Entropy shutdown plans are underway, and Entropy investor refunds will follow, according to founder and CEO Tux Pacific. Pacific said the company could not find a scalable business model after four years of work.

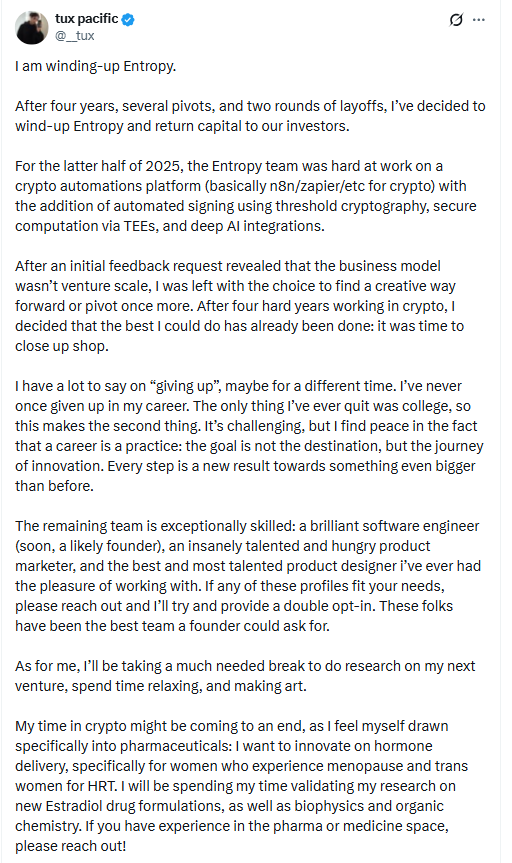

Pacific wrote on X,

“After four years, several pivots, and two rounds of layoffs, I’ve decided to wind up Entropy and return capital to our investors.”

Entropy started operations in late 2021. It later shifted toward a crypto automations platform. Pacific said the platform had no clear path forward after years of changes.

Entropy funding details tie the Entropy shutdown to a16z crypto and Coinbase Ventures

The Entropy shutdown affects a startup backed by a16z crypto and Coinbase Ventures. Entropy raised a $25 million seed round in June 2022, with Andreessen Horowitz backing the round and Coinbase Ventures also participating.

Other reporting also described an earlier raise. It said Entropy raised $1.95 million in a pre seed round in January 2022 before the $25 million seed round.

Pacific framed the decision around scale and fit. He said early feedback on the newer product showed the model “wasn’t venture scale.” In simple terms, he said the business would not grow large enough for venture funding targets.

Crypto automations platform pivot followed Entropy self custody roots

Entropy first launched as a self custody project. Self custody means users control their own private keys, rather than relying on a central custodian.

Later, the team worked on a crypto automations platform. Pacific compared the direction to tools like Zapier style workflows, where software runs tasks based on triggers. He said Entropy built that product during the second half of 2025.

Even so, Pacific said the company faced another pivot choice. He added,

“After four hard years working in crypto, I decided that the best I could do has already been done: it was time to close up shop.”

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 26, 2026 • 🕓 Last updated: January 26, 2026