~$8.32M)

-

7.76M ENA tokens (~$4.62M)

-

38.86B PEPE (~$415K)

These transactions were executed across platforms like Uniswap, Flowdesk, and Binance.

In addition, Hayes funneled large USDC transfers from multiple wallets before offloading assets to centralized exchanges—indicating a well-planned liquidation.

Despite the sell-off, this may not signal a bearish stance. Just weeks prior, Hayes reportedly acquired $1.5M worth of ENA tokens during a market dip, aligning with a more tactical trading approach.

Looking Ahead: Hayes to Speak at WebX Asia in Tokyo

Hayes is scheduled to speak at the WebX Asia conference in Tokyo on August 25, 2025, where he will expand on macroeconomic threats, derivatives strategy, and the future of crypto under shifting trade policy.

With market participants facing a foggy macro outlook, the event could offer clarity for traders navigating these choppy waters.

Frequently Asked Questions (FAQ)

Why is Arthur Hayes warning about Bitcoin and Ethereum?

Hayes believes global credit expansion is too slow to support nominal GDP growth, and that the U.S. tariff bill could worsen macro conditions, leading BTC to test $100K and ETH to fall to $3K.

How much crypto did Arthur Hayes sell?

Hayes sold over $13.35 million worth of crypto, including ETH, ENA, and PEPE tokens, across multiple platforms like Uniswap and Binance.

Will Hayes speak publicly about this outlook?

Yes, Hayes will speak at the WebX Asia event in Tokyo on August 25, 2025, where he will share insights on derivatives, macro trends, and trade policy’s role in crypto.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 2, 2025 • 🕓 Last updated: August 2, 2025

✉️ Contact: [email protected]