BlackRock placed its IBIT Bitcoin ETF on its homepage as one of three main 2025 themes as 2026 approaches. The firm also highlighted an ETF tied to Treasury bills and another linked to the “Magnificent 7” US tech stocks: Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla.

The positioning linked the IBIT Bitcoin ETF to mainstream ETF categories. It also showed that BlackRock kept the Bitcoin ETF in focus during a weaker price year.

IBIT Bitcoin ETF Pulls $25 Billion Even With Negative 2025 Return

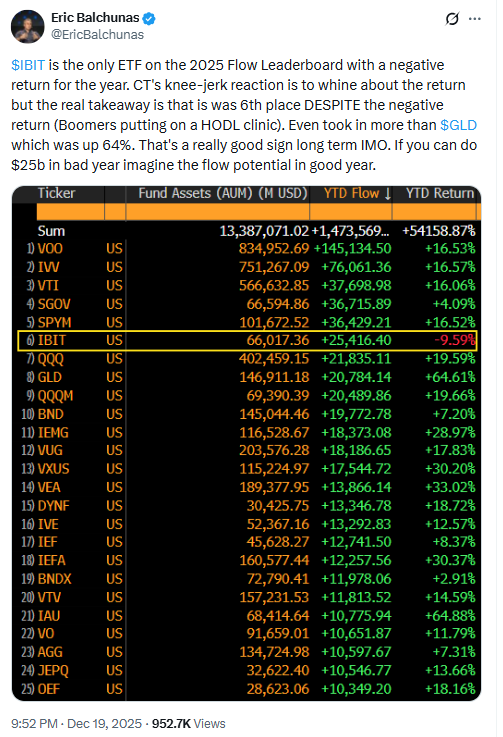

The IBIT Bitcoin ETF has attracted more than $25 billion in net inflows in 2025, according to the figures cited in the report. That ranked IBIT sixth among all ETFs by inflows as of mid December.

The same report said IBIT has delivered a negative return so far in 2025. It also noted Bitcoin fell about 30% from its October high, with BTC shown near $87,303 in the post.

Nate Geraci, president of NovaDius Wealth Management, said BlackRock’s naming of IBIT showed the firm “isn’t fazed” by Bitcoin’s pullback. He made the comment on Monday.

Farside Data Shows IBIT Bitcoin ETF at $62.5 Billion Total Inflows

The report said IBIT brought in about $37 billion in 2024. When combined with 2025 inflows, it takes total inflows since launch to $62.5 billion, based on Farside Investors data.

The IBIT Bitcoin ETF has also outpaced competing spot funds. The report said its flow tally is more than five times that of the Fidelity Wise Origin Bitcoin Fund (FBTC).

Bloomberg ETF analyst Eric Balchunas added a reaction on Friday. He said if the ETF

“can do $25 billion in a bad year, imagine the flow potential in a good year.”

A chart he shared ranked ETF inflows for 2025 as of mid December.

BlackRock Files Bitcoin Premium Income ETF Using Covered Calls on Futures

BlackRock filed to register a Bitcoin Premium Income ETF in September, according to the report. The proposed fund would sell covered call options on Bitcoin futures.

The strategy aims to collect option premiums and use them as a source of yield. The filing described the approach as part of the product design.

BlackRock ETHA Ethereum ETF Brings $9.1 Billion Inflows and Spurs Staked ETH ETF Filing

BlackRock’s ETHA Ethereum ETF has attracted more than $9.1 billion of inflows in 2025, the report said. That brought total inflows to nearly $12.7 billion.

BlackRock also filed in November to register an iShares Staked Ethereum ETF to complement ETHA, according to the report. It said BlackRock first launched ETHA without staking.

The report also linked the filing to a more crypto friendly Securities and Exchange Commission environment. It said the regulator has loosened ETF standards, which has opened room for new ETF structures.

BlackRock Keeps Bitcoin ETF and Ethereum ETF Focus While Others Push Altcoin ETFs

The report said BlackRock has not joined the altcoin ETF push seen across the market. It noted that other asset managers have launched products tied to Litecoin, Solana, and XRP in recent months.

Those references appeared alongside prices shown in the feed: LTC $76.80, SOL $124.54, and XRP $1.88. The report did not cite BlackRock filings for those tokens.

BlackRock’s updates kept attention on the IBIT Bitcoin ETF and the ETHA Ethereum ETF, while filings pointed to further expansion through strategy and staking formats.

SEO keywords used throughout: IBIT Bitcoin ETF, BlackRock Bitcoin ETF, iShares Bitcoin Trust ETF, Bitcoin ETF inflows, Farside Investors data, ETHA Ethereum ETF, iShares Staked Ethereum ETF, Bitcoin Premium Income ETF, covered calls Bitcoin futures, Treasury bills ETF, Magnificent 7 ETF.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 23, 2025 • 🕓 Last updated: December 23, 2025