The crypto streets are buzzing with chatter about altseason making a comeback.

You know, that hopeful moment when altcoins step out of Bitcoin’s shadow, roll up their sleeves, and show the world they’re not just sidekicks but heroes in their own right.

But hold on. Is this the real deal or just another false start? Hundred experts, thousands of different opinions.

Structural weakness?

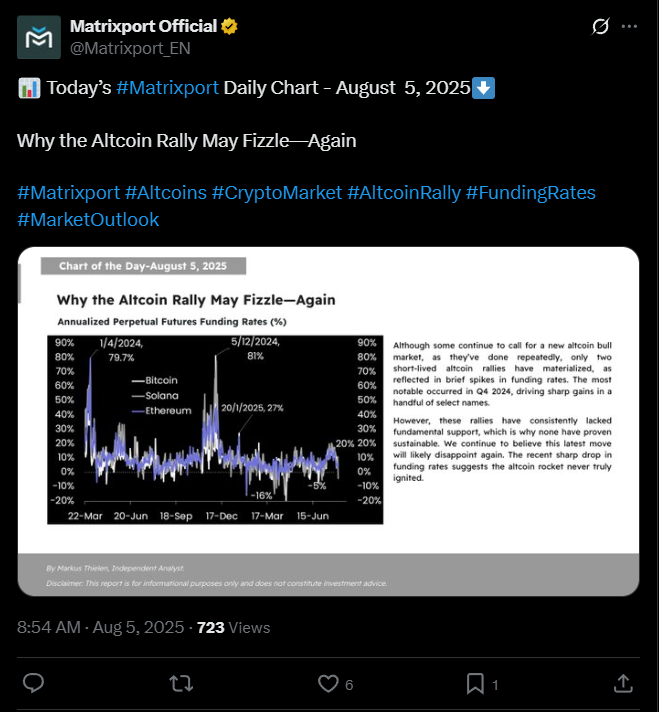

First off, the old guard from Matrixport is waving a caution flag so high you’d think it’s a lighthouse on a stormy night.

Analyst Markus Thielen’s take? Despite the cheers and bullish tweets, the altcoin market is still walking on shaky legs. He points to two brief alt rallies, one notable spike in late 2024, that fizzled faster than a cheap firework.

The funding rates? They shot up temporarily but never had the juice to keep the party going.

Now, those same rates are heading south again, signaling that the hype might already be burning out.

If you’re sitting there dreaming of a steady altcoin climb, you might want to take a seat. Structural weaknesses in the market could rain on your parade yet again.

Golden opportunity?

On the other hand, the data tosses us some mixed signals. Bitcoin dominance dipped near the 60% mark.

This is a threshold historically known to hint that altcoins might just take the driver’s seat soon.

And some fancy capital, what people call smart money, seems to be slipping into altcoin positions quietly, ahead of the retail crowd.

SwissBlock’s Altcoin Vector reports this early shuffle is more like a calm before the storm, an early innings phase where insiders get ready for a possible burst.

Smart capital rotates here, before the crowd sees it.

Momentum is turning, structure is stabilizing.

This isn’t a breakout: now pre-positioning begins.https://t.co/8Q8UxxK2By pic.twitter.com/bOGvB7c5xL

— Altcoin Vector (@altcoinvector) August 5, 2025

This could mean a golden opportunity for those sharp-eyed traders looking to get in before the crowd rushes in.

And don’t forget the USDT’s dominance. It’s been stuck in a descending triangle for nearly two years and looks ready to break down.

Traditionally, when USDT dominance falls, it means traders are moving cash away from stable, sleepy assets into riskier, flashier ones, you guessed it, altcoins.

Some market watchers are betting this breakdown could fan the flames for a major altcoin rally, turning these months of sideways action into the opening act of a full-blown altseason.

This chart is one big reason why I think we're going to see a legendary Altseason.🫡

USDT Dominance has been in a descending triangle for almost 2 years and is about to break down.

USDT D. down = Altcoins up.

Everything we've seen so far has just been a warm-up.🔥 pic.twitter.com/HbnuaFehD2

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) August 5, 2025

Crossroads

So where does this leave us? The altcoin market is teetering at a crossroads, caught between fading enthusiasm and the real potential for a breakout.

Whether you see a slow fade or a breakout party depends on which signals you trust.

Either way, this dance with altseason isn’t decided yet, and the next move might be the wildest step yet.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 7, 2025 • 🕓 Last updated: August 7, 2025

✉️ Contact: [email protected]