Bitcoin miners are taking a bigger share of corporate adoption as Bitcoin treasury purchases slow, according to BitcoinTreasuries.NET.

The new corporate adoption report, led by BitcoinTreasuries.NET President Pete Rizzo, says listed treasury companies are on track to buy about 40,000 BTC in the fourth quarter. That would be the lowest quarterly total since Q3 2024.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

During the period covered by the report, Bitcoin price hovered near $92,617. Even with that level, corporate buying eased. Rizzo wrote that Bitcoin miners now “anchor public-market Bitcoin holdings,” because they continue to add coins while some treasuries step back.

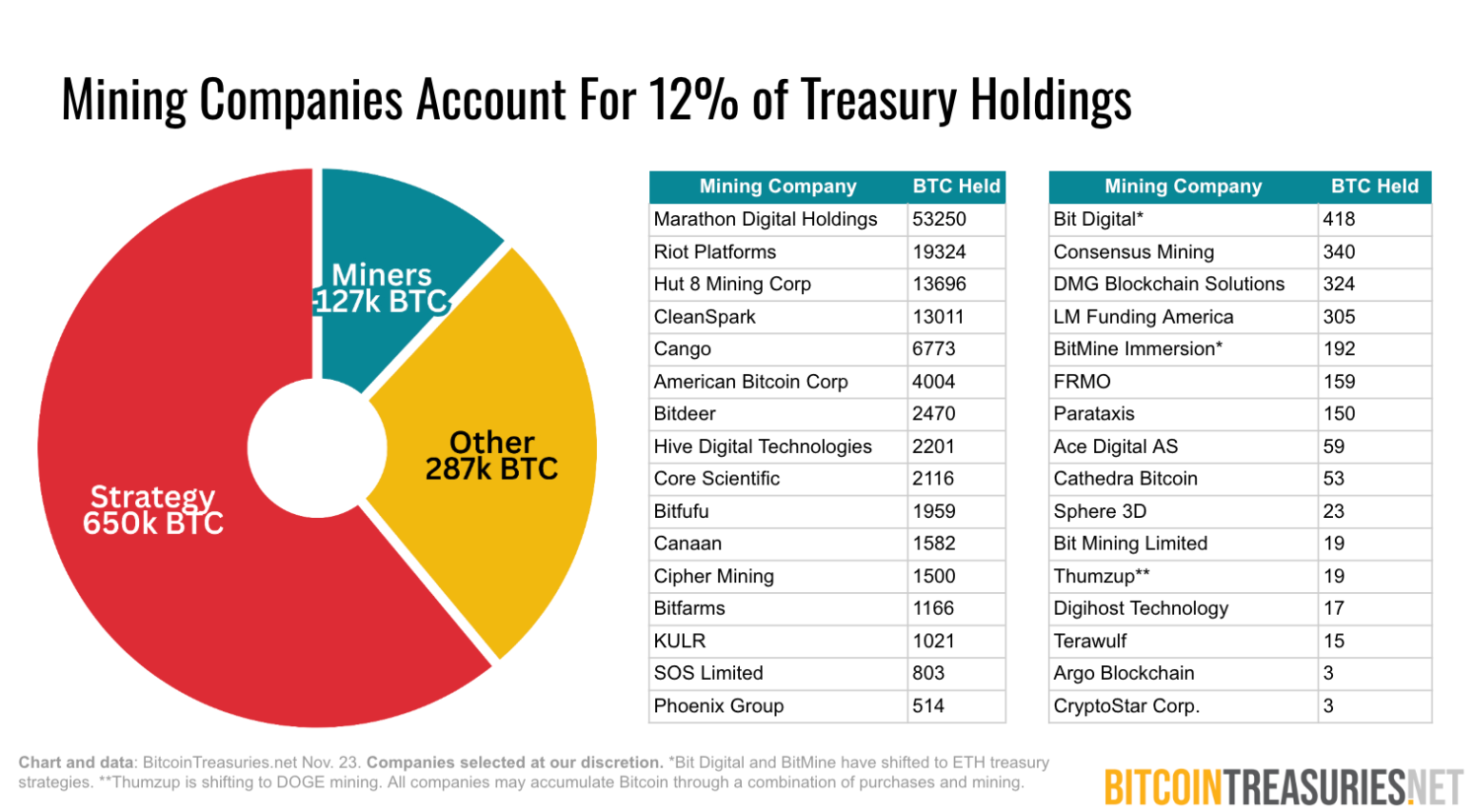

In November, miners accounted for 5% of new BTC additions among public companies and held 12% of their combined Bitcoin holdings.

That share shows how mining firms now influence BTC balance sheets alongside traditional treasury buyers.

“Because miners can acquire BTC at an effective discount to spot markets via block production, their balance sheets may become increasingly important in supporting corporate adoption, especially if other treasuries pause or slow purchases,” he said.

Marathon Digital, Riot Platforms and Hut 8 Bitcoin Holdings

The report notes that Bitcoin miners generate about 900 BTC per day, based on data from Bitbo.

That production follows the protocol schedule and does not depend on market sentiment.

As a result, miners can keep building Bitcoin holdings even when other public companies slow their treasury activity.

Among public firms, Marathon Digital Holdings (MARA) ranks near the top by Bitcoin treasury size. The company holds 53,250 BTC, which places it as the second-largest public Bitcoin holder globally in the dataset.

Riot Platforms sits in the seventh position with 19,324 BTC on its balance sheet. Hut 8 Mining follows in ninth place with 13,696 BTC. Together, these three miners control more than 86,000 BTC.

Because these miners appear in the top ten public holders, they now stand beside traditional corporate treasuries in shaping corporate adoption. Their steady inflow from mining rewards makes their BTC balance sheets important when new treasury buying slows.

Bitcoin Treasury Buying Cools After Summer Frenzy

Rizzo said the “summer buying frenzy” from Bitcoin treasury companies has faded. However, he noted that the change looks more like normalization than a collapse in interest.

According to the report, many corporations added significant Bitcoin holdings earlier in 2025.

As a result, boards and risk teams now reassess those positions instead of adding large new allocations each month.

Rizzo wrote that “public corporations appear to be normalizing to a slower, more selective cadence as they digest recent purchases and reassess risk.”

That pattern aligns with the projected 40,000 BTC in fourth-quarter buying, which remains meaningful but sits at a multi-quarter low.

The report states that corporate adoption remains in place, yet its drivers are shifting. Bitcoin miners keep adding coins through production, while non-mining treasuries move more cautiously.

November Bitcoin Price Drop Tests Corporate BTC Balance Sheets

The corporate adoption study highlights November as an early stress event for Bitcoin treasury strategies.

During the month, Bitcoin price fell below $90,000 for the first time since April, pressuring recent corporate buyers.

Rizzo said that roughly 65% of companies in the sample purchased BTC above current levels. Those firms now hold unrealized losses on their BTC balance sheets at recent spot prices.

“Bitcoin’s late-November drawdown pushed spot prices toward $90,000, dragging many 2025 buyers into the red. For the 100 companies where cost basis could be measurable, about two-thirds now sit on unrealized losses at current prices,” he said.

He added that the data “does not yet point to widespread distress,” but it forces risk committees and boards to confront the downside of averaging into higher Bitcoin price levels.

The report frames this as one of the first true stress tests of the current Bitcoin capital markets phase, with Bitcoin miners, Marathon Digital, Riot Platforms, and Hut 8 now central to how public markets hold and manage BTC.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 12, 2025 • 🕓 Last updated: December 12, 2025