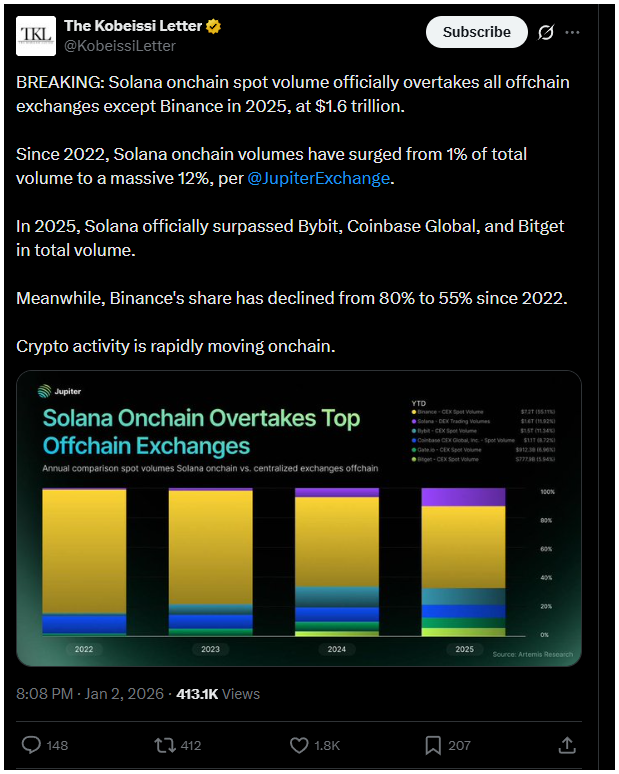

Buckle up for the crypto uprising nobody called. Experts shared that Solana’s onchain horde stormed the castle in 2025, slinging $1.6 trillion in spot volume that left most centralized exchange titans eating dust.

Picture Jabba the Hutt’s palace swapped for a blockchain bazaar, traders ditching suits for DEX dashboards, volumes exploding past Coinbase, Bybit, and Bitget.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Only Binance clings to the throne, but even that’s slipping like sand through fat fingers.

Big-shot traders now hammer massive spot deals onchain

Flashback to 2022, and Solana’s onchain action? A pathetic 1% blip in the global trading swamp.

Fast-forward to 2025, and boom, 12% dominance, a rocket ride fueled by DEX apps that settle faster than a gunslinger’s draw, fees cheaper than yesterday’s coffee.

Analysts highlighted that Jupiter Exchange data spills the beans, big-shot traders now hammer massive spot deals onchain, thumbs-up to the middlemen.

Liquidity bubbling up

The industry experts from Kobeissi Letter dropped the bomb via X, crowing how Solana’s native spot frenzy outpaces every major offchain pit except the Binance behemoth.

Centralized kings? Toppled. Coinbase Global, Bybit, Bitget, Solana lapped ’em all in raw volume.

Binance? Still the 800-pound gorilla, but its global spot share tumbled from 80% in 2022 to a wobbly 55%.

Fragmentation’s the new king, with liquidity bubbling up from blockchain bowels, not boardrooms.

The death knell for centralized middlemen

This ain’t just numbers flexing, because traders now hunt liquidity, execute, settle right on the chain, prices birthing in the wilds of DeFi, not some CEX vault. Solana’s proof is clear, onchain economies aren’t side gigs anymore.

On the contrary, they’re the main event, luring institutional toys and compliance cloaks straight into the fray.

So, the time has arrived when onchain trading’s devouring the CEX empire from within.

Solana’s $1.6T blitz signals the death knell for centralized middlemen, blockchains now forge prices, pool liquidity, and rake volumes at warp speed.

2025 flipped the script, but some say 2026 might bury it.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: January 6, 2026 • 🕓 Last updated: January 6, 2026

✉️ Contact: [email protected]