Ethereum just crushed through $4,000 again. That’s something we haven’t seen since December.

It’s like your quiet coworker suddenly flipping the office pong table and shouting, game on!

After slumping around, stuck in a consolidation hole, ETH’s on a rampage fueled by some seriously powerful engines.

Ethereum is the next gold rush?

Short sellers? They got steamrolled, $105 million wiped out in short liquidations on a single Friday.

That’s half the entire market’s bearish bets blown to smithereens. Eric Trump didn’t hold back either, clowning bearish traders, warning them they’re gonna get run over if they keep betting against Bitcoin and Ethereum.

And this frenzy isn’t slowing, $200 million in liquidations in 24 hours say ETH is playing for keeps.

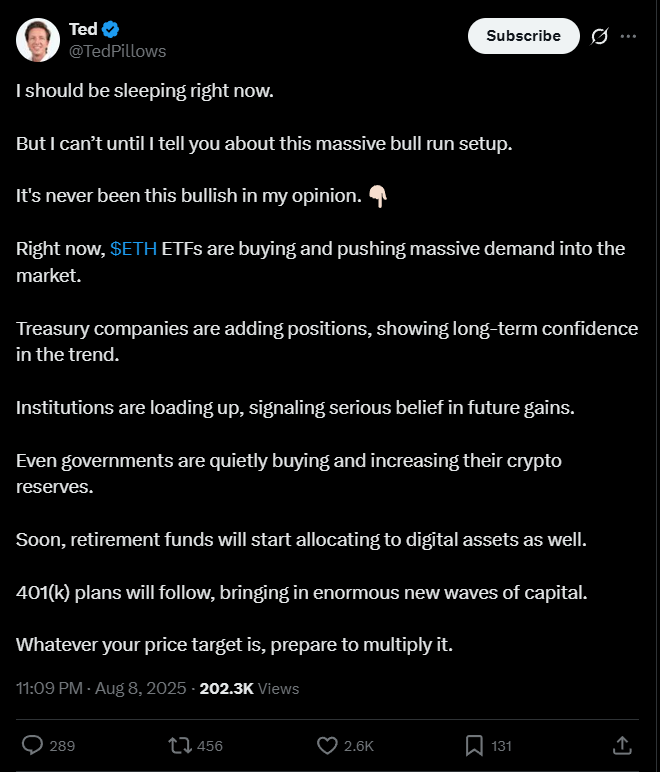

Investor Ted Pillows is shouting from the rooftops that Ethereum’s setup has never looked so damn bullish.

Why? We got massive inflows in spot ETFs, big shots building stacks quietly, and corporations tucking ETH away like it’s the next gold rush.

Even governments? Quietly buying. Pillows’ prophecy? $10,000 ETH in this cycle, and guys, nothing’s standing in the way.

Unstoppable momentum?

Trump’s executive order could push this rocket to the moon. It opens up 401(k) plans to invest in crypto, private equity, real estate, you name it.

Loads of new cash could flood into Ethereum, the well-known blockchain platform that everyone trusts.

You thought your last price guess was crazy? Pillows says, multiply it by ten.

And the money keeps pouring, Ethereum spot ETFs pulled in half a billion USD in the last four trading days alone.

On August 8th? $460 million in a single day. Momentum? It’s like watching a freight train roll downhill, unstoppable.

Betting big

Another popular expert, Mikybull Crypto is calling for a 10x to 50x breakout on ETH, while analyst Miles Deutscher foresees an altseason blastoff followed by Bitcoin growing to $120K-$140K, then another sick leg up for altcoins, including Ethereum.

ETHEREUM IS SET FOR A MEGA BREAKOUT

GET READY FOR 10-50X SEASON FOLKS! pic.twitter.com/41kkH7pso8

— Mikybull 🐂Crypto (@MikybullCrypto) August 8, 2025

But what about Bitcoin dominance, you may ask? It’s dropping, sitting at just 59% now.

When Ethereum flexes more than Bitcoin, it signals capital shifting into altcoins, the underdogs ready to steal the show.

So Ethereum’s bull run is getting real, and experts are betting big.

Frequently Asked Questions (FAQ)

Why is Ethereum breaking through the $4,000 barrier now?

Ethereum’s breakout above $4,000 is driven by massive institutional inflows, spot ETFs, and strong support from large corporations and governments. The combination of bullish sentiment, short liquidations, and new regulations like Trump’s executive order has fueled Ethereum’s rise to this price level.

What impact did Trump’s executive order have on Ethereum?

Trump’s executive order allows 401(k) plans to invest in crypto, private equity, and real estate, potentially bringing massive new liquidity into the crypto market, particularly Ethereum. This move could significantly boost Ethereum’s price as more capital floods into the space.

Is Ethereum’s rally sustainable or a temporary spike?

Ethereum’s current rally is supported by strong fundamentals, including growing institutional interest, massive inflows into Ethereum ETFs, and decreasing Bitcoin dominance. However, as with any bull run, there’s always the risk of short-term volatility. Still, many experts believe Ethereum could continue its climb, with some predicting a $10,000 ETH by the end of this cycle.

What does Ethereum’s growing dominance mean for altcoins?

As Ethereum’s dominance increases, it signals a shift in capital from Bitcoin to altcoins, a trend that could lead to explosive growth for Ethereum and other altcoins. With Ethereum flexing its strength, it could pave the way for other altcoins to shine during this upcoming altseason.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 10, 2025 • 🕓 Last updated: August 10, 2025

✉️ Contact: [email protected]