Kraken parent company Payward reported strong financial growth in 2025 as trading activity increased across its platform.

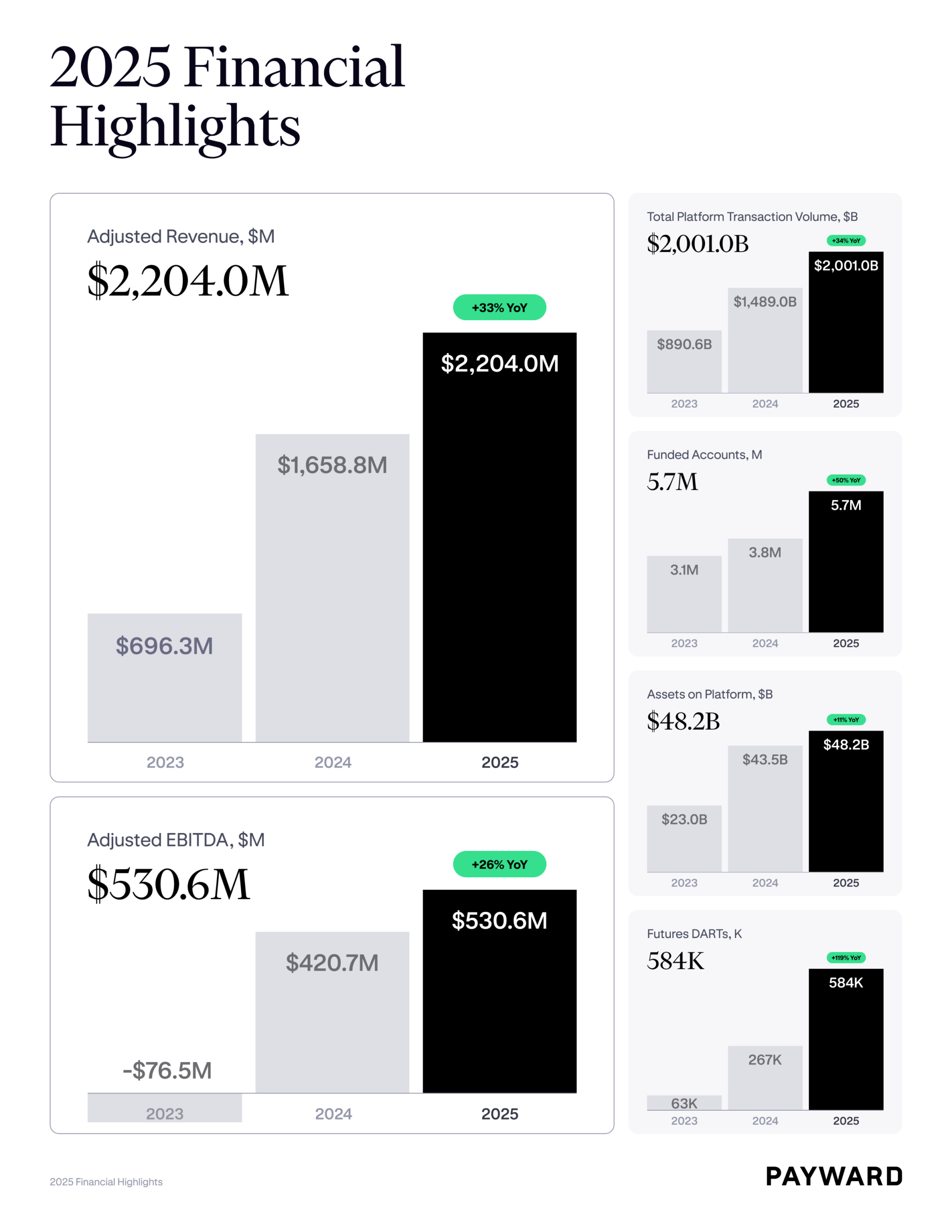

Payward revenue growth 2025 reached $2.2 billion, up from $1.6 billion in 2024. The company linked the increase to higher trading activity and asset based revenue.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

At the same time, Payward transaction volumes rose 34% during the year to about $2 billion.

Arjun Sethi, Kraken co CEO, said Kraken parent Payward revenue stayed balanced in 2025. He said 47% came from trading based revenue.

Meanwhile, 53% came from asset based and other revenue. The company reported broad activity across products and regions.

The update followed growing investor attention on Kraken IPO filing plans.

Kraken parent company Payward confirmed it filed confidential paperwork for a public offering in November. The company did not share further timing details.

Payward Revenue Growth 2025 Tied to Trading and Asset Based Income

Payward revenue growth 2025 reflected higher trading activity across markets. The company said trading volumes increased as user activity rose.

As a result, Payward trading volumes supported revenue from transaction fees and related services.

At the same time, asset based revenue increased as users held more funds on the platform.

According to the report, Payward platform assets reached $48.2 billion, up 11% over the year. The rise reflected higher balances held by users.

User growth also supported Kraken revenue 2025. The company said funded accounts rose 50% to 5.7 million.

This increase showed wider platform use during the year. The company did not provide regional data for account growth.

Payward Acquisitions 2025 Expand Kraken Parent Company Payward Product Lines

Payward acquisitions 2025 supported revenue growth and trading activity. Kraken parent company Payward acquired NinjaTrader, Breakout, Small Exchange, and Capitalise.ai during the year.

These firms operate in futures trading, prop trading, derivatives, and trading automation.

The company said the acquisitions expanded product access for different user groups. As a result, product usage rose across platforms.

According to Arjun Sethi, acquisitions, especially NinjaTrader and Breakout, led to a 119% increase in daily average revenue trades.

Payward also acquired Backed last month. Backed operates in tokenized stocks and supports the xStocks platform. The deal added exposure to tokenized equity products within Kraken parent Payward revenue streams.

Kraken IPO Filing Watch as Payward Platform Assets and Users Increase

Kraken IPO filing activity continued to draw attention in 2025. Kraken parent company Payward confirmed it filed confidential IPO paperwork in November. The company did not share further details on timing, valuation, or listing venue.

At the same time, Payward platform assets rose to $48.2 billion. The company said assets increased as users held more funds across products. This rise supported asset based revenue within Kraken parent Payward revenue.

User growth also continued. Kraken user growth reached 5.7 million funded accounts, up 50% over the year. The increase followed higher trading activity and wider use of asset services.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 4, 2026 • 🕓 Last updated: February 4, 2026