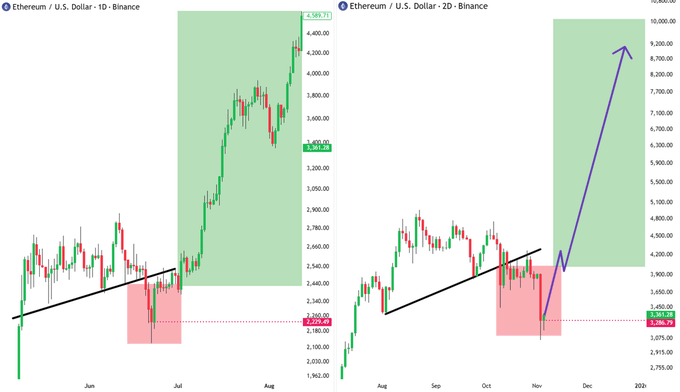

Crypto trader Pepesso posted a side-by-side Ethereum chart on X, arguing that the current pullback mirrors a July pattern that preceded a vertical rally.

The new chart pairs a one-day view of the earlier breakout with a two-day view of today’s structure.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

It highlights a break below a short rising trendline, a flush into a red demand zone, and then a projected recovery that targets the $9,000–$10,000 area.

In the illustration, price first loses a shallow uptrend, then stabilizes inside support roughly around the high-$2,000s to low-$3,000s.

From there, the prior example shows a clean impulse through the mid-$3,000s and into the low-$4,000s.

Pepesso applies the same template now: after the October drop, a rebound through ~$3,600–$3,900 would, in his view, confirm momentum and open room toward former highs before an extension toward five digits.

However, the setup still hinges on buyers defending that pink support band. If ETH closes back below the marked zone (roughly the mid-$2,000s), the fractal breaks and invalidates the $10K path for now.

Until price reclaims the broken trendline and then clears the ~$3,800–$4,000 supply, the move remains a thesis rather than a trend.

As always, the chart focuses on structure: reclaim resistance, hold higher lows, and extend.

ETH forms bearish flag on 1-hour chart — Nov. 6, 2025

Ethereum traded near $3,388 on Nov. 6, 2025, as the 1-hour ETH/USD chart on Bitstamp showed a sharp drop, then a tight upward-sloping channel against the 50-EMA near $3,435.

A bearish flag is a brief, rising consolidation that follows a swift sell-off and often resolves lower in the direction of the prior move.

The current channel fits that template: volume thinned during the climb, price repeatedly met supply near the upper rail, and momentum (MACD) started to roll over.

If price closes below the flag’s lower trendline, the pattern confirms continuation lower. Based on the measured move—the height of the flagpole from the late-session dump—downside projections align with the green horizontal level around $3,003.7.

From the latest print near $3,388, that path implies roughly an 11% decline. Interim support sits near $3,300 and then $3,200; failure at those shelves would increase the probability of reaching $3,003.7.

However, if buyers defend the lower rail and reclaim the 50-EMA around $3,435 with expanding volume, the flag loses potency and short-term momentum improves.

Until then, structure favors downside follow-through: break the channel, expand volume, and extend the prior leg lower by the measured distance.

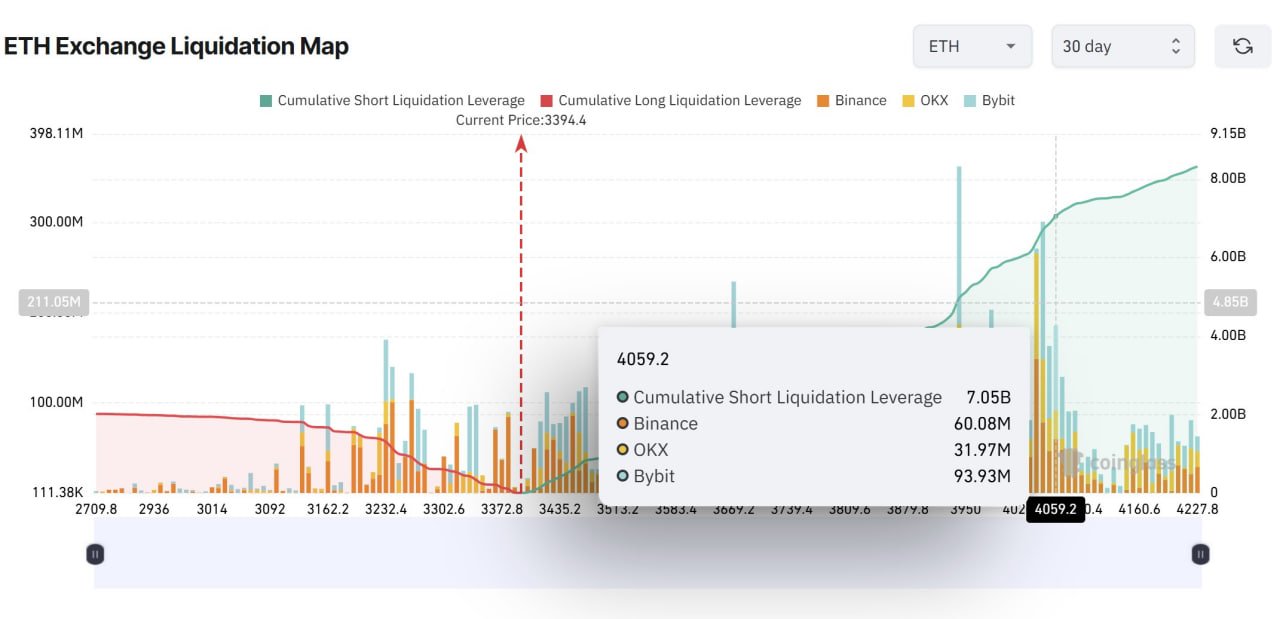

ETH liquidity map tilts bullish-to-squeeze near $4K

Ethereum rebounded after a flash drop to ~$3,050 that erased about $1.3 billion in long positions.

Now, liquidity data shows roughly $7 billion in cumulative short liquidations stacked around $3,950–$4,100.

That cluster creates a clear magnet: if price drives into the zone, forced buy-backs from short covers can accelerate upside.

Moreover, the map shows thinning liquidity below current levels compared with the wall above.

Therefore, sellers must push price back under ~$3,300 to regain control and avoid a move toward $4K. Until that break happens, the path of least resistance tilts upward into the short-heavy pocket.

Even so, confirmation still matters. First, ETH needs a clean reclaim of recent intraday supply near ~$3,600–$3,700 with rising spot and futures volume.

Next, a push through ~$3,850 would likely trigger the initial wave of short liquidations.

Finally, a print above ~$4,000 could cascade into the bulk of that $7B stack, turning defense into fuel for a squeeze.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 6, 2025 • 🕓 Last updated: November 6, 2025