A16z Crypto, the crypto arm of Andreessen Horowitz, has opened its first Seoul crypto office in South Korea.

The new A16z Crypto base is the firm’s first office in Asia and sits inside one of the most active South Korea crypto markets. The move focuses on Asia crypto adoption, not only on new investments.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The Seoul crypto office will be led by SungMo Park, a former Polygon Labs executive. A16z Crypto said Park will use his regional experience to help portfolio projects understand South Korea crypto conditions and broader Asia crypto adoption trends. He will also work on links between founders, local partners, and communities.

In its statement, A16z Crypto said Asia has a “particularly strong concentration” of onchain users.

The firm said the Seoul crypto office aims to support portfolio companies with growth, partnerships, and community efforts across Asia.

The focus stays on practical support in markets where Asia crypto adoption is already high.

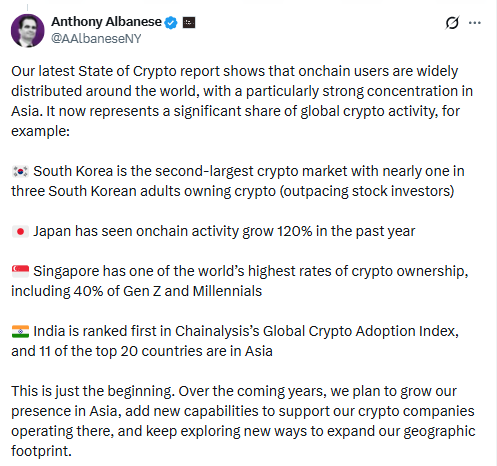

Anthony Albanese, managing partner and chief operating officer at A16z Crypto, described the role of the new base.

“Our expansion will offer go-to-market support for portfolio companies seeking to accelerate growth, forge strategic partnerships, and build lasting communities across Asia,”

he said. The quote sets out how A16z Crypto plans to use the Seoul crypto office for its existing projects.

Albanese added that this step is only part of a wider plan.

“Over the coming years, we plan to grow our presence in Asia, add new capabilities to support our crypto companies operating there, and keep exploring new ways to expand our geographic footprint,”

he said. The comments link the Seoul crypto office to a longer-term Asia crypto adoption strategy, although no specific new locations were named.

Asia Crypto Adoption Data Backs A16z Crypto’s Seoul Move

The A16z Crypto decision rests on several data points about Asia crypto adoption. Albanese said the region accounts for a significant share of global crypto activity.

He noted that nearly a third of South Korean adults own digital assets, underlining how large the South Korea crypto user base has become.

Research from Chainalysis also supports the focus on Asia crypto adoption. The firm’s rankings show India at the top of global crypto adoption tables.

This means India scores high for several metrics, including transaction volumes and onchain use relative to income levels and population.

Chainalysis data further shows that Japan has seen onchain activity grow by around 120% in the past year.

This increase adds another important market to the Asia crypto adoption map that A16z Crypto is watching. The region also includes Singapore, which has one of the highest crypto ownership rates globally.

According to the same Chainalysis data, 11 of the top 20 countries for crypto adoption are located in Asia. This concentration shows why an investor like A16z Crypto wants a physical presence in the region. The Seoul crypto office places the firm inside a time zone and market where users already interact with crypto at scale.

For South Korea crypto markets, the arrival of A16z Crypto brings one of the sector’s largest venture players into closer contact with local exchanges, protocols, and developers.

The firm did not announce any new deals tied directly to the launch. However, the office gives teams in the A16z Crypto portfolio a base when they work on Asia crypto adoption plans.

Asian Crypto Investors Hold Significant Allocations, Survey Shows

Separate data from Sygnum adds detail to the Asia crypto adoption story that supports the Seoul crypto office decision.

In a recent survey, Sygnum reported that six in ten surveyed Asian high-net-worth individuals are prepared to increase their crypto allocations.

They linked this stance to a strong long-term view on digital assets in Asia.

The same Sygnum survey found that 87% of affluent Asian investors already hold crypto. This high share shows that Asian crypto investors are active, not just exploring the sector. Around half of these investors allocate more than 10% of their portfolios to digital assets, according to the survey.

These numbers place Asian crypto investors among the most committed groups globally. For A16z Crypto, this means that Asia crypto adoption is visible not only in retail usage but also in wealth management and private banking.

The Seoul crypto office sits closer to these investor bases and to family offices and advisors who shape allocations.

Activity in Asia also includes large retail and trading communities. As one example, brokerage app Robinhood is preparing to enter Indonesia, targeting about 17 million local crypto traders.

The move highlights how Asia crypto adoption extends beyond a few financial centers, reaching wider user groups across the region.

In this environment, the new A16z Crypto Seoul crypto office connects the venture firm to users, builders, and Asian crypto investors in real time.

The office follows the data from Chainalysis and Sygnum, which both show that Asia crypto adoption plays a central role in today’s digital asset landscape.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 11, 2025 • 🕓 Last updated: December 11, 2025