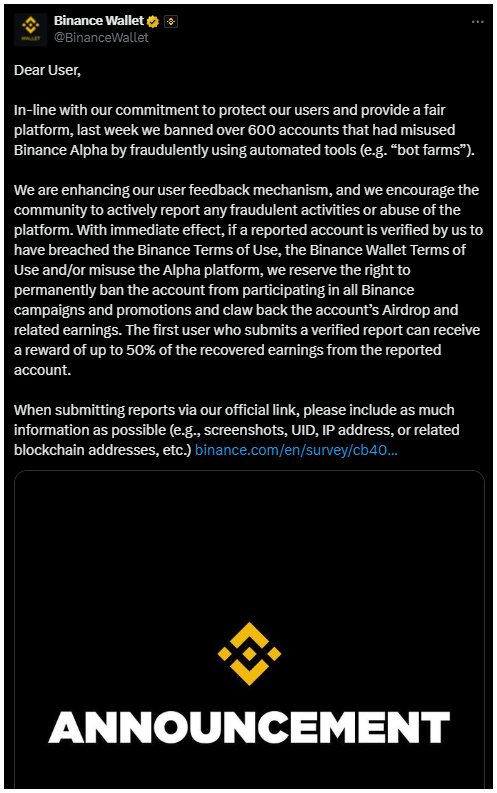

Binance recently took a hard stance against users exploiting its Binance Alpha platform, permanently banning over 600 accounts involved in coordinated bot farming.

Binance Alpha serves as a launchpad for early-stage Web3 projects, granting users early access to tokens through a point system.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

But then, bots were deployed by some to manipulate rewards, monopolizing token sale allocations designed for fair distribution.

Unfairly generated millions

This bot abuse echoes similar issues uncovered by blockchain analytics firm Bubblemaps, which revealed coordinated groups controlling the top-earning wallets on projects like ChainOpera.

Such manipulation generated millions unfairly and undermined decentralized principles.

In response, Binance has upgraded monitoring tools and launched a whistleblower program allowing users to report suspicious accounts with proof, screenshots, wallet details, or IP addresses, with rewards of up to 50% of recovered funds.

Oversight

While this incentivizes community policing, critics worry it could turn Binance’s ecosystem into a surveillance state, eroding trust and shifting away from the platform’s original “social farming” ethos.

Crypto analyst Demiter expressed concern that this policy risks creating an environment where users feel watched and policed rather than empowered.

The broader worry is that Binance’s enforcement model might evolve into heavy-handed oversight, which could alienate community members.

Terms of Use

Still, Binance maintains strong enforcement, warning that accounts violating its Terms of Use face permanent suspension and loss of rewards.

This crackdown also comes amid user frustration over technical glitches and flash crashes affecting trades, highlighting the exchange’s effort to rebuild trust through fairness and transparency.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 20, 2025 • 🕓 Last updated: October 20, 2025

✉️ Contact: [email protected]